|

Monday Morning, April 25, 2016 0730ET

Market Timing Charts, Analysis & Commentary for Issue #140

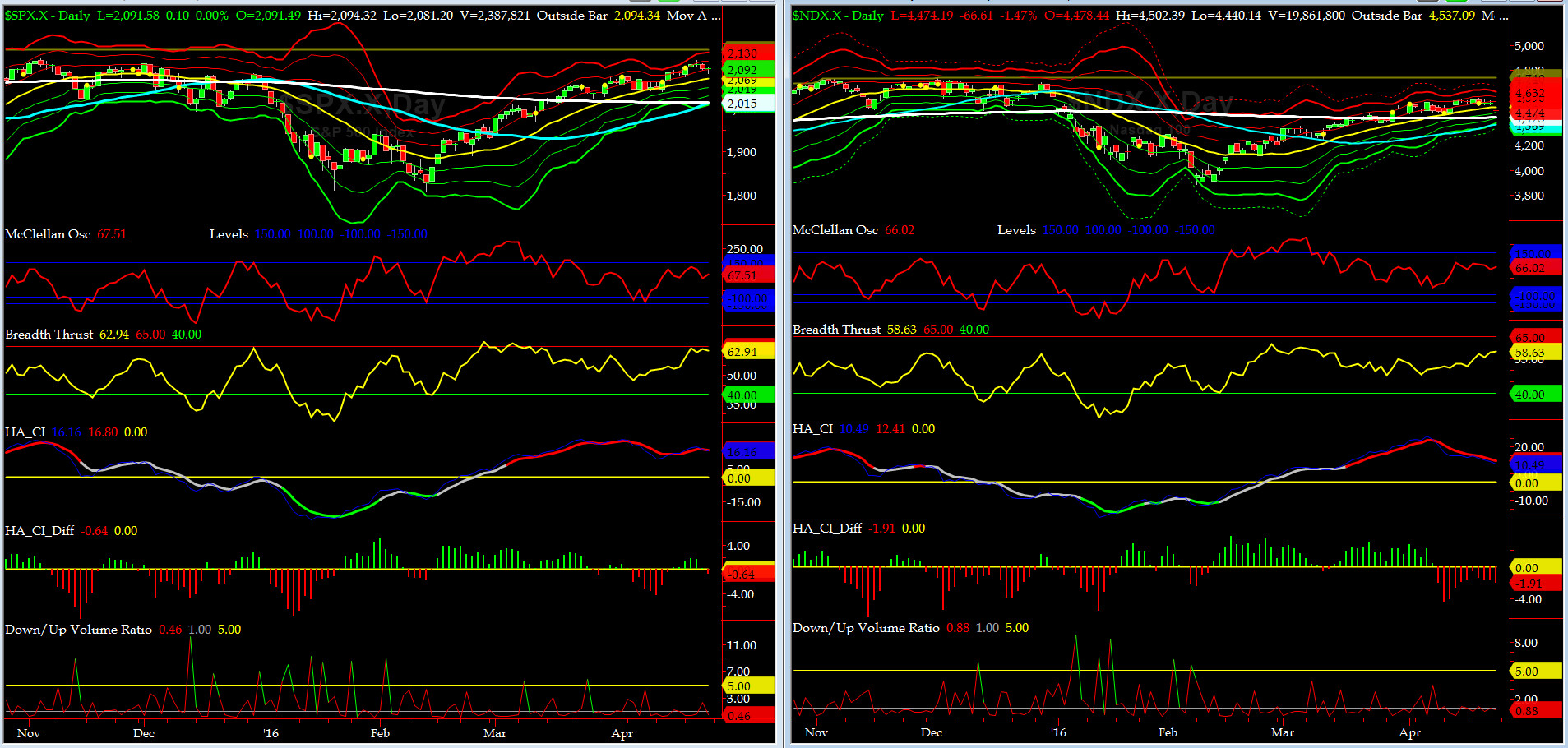

Timer Charts of S&P-500 Cash Index (SPX) + NASDAQ-100 Cash Index (NDX)

