|

|

|

|

|

|

|

|

|

Proactive Market Timing Proactive Market Timing

|

|

|

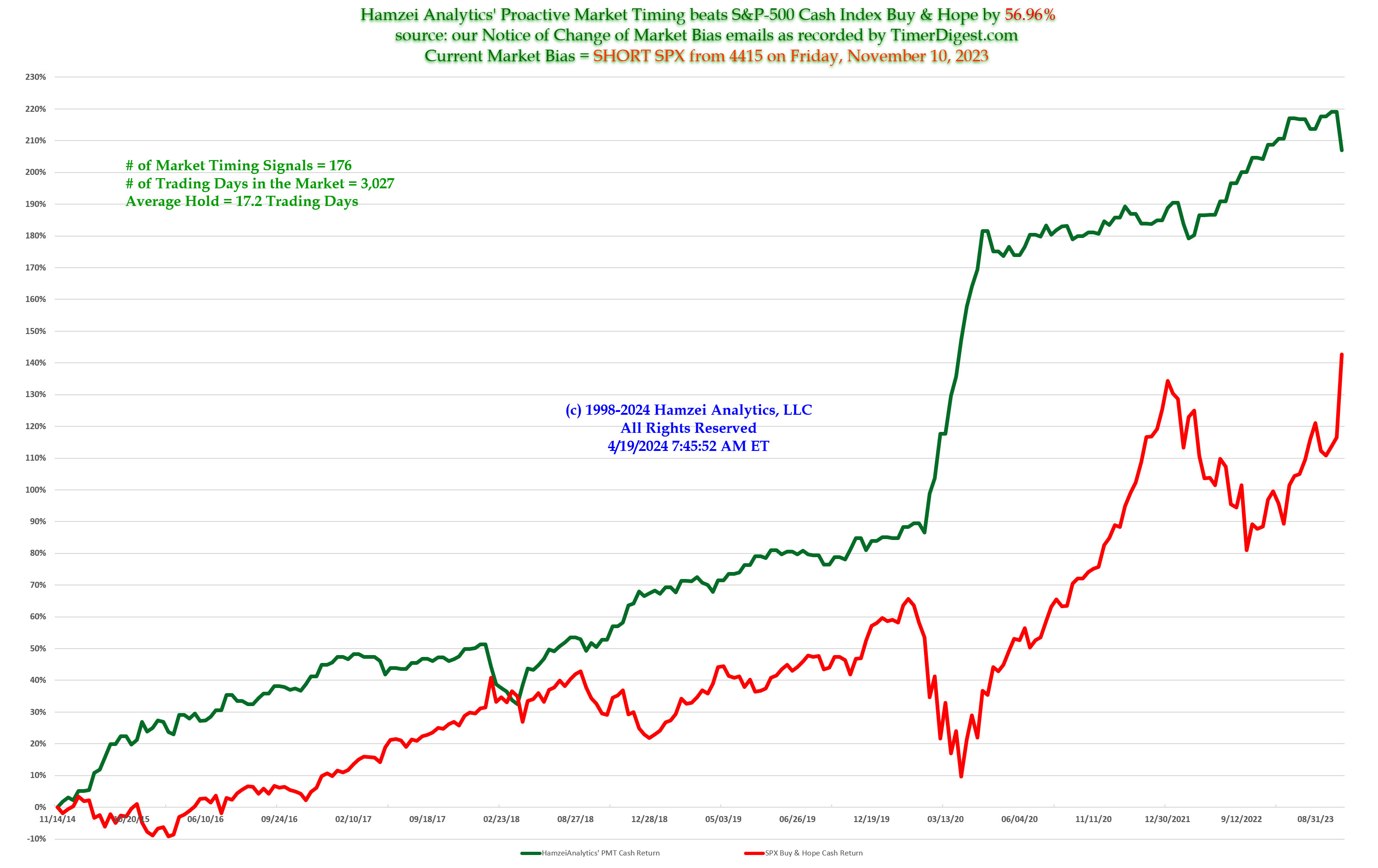

Most Recent PMT vs SPX Performance Chart

|

|

|

|

Wednesday, February 3, 2016, 2330ET

Updated Market Bias for Issue #129

This WEEK’s Bias = LONG SPX or SPY via Call Spreads

Profit Target = 1950 to 1970

Money Management Stop = 1900

BOTTOM LINE: SPX 1870 was Line-in-the-Sand. Plain and Simple. It was defended with an overwhelming force (as if it was scripted by Gen. Colin Powell) and no prisoners were taken by the Victor.

Note: Once one the targets is hit (Profit or Money Management), the trade for that week is over. Go to Cash and wait for the next PMT Issue.

Fari Hamzei

|

|

|

|

|

|

Wednesday, February 3, 2016, 2311ET

Notice of Change of Market Bias with Timer Digest

Dear Jim,

As a scuba diver, I learned long ago, that the Ocean will always win over me. In like fashion, today as SPX approached 1870, the Invisible Hand came in & voraciously bought the Market hand over fist.

Market is very much like an Ocean. We can not win, in a match with the Market either.

Therefore, we, hereby reverse up our SHORT SPX position and get LONG. Better keep our ammo dry and save it to fight another battle [to the downside] later.

This puts us back about 9 S&P handles……oh, well.

Fari Hamzei

|

|

|

|

|

|

Tuesday, February 2, 2016, 2345ET

Updated Market Bias for Issue #129

This WEEK’s Bias = SHORT SPX or SPY via Put Spreads

Profit Target = 1875 to 1835

Money Management Stop = 1915

BOTTOM LINE: As suspected here last Sunday, the jubilation following the Bank of Japan’s unexpected move into negative interest rates last Friday, was squashed today, with lower crude oil prices, credit rating downgrades by S&P of 10 largest energy names and sell-off in banks & biotech.

Our most worry is the continued drop in the price of WTI Crude Oil and expanding CDSs of a few large European Banks.

Note: Once one the targets is hit (Profit or Money Management), the trade for that week is over. Go to Cash and wait for the next PMT Issue.