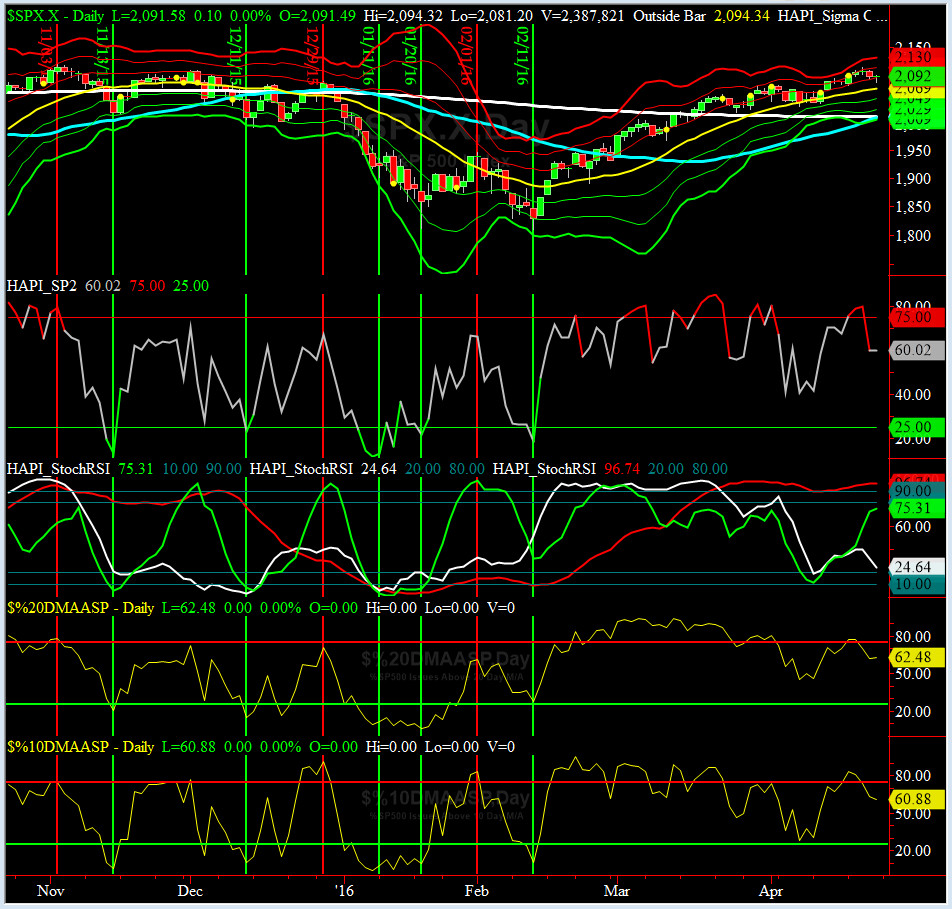

Most recent S&P-500 Cash Index (SPX): 2091.58 up +10.85 (up 0.5%) for the week ending on Friday, April 22nd, 2016, which closed about near its +1 sigma.

SPX ALL TIME INTRADAY HIGH = 2134.72 (reached on Wednesday, May 20th, 2015)

SPX ALL TIME CLOSING HIGH = 2130.82 (reached on Thursday, May 21st, 2015)

Current DAILY +2 Sigma SPX = 2110 with WEEKLY +2 Sigma = 2134

Current DAILY 0 Sigma (20 day MA) SPX = 2069 with WEEKLY 0 Sigma = 1989

Current DAILY -2 Sigma SPX = 2029 with WEEKLY -2 Sigma = 1844

NYSE McClellan Oscillator = +67.5 (-150 is start of the O/S area; around -275 to -300 area or lower, we go into the “launch-pad” mode, over +150, we are in O/B area)

NYSE Breadth Thrust = 62.9 (40 is considered as oversold and 65 as overbought)

On Thursday, both GOOGL & MSFT missed JPM rallied to +3 sigma. High tide rises all boats including, floating trash (C & BAC). As we move forward into the Q1 Earning Reports, our fav, GOOGL, reports this week and AAPL, next week.

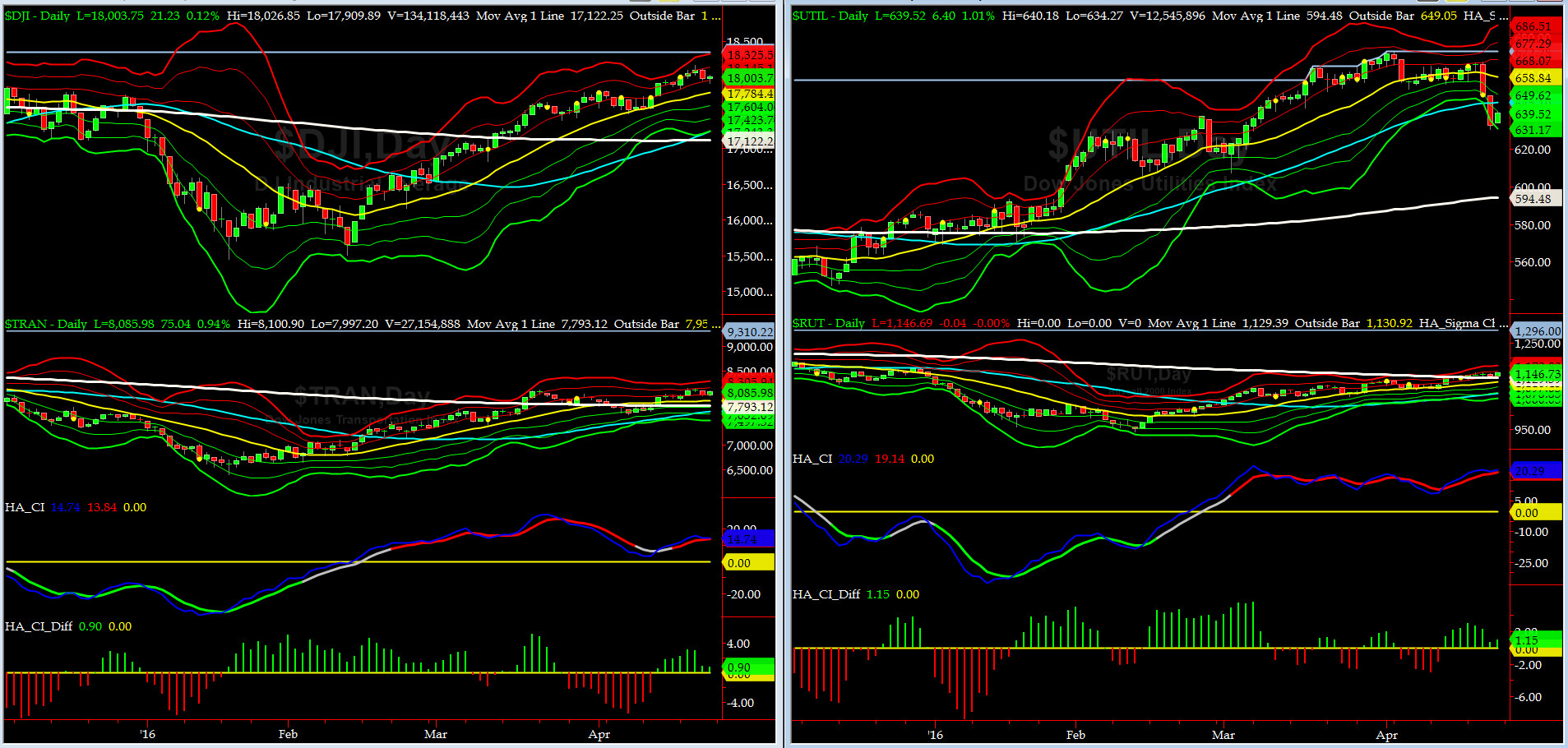

Canaries [in the Coal Mine] Chart for DJ TRAN & RUT Indices

200-Day MA DJ TRAN = 7793 or 3.8% below DJ TRAN (max observed in last 5 yrs = 20.2%, min = -20.3%)

200-Day MA RUT = 1129 or 1.5% below RUT (max observed in last 5 yrs = 21.3%, min = -22.6%)

DJ Transports (proxy for economic conditions 6 to 9 months hence) continued to push higher. Next move should get its 50MA over its 200MA.

Russell 2000 Small Caps (proxy for RISK ON/OFF) also pushed up and nearing a critical breakout level (1160). RISK is ON.