Fari Hamzei

|

|

|

|

|

|

Monday, February 1, 2016, 1045ET

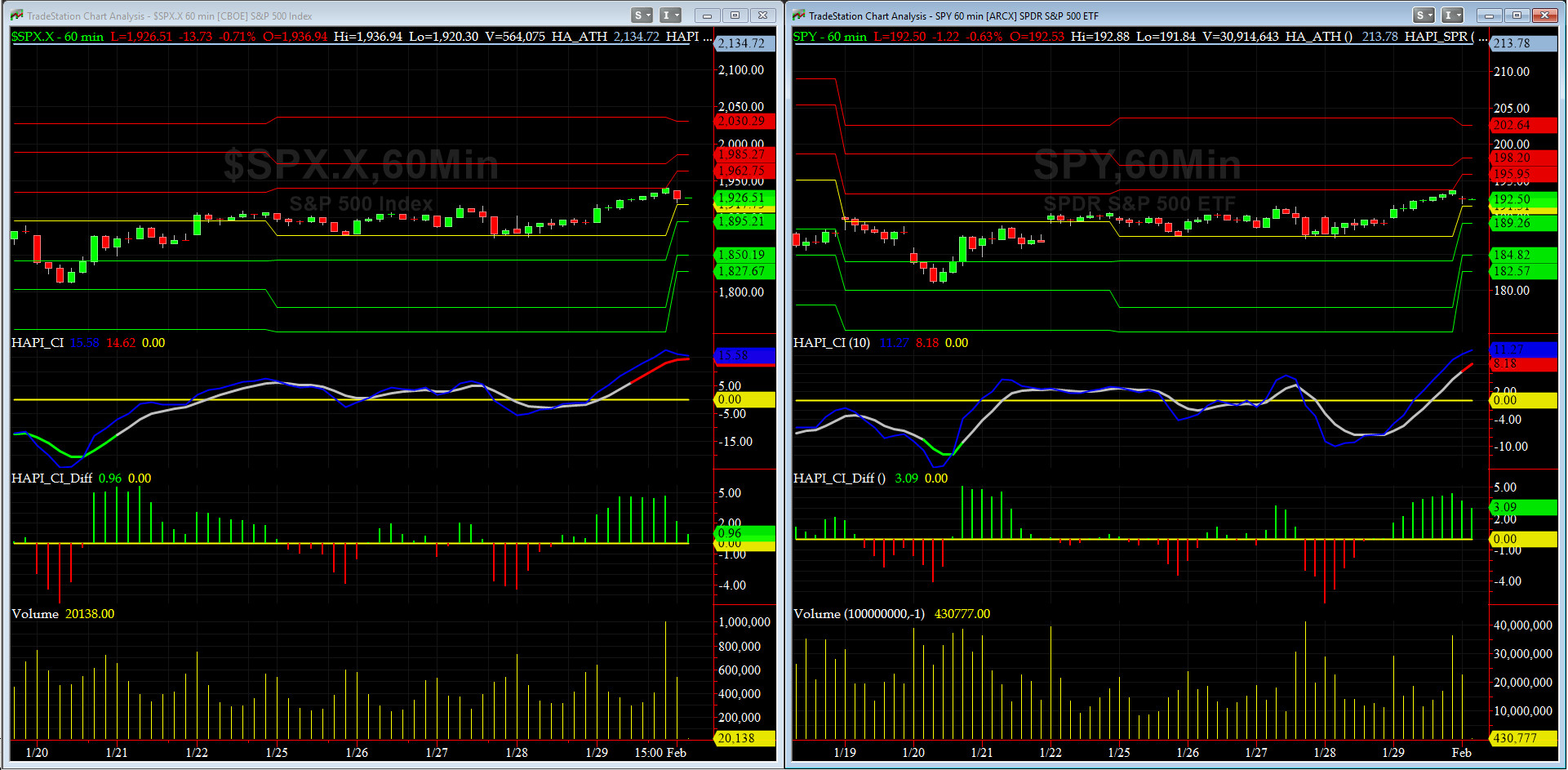

Companion Chart for Market Bias Review, Issue #129

|

|

|

|

|

|

Sunday, January 31, 2016, 2100ET

Market Bias, Issue #129

Our current SPX Bias with Timer Digest: SHORT SPX as of Tuesday, January 26, 2016 Close at 1903.63

Our previous Bias: LONG SPX (as of Wednesday, January 20, 2016 Close at 1859.33)

This WEEK’s Bias = NEUTRAL for a day or two then we take a [short] position

Profit Target = N/A

Money Management Stop = N/A

BOTTOM LINE: Bank of Japan’s unexpected move on Friday to lower a key interest rate below zero is viewed, by some, as a sign that the program of radical economic stimulus, introduced by Prime Minister Shinzo Abe in 2013, just isn't working.

Markets' initial response was positive: Nikkei closed up 2.8% and SPX up 2.5%.

We would rather step back and see if there is a follow thru. We suspect NOT, but only price & volume are a good tell. Have more Foumanat Tea for now.

We will review each evening and update as warranted.

NOTE: All LEVELS mentioned here have been, are, and will be, based on the S&P-500 SPX Cash Index, and not the ES Futures. Tomorrow after the first hour is complete, we will post here a companion chart showing critical short-term WEEKLY levels to watch for possible “retest failures.”

Also Note: Once one the targets is hit (Profit or Money Management), the trade for that week is over. Go to Cash and wait for the next PMT Issue.