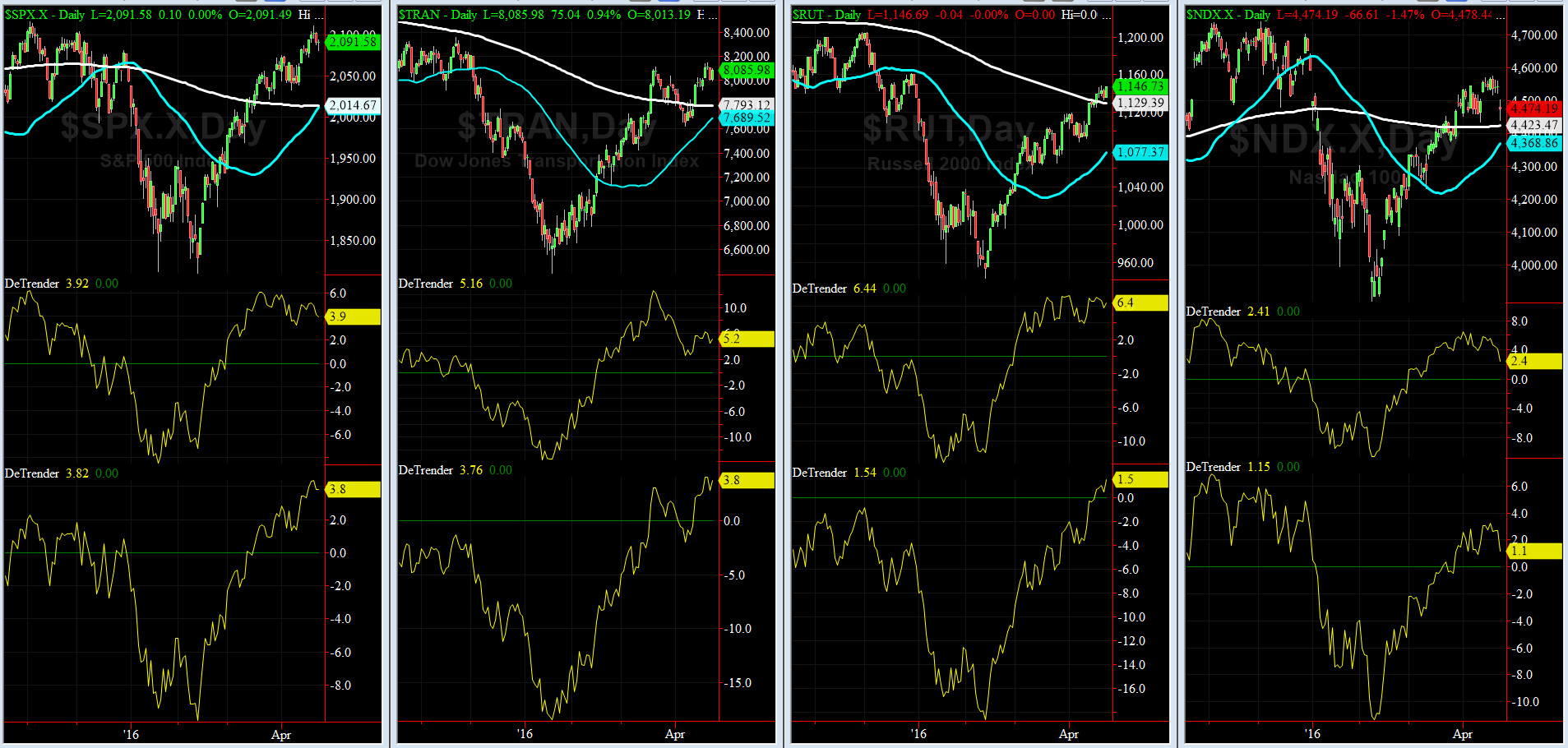

DeTrenders Charts for SPX, NDX, TRAN & RUT Indices

50-Day MA SPX = 2013 or +3.9% below SPX (max observed in last 5 yrs = +8.6%, min = -9.3%)

200-Day MA SPX = 2015 or +3.8% below SPX (max observed in last 5 yrs = 15.2%, min = -14%)

ALL of our Eight DeTrenders are positive now. We still see [soft] bearish divergences between DTs and the prices. Again, nothing big and too early to be alarmed about them for now.

HA_SP1_momo Chart

WEEKLY Timing Model = on a BUY Signal since Friday 4/15/16 CLOSE

DAILY Timing Model = on a BUY Signal since Friday 4/14/16 CLOSE

Max SPX 52wk-highs reading last week = 19 (over 120-140, the local maxima is in)

Max SPX 52wk-Lows reading last week = 2 (over 40-60, the local minima is in)

HA_SP1 = between in the +1 to +2 sigma channels

HA_Momo = +1.3(reversals most likely occur above +10 or below -10)

NOTE: As WEEKLY SPX CI Diff continues to stay green, we should further price improvements.

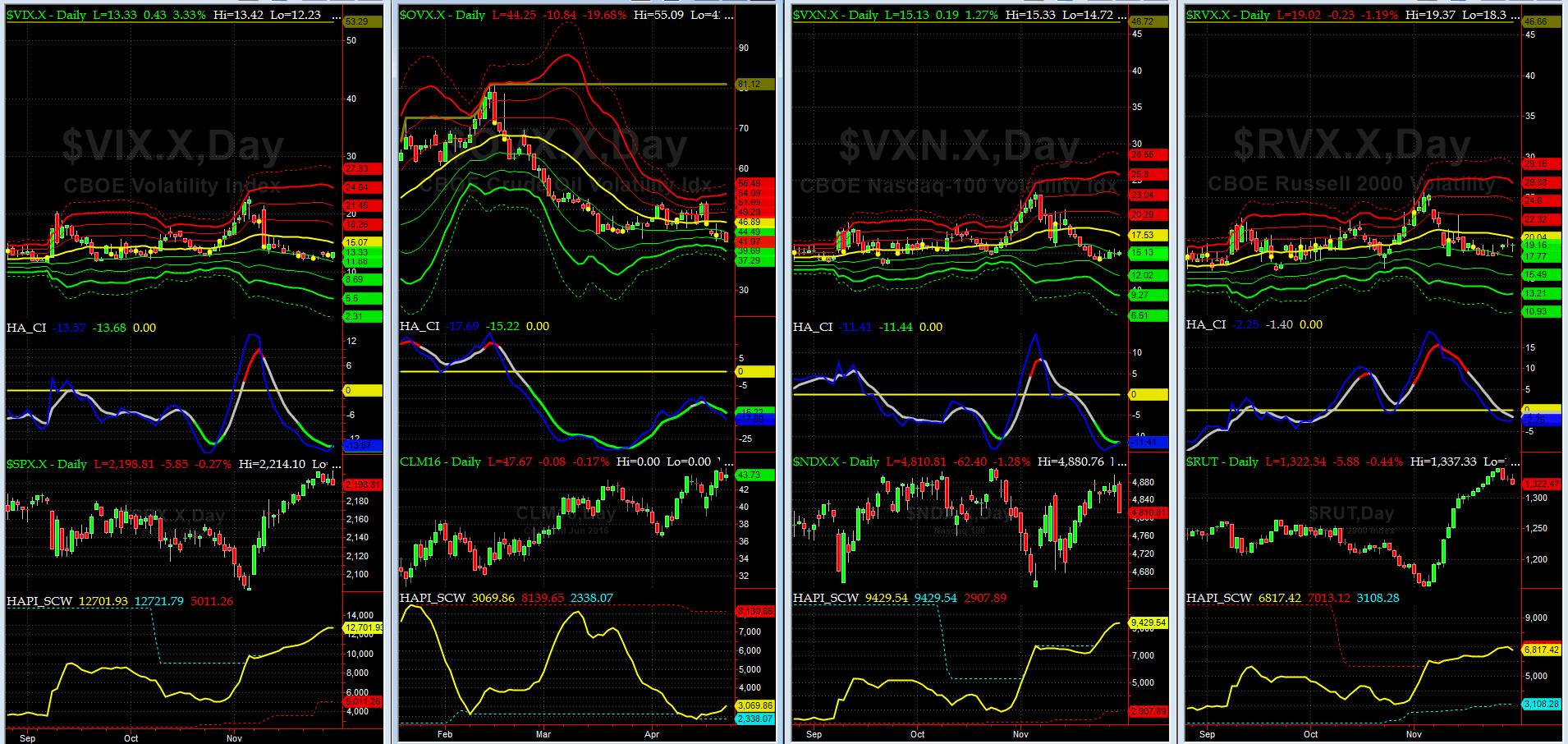

Vol of the Vols Chart

VIX = 14.1 is now at its zero sigma (remember it’s the VIX’s vol pattern (its sigma channels) that matters, and not the level of VIX itself (this is per Dr. Robert Whaley, a great mentor and the inventor of original VIX, now called VXO. VIX usually peaks around a test of its +4 sigma).

The Fear Index stil remains "dazed and confused" here, in LedZepp parlance.