Fari Hamzei

|

|

|

|

|

|

Sunday, January 31, 2016 1800ET

Market Timing Charts, Analysis & Commentary for Issue #129

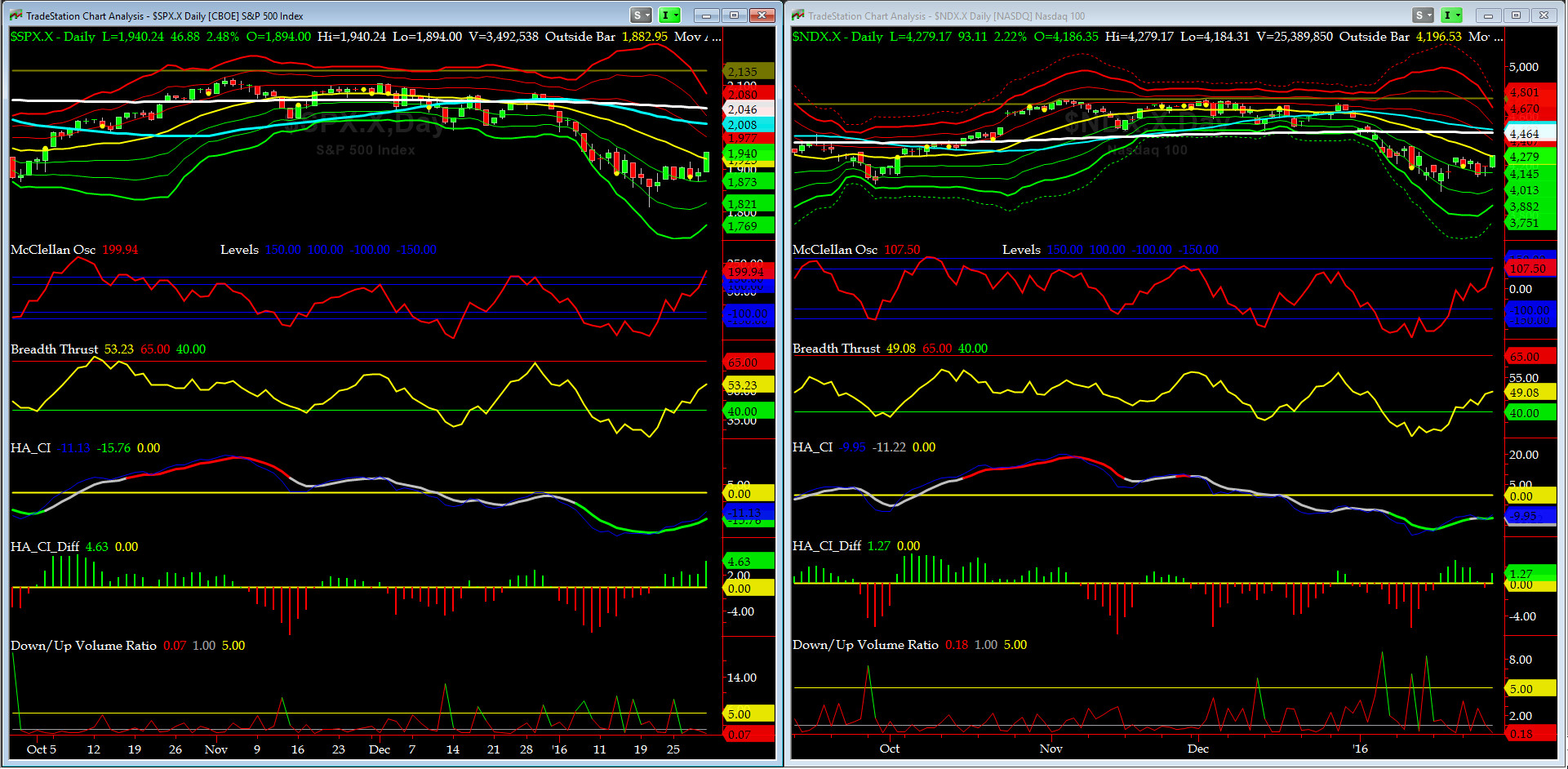

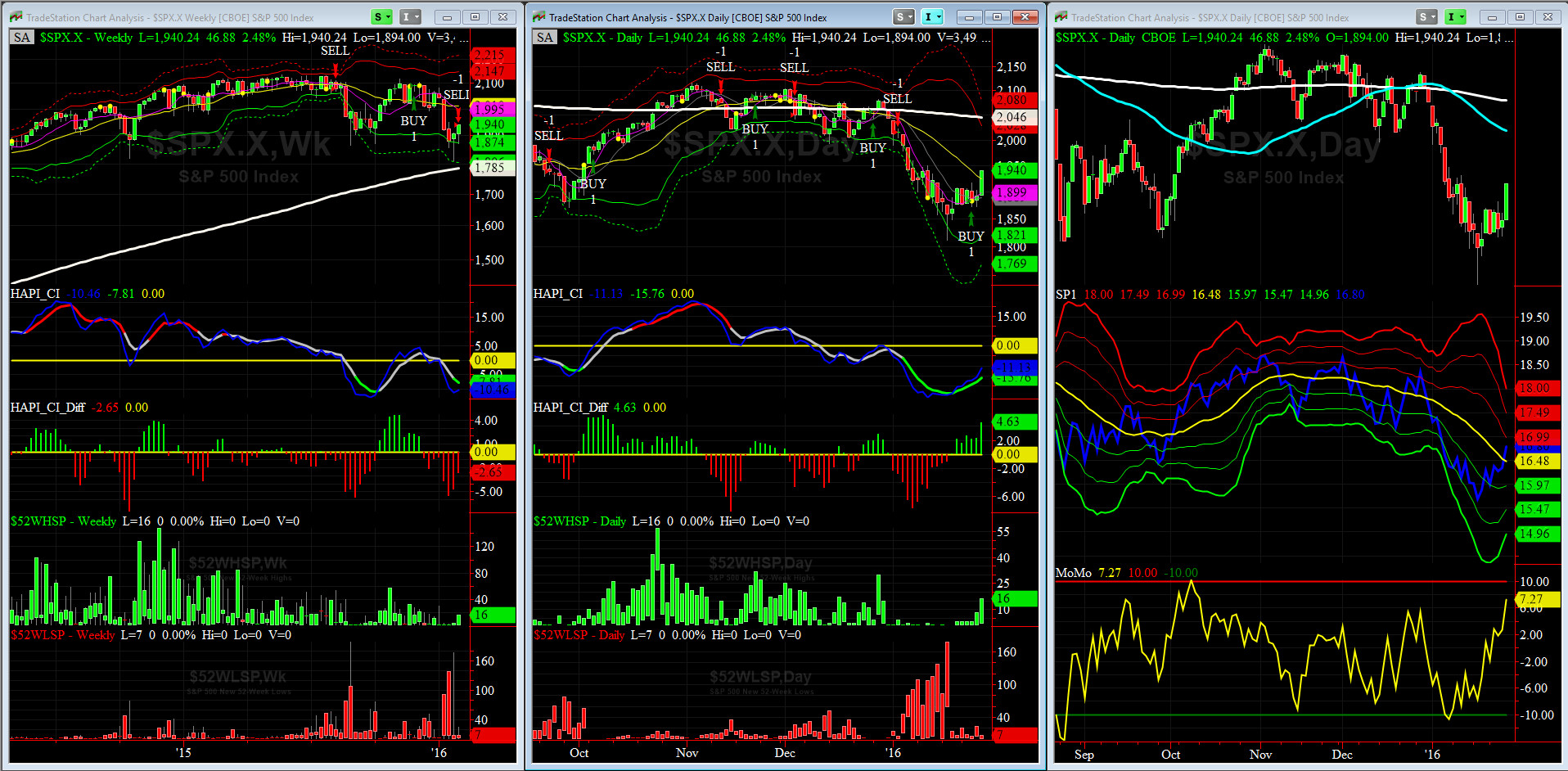

Timer Charts of S&P-500 Cash Index (SPX) + NASDAQ-100 Cash Index (NDX)

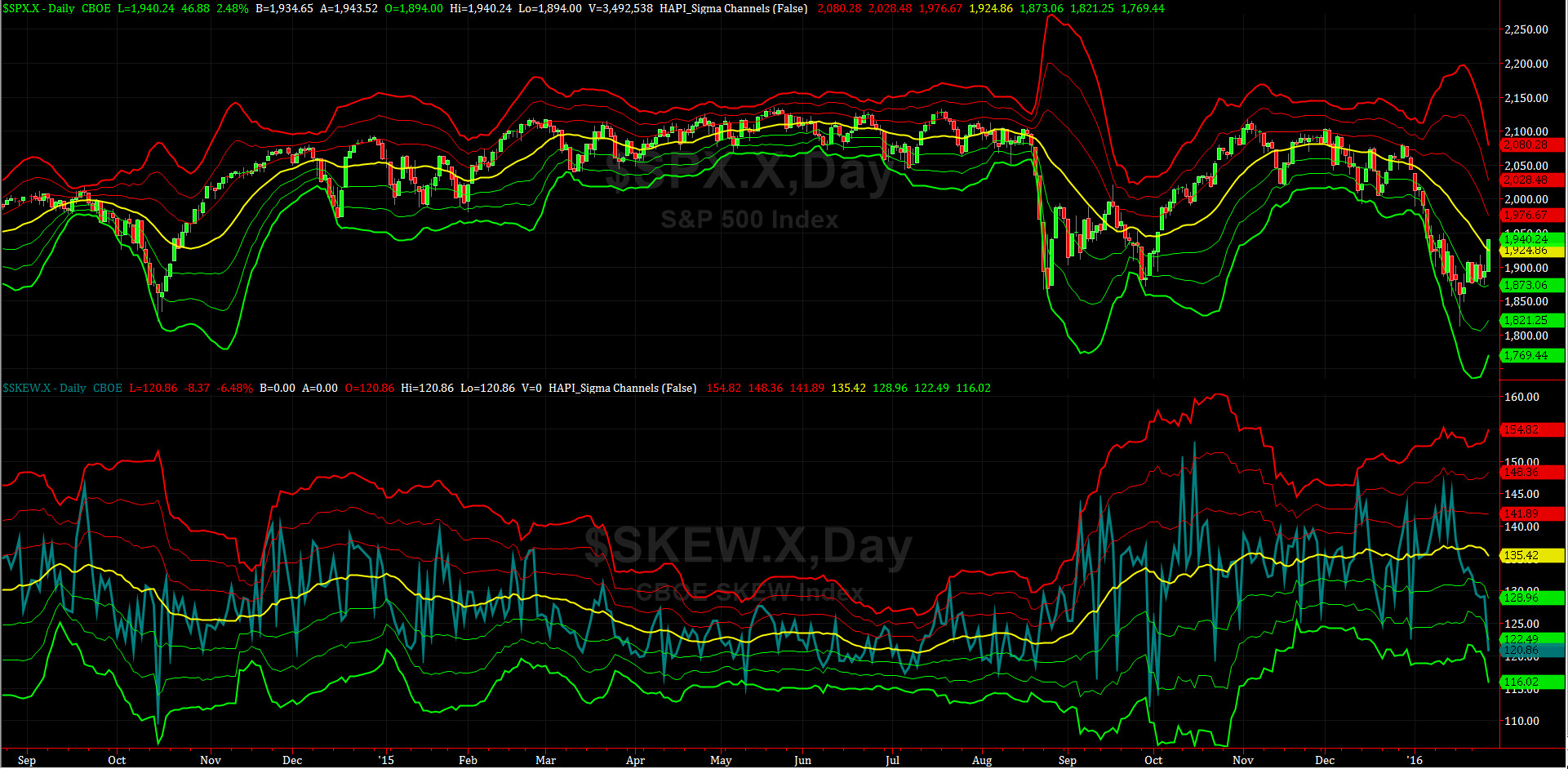

Most recent S&P-500 Cash Index (SPX): 1940.24 up +34.34 (up +1.8%) for the week ending on Friday, January 29th, 2016, which closed above its zero sigma.

SPX ALL TIME INTRADAY HIGH = 2134.72 (reached on Wednesday, May 20th, 2015)

SPX ALL TIME CLOSING HIGH = 2130.82 (reached on Thursday, May 21st, 2015)

Current DAILY +2 Sigma SPX = 2028 with WEEKLY +2 Sigma = 2147

Current DAILY 0 Sigma (20 day MA) SPX = 1925 with WEEKLY 0 Sigma = 2010

Current DAILY -2 Sigma SPX = 1821 with WEEKLY -2 Sigma = 1874

NYSE McClellan Oscillator = +200 (-150 is start of the O/S area; around -275 to -300 area or lower, we go into the “launch-pad” mode, over +150, we are in O/B area)

NYSE Breadth Thrust = 53.23 (40 is considered as oversold and 65 as overbought)

We had a great bounce on Friday which surprised us. Are we over-extended? Not yet but we should be close. End of the Month BUYS + some anticipation of fresh cash coming in from pending M&A activity managed to register one largest MOC data we have seen in months, if not in years ($4.4 Bils).