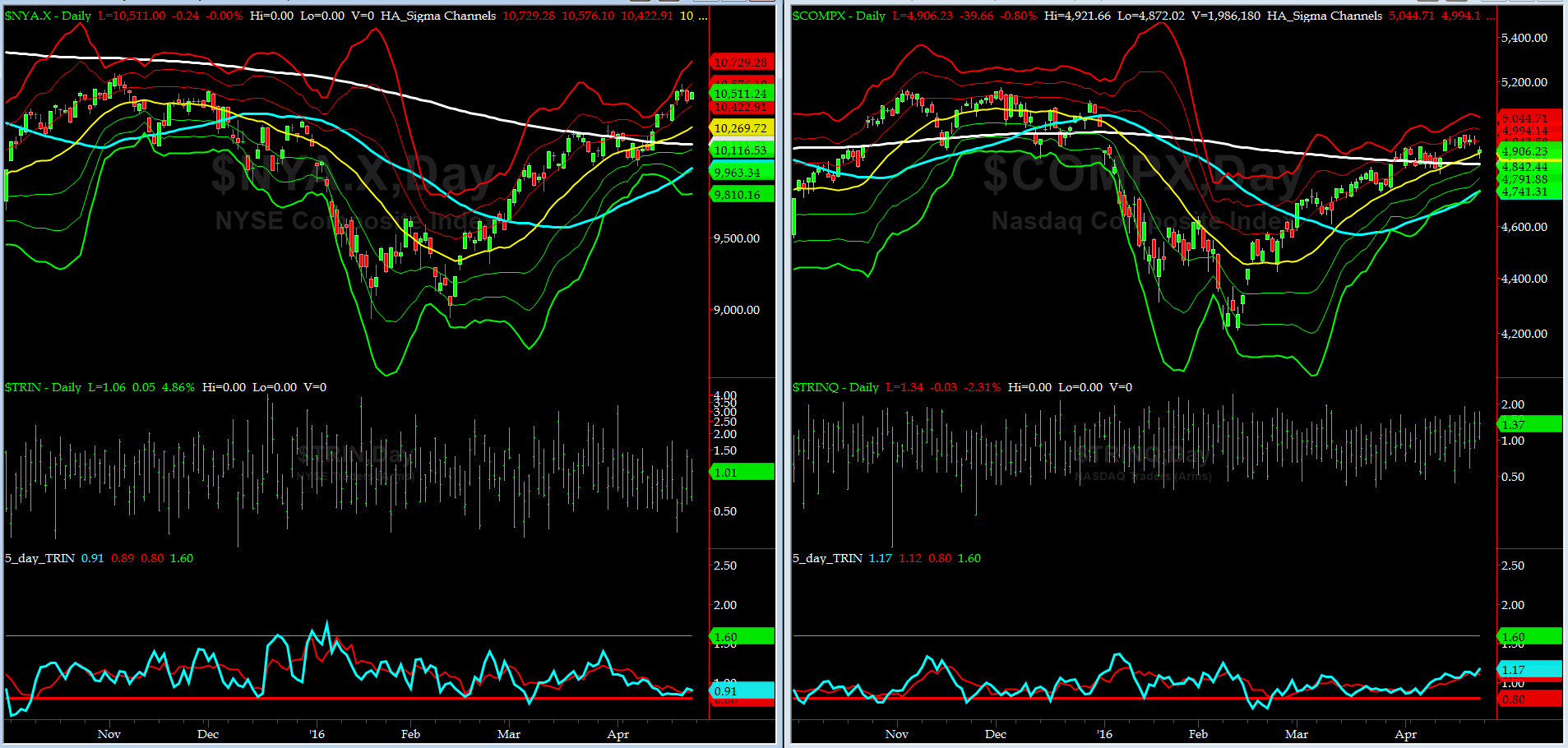

5-day TRIN & TRINQ Charts

Both 5-day TRIN (for NYSE) and 5-day TRINQ (for NASDAQ) remain NEUTRAL here. No signal.

Components of SPX above their respective 200day MA Chart

BREAK OUT....BREAK OUT.....

This past week, this scoring indicator jumped to 74% in a SIDEWAY price action & neared the top of our target zone discussed here last week (72% to 75%). This is BULLISH.

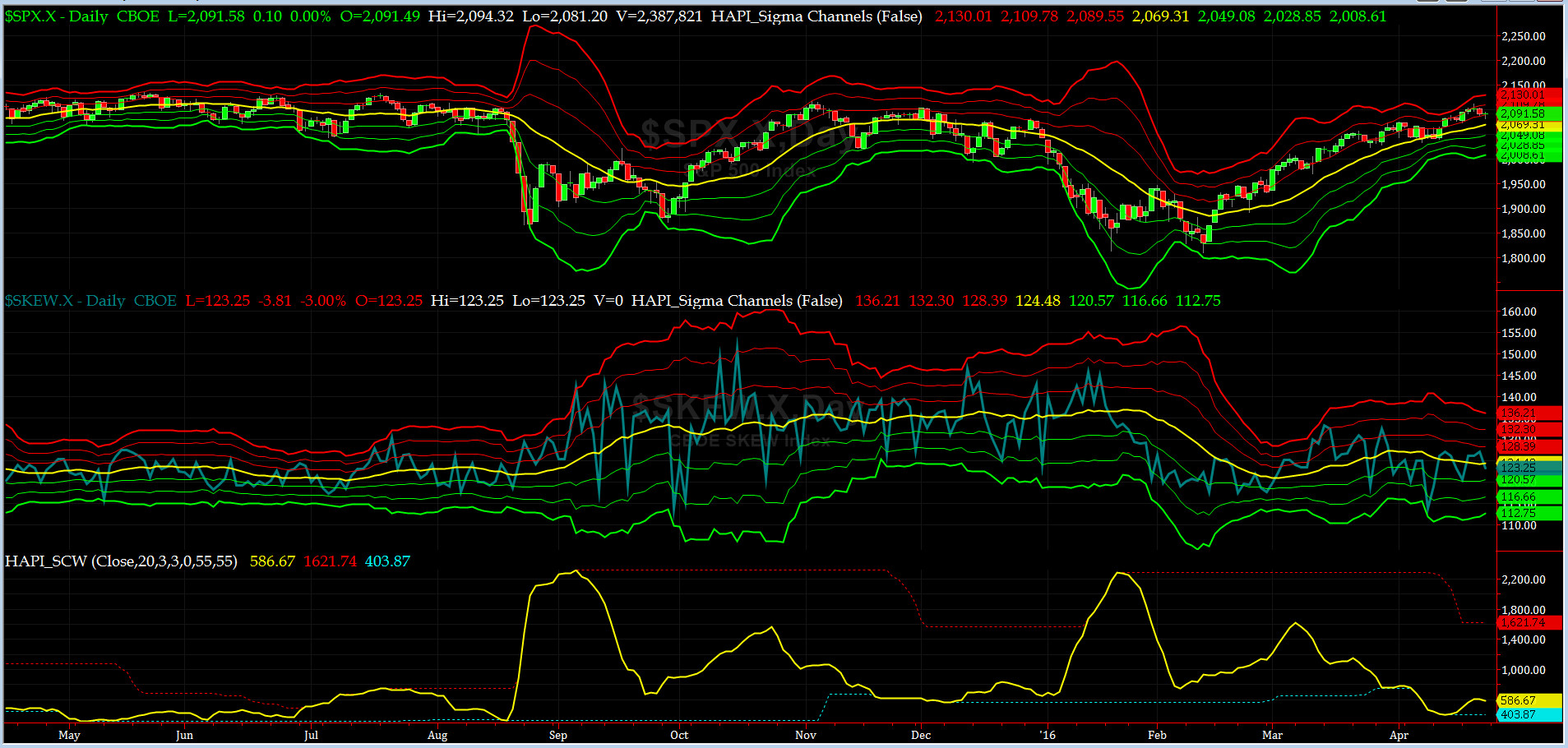

SPX SKEW (Tail Risk) Chart

SPX SKEW (Tail Risk) = 123 and near its 0 sigma (normal = 120-125, range 100-150)

All Quiet on the Mid-Western Front? All Problems Solved, all of a sudden? ubetcha if you listen to a certain billionaire who thinks he can pay off the NatDebt in 8 yrs (ROFLMTO) should win the White House.

3-month VIX Futures Spread(VX) Chart

Our 3-month VIX Futures Spread (LONG MAY16 & SHORT AUG16) is trading at about -2.85 this morning. No signal here.

HA_SP2 Chart

HA_SP2 = 60 (Buy signal <= 25, Sell Signal >= 75)

At ~60, this prop indicator is above NEUTRAL zone.