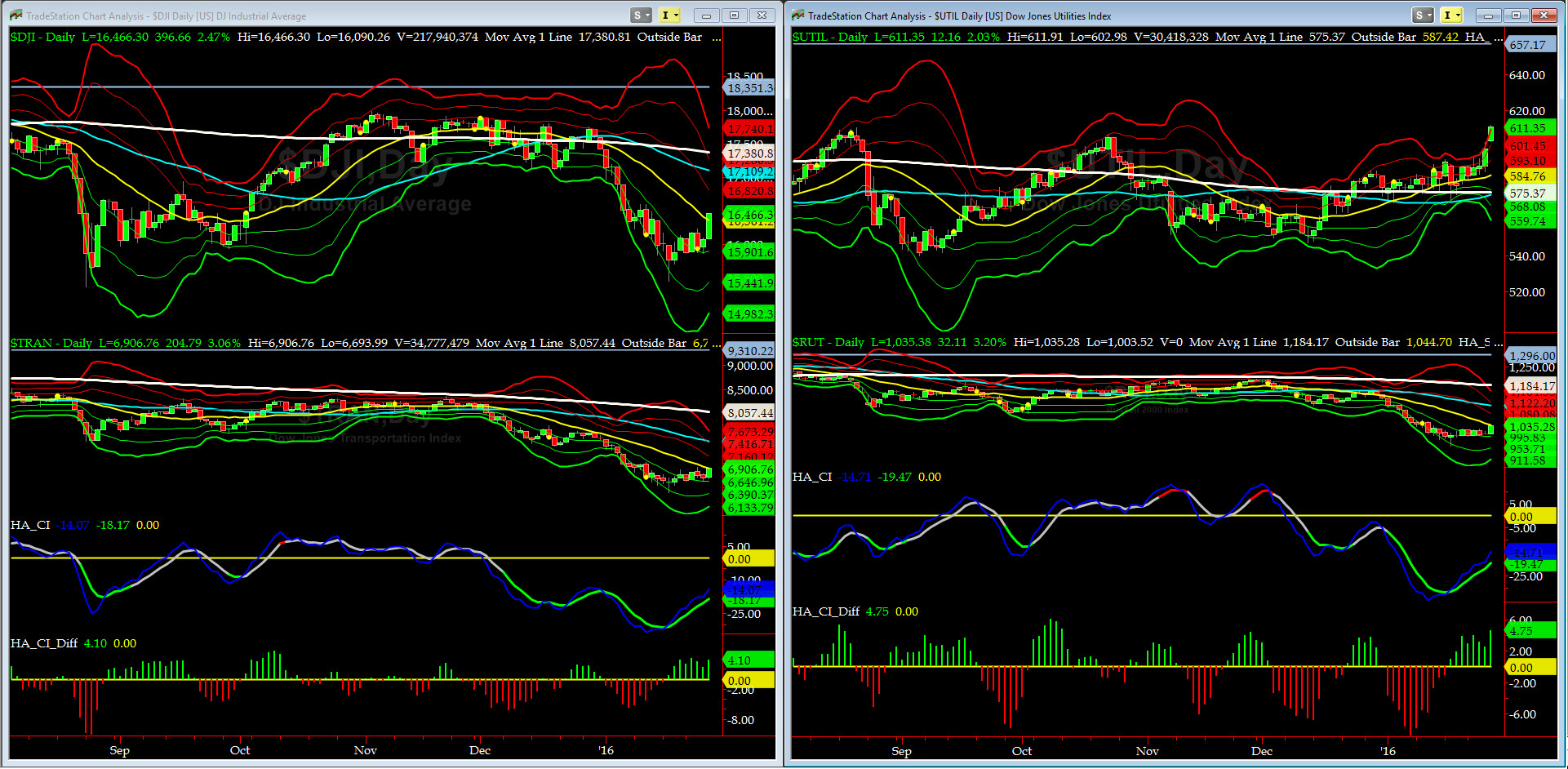

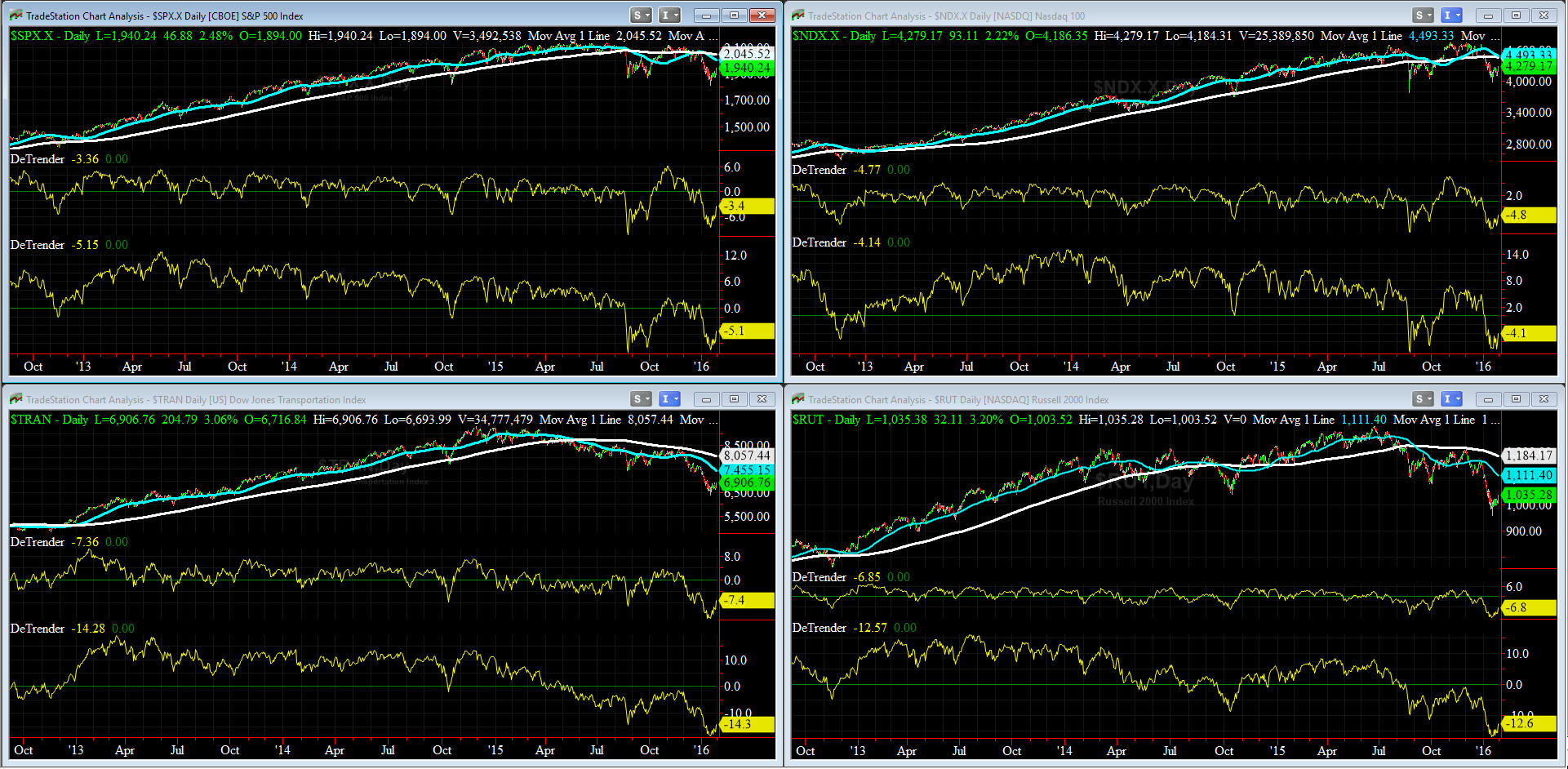

Canaries [in the Coal Mine] Chart for DJ TRAN & RUT Indices

200-Day MA DJ TRAN = 7455 or -14.3% above DJ TRAN (max observed in last 5 yrs = 20.2%, min = -20.3%)

200-Day MA RUT = 1111 or -12.6% above RUT (max observed in last 5 yrs = 21.3%, min = -22.6%)

Both DJ Transports (proxy for economic conditions 6 to 9 months hence) & Russell 2000 Small Caps (proxy for RISK ON/OFF) edged up this past week but not a hard bounce like SPX. We read that as negative tell!!

We still maintain that a key retest failure is ahead and we need to keep our guards up.

DeTrenders Charts for SPX, NDX, TRAN & RUT Indices