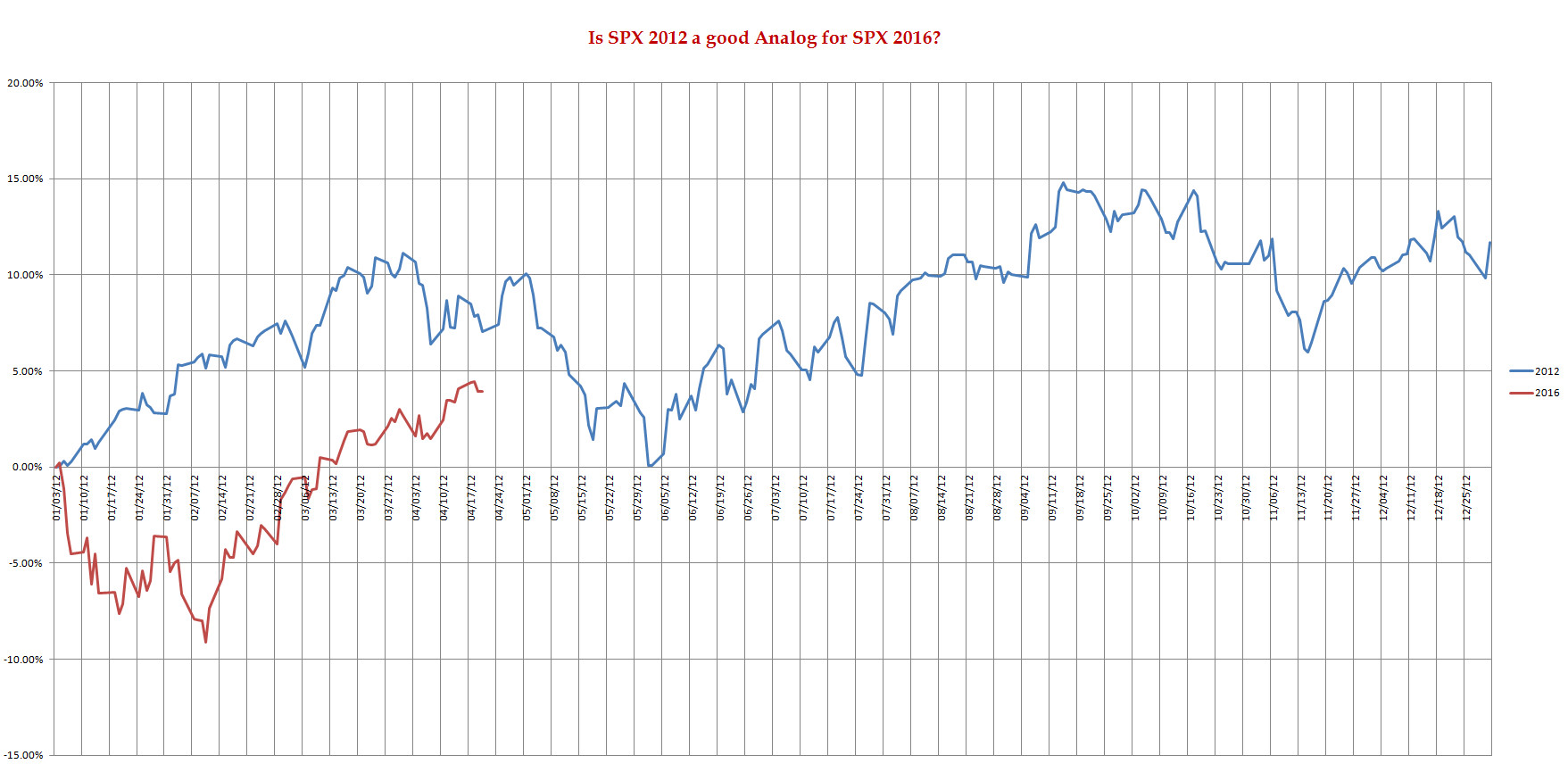

SPX 2012 Analog for SPX 2016

Based on this Analog, it still looks like that we may see a reversal in early-May. Is that certain? Of course NOT.

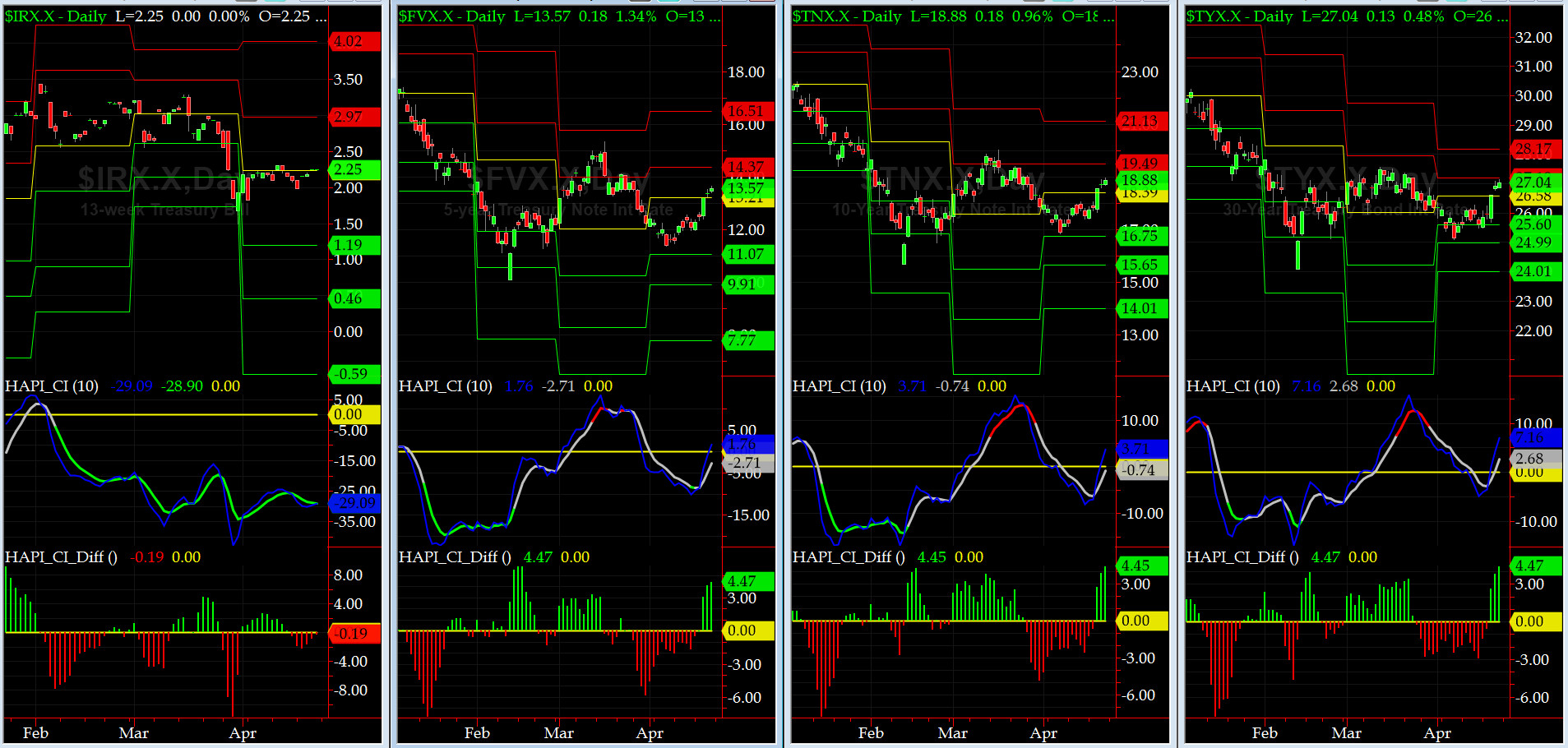

US Treasury T-Notes & T-Bonds Yields Chart

This past week, US Treasury Yields dropped to, or below, their April Pivot marks. Bond Market has gone Blonde (clueless in our parlance), LOL.

Fari Hamzei

|