50-Day MA SPX =2008 or -3.4% above SPX (max observed in last 5 yrs = +8.6%, min = -9.3% )

200-Day MA SPX = 2046 or -5.1% above SPX (max observed in last 5 yrs = 15.2%, min = -14%)

All of our Eight DeTrenders are still negative but now they are all reversed up.

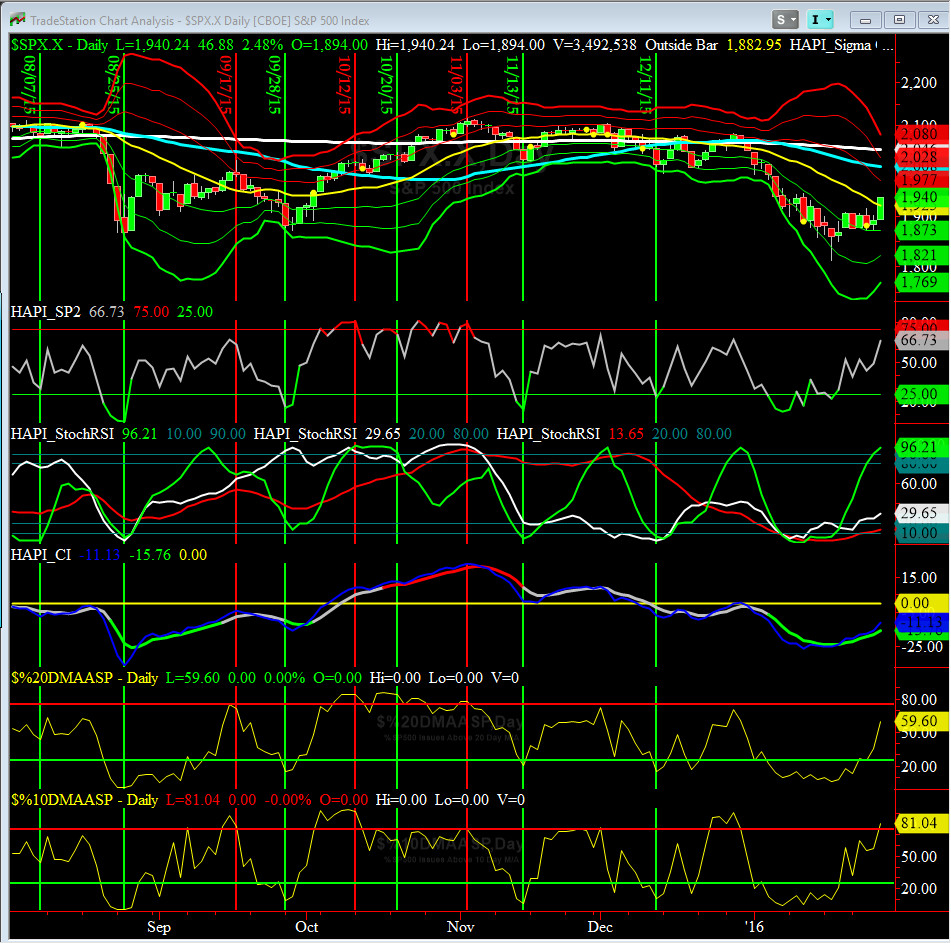

HA_SP1_momo Chart

WEEKLY Timing Model = on a SELL Signal since Friday 1/29/16 CLOSE

DAILY Timing Model = on a BUY Signal since Tuesday 1/27/16 CLOSE

Max SPX 52wk-highs reading last week = 16 (over 120-140, the local maxima is in)

Max SPX 52wk-Lows reading last week = 24 (over 40-60, the local minima is in)

HA_SP1 = just below its +1 Sigma

HA_Momo = +7.27 (reversals most likely occur above +10 or below -10)

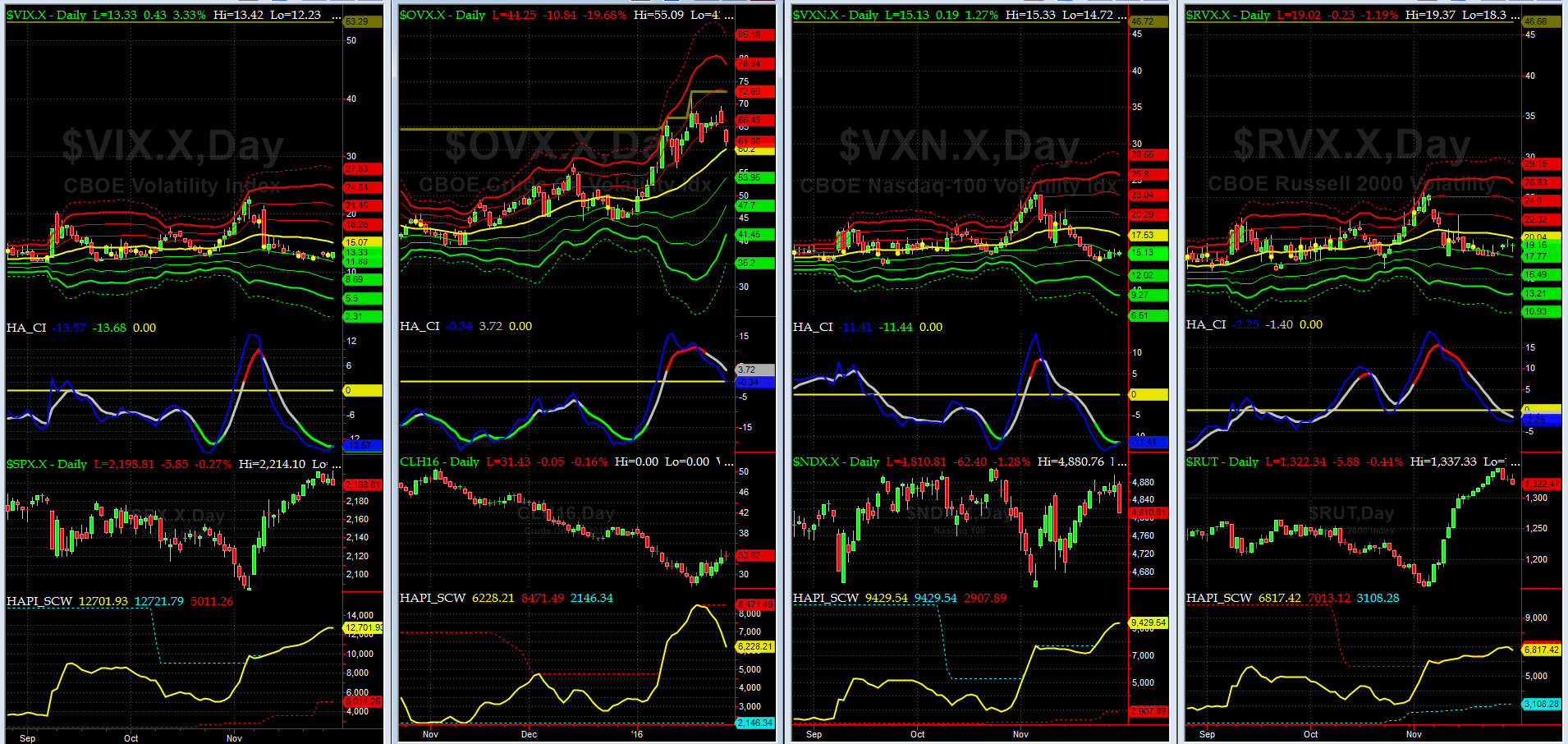

Vol of the Vols Chart

VIX = 20.20 which is just below its -1 sigma (remember it’s the VIX’s vol pattern (its sigma channels) that matters, and not the level of VIX itself (this is per Dr. Robert Whaley, a great mentor and the inventor of original VIX, now called VXO. VIX usually peaks around a test of its +4 sigma).

This shockwave is over, at least for now, ioho, till the next shoe drops.

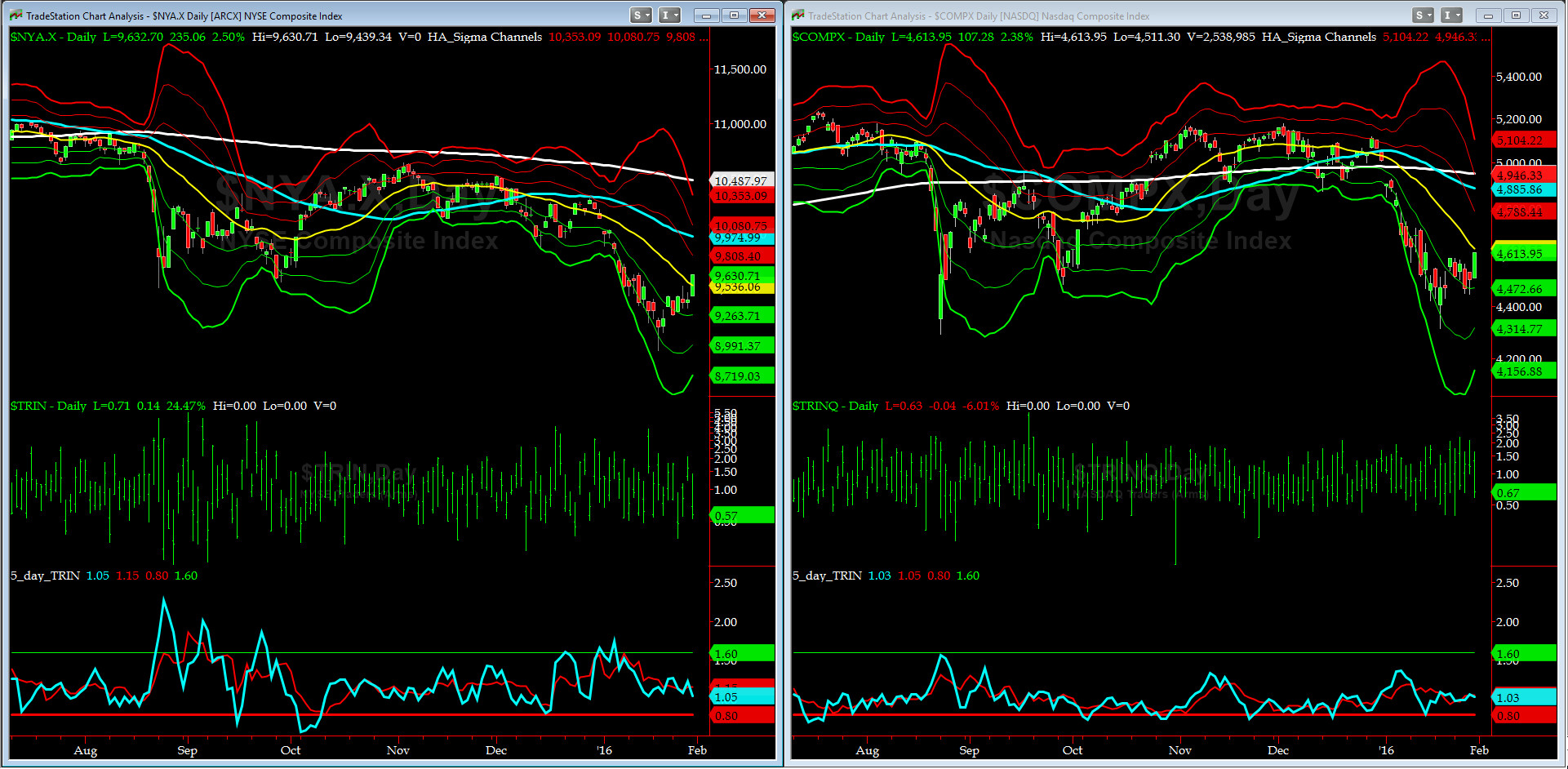

5-day TRIN & TRINQ Charts

Both 5-day TRIN (for NYSE) and 5-day TRINQ (for NASDAQ) closed, again, very neutral this past Friday.

Components of SPX above their respective 200day MA Chart

The 30% level was tested last Friday but the real target still is the 34-35% zone.

SPX SKEW (Tail Risk) Chart

SPX SKEW (Tail Risk) = 120.86 is below its -2 sigma (normal = 120-125, range 100-150)

All Quiet on the MidWestern Front?

Yes, ALL VERY CALM & QUIET until the next perfect storm hits, ioho.

3-month VIX Futures Spread(VX) Chart

Our 3-month VIX Futures Spread (LONG FEB16 SHORT MAY16), closed Friday at +0.14. That's neutral for now.

HA_SP2 Chart

HA_SP2 = 66.7 (Buy signal <= 25, Sell Signal >= 75)

At ~67, this prop indicator is showing a gradual move up but not overbought yet.

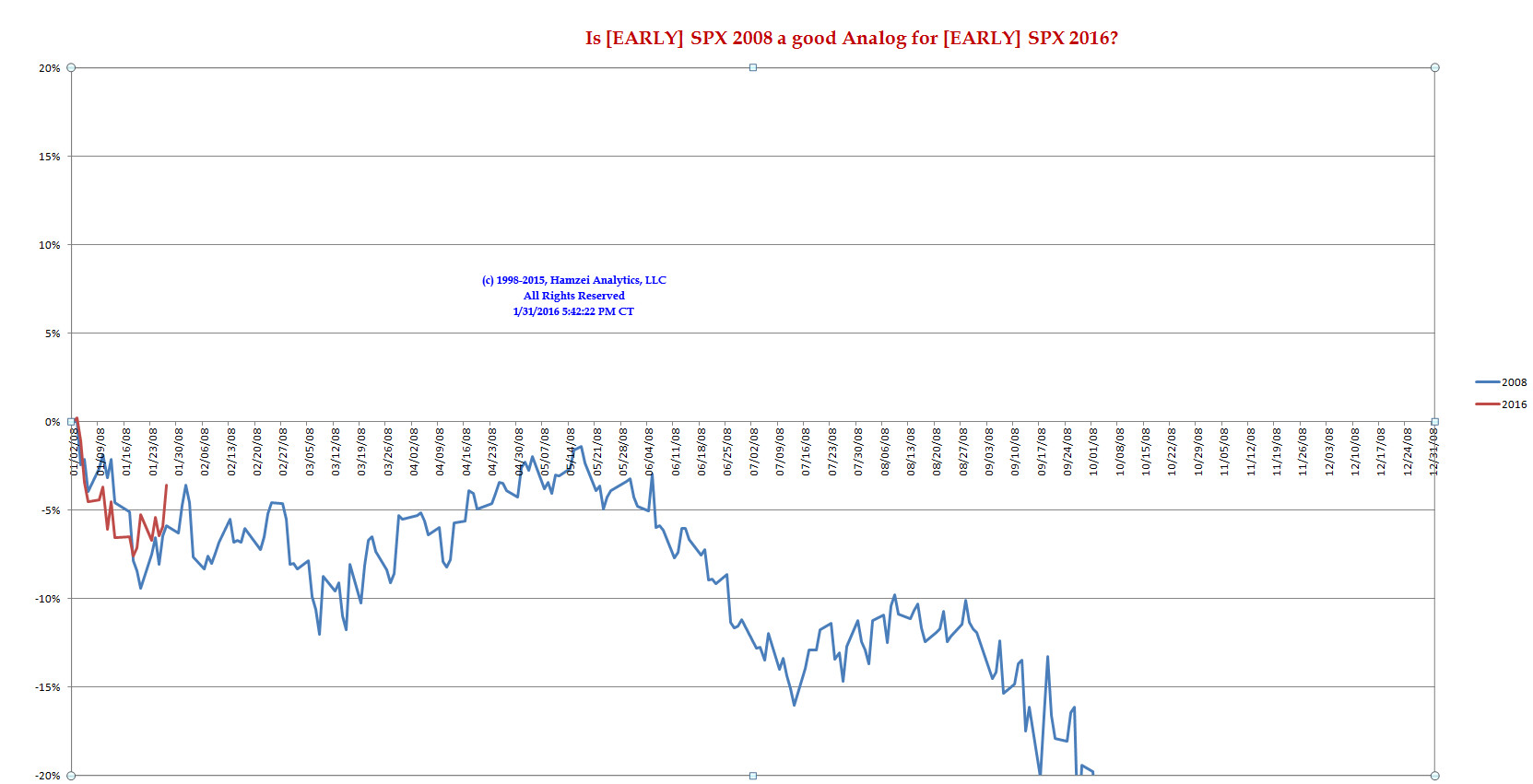

SPX 2008 Analog for SPX 2016

FWIW, my co-pilot, @Capt_Tiko (now with about 260 Twitter Followers) is anxiously following a track using 2008. I may have to step in and provide some guidance and counsel.

US Treasury T-Notes & T-Bonds Yields Chart

Treasury Complex Yields snapped down on Friday as Equities took off hard due to BoJ surprise easing announcement.

Good luck this week,

Fari Hamzei

|

|

|

|

|

|

Customer Care:

|

|

|

|

|

|

|

|

|

|