|

Tuesday, August 9, 2016, 2300ET

Mini Update covering Select Charts & Market Bias

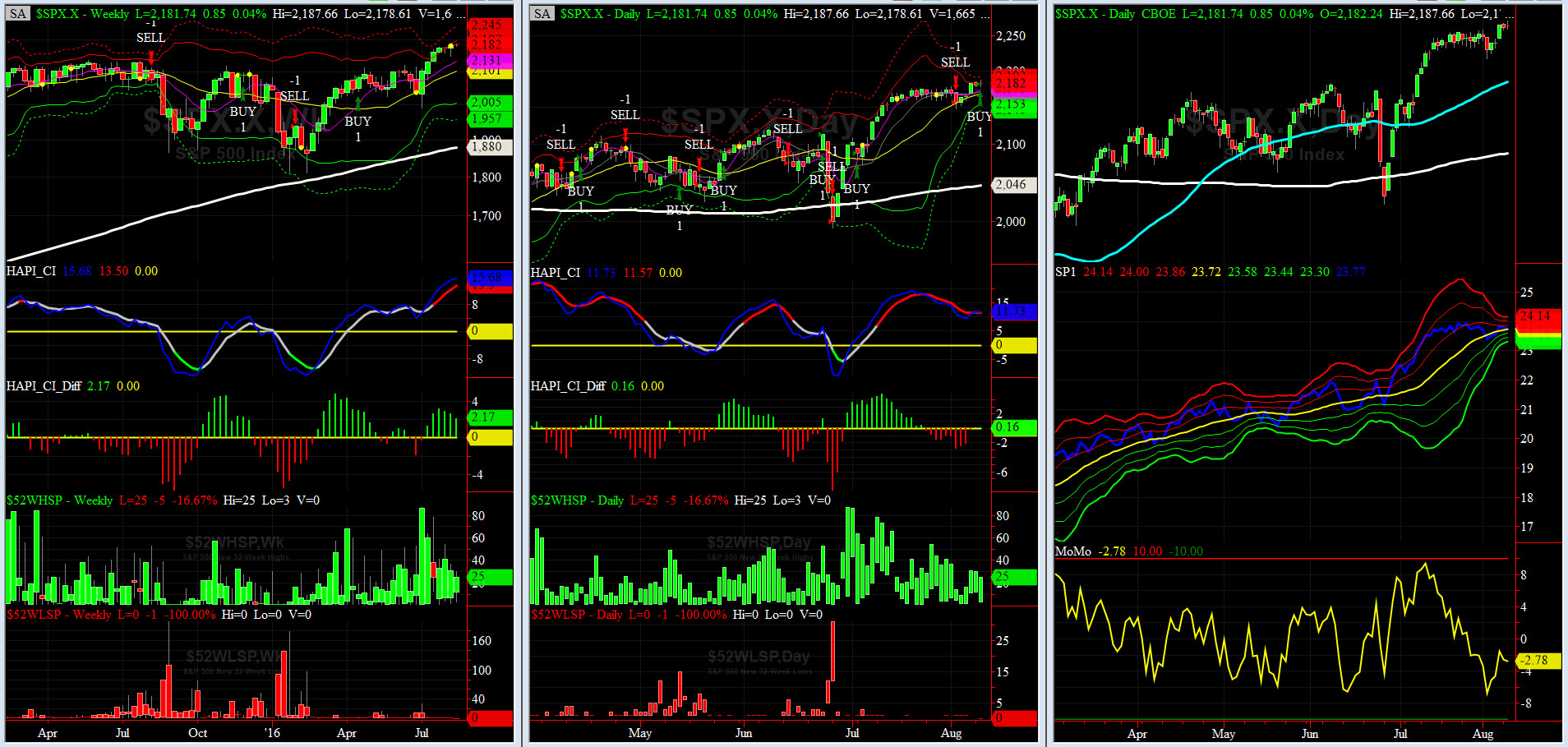

DeTrenders Charts for SPX, NDX, TRAN & RUT Indices

HA_SP1_Momo Chart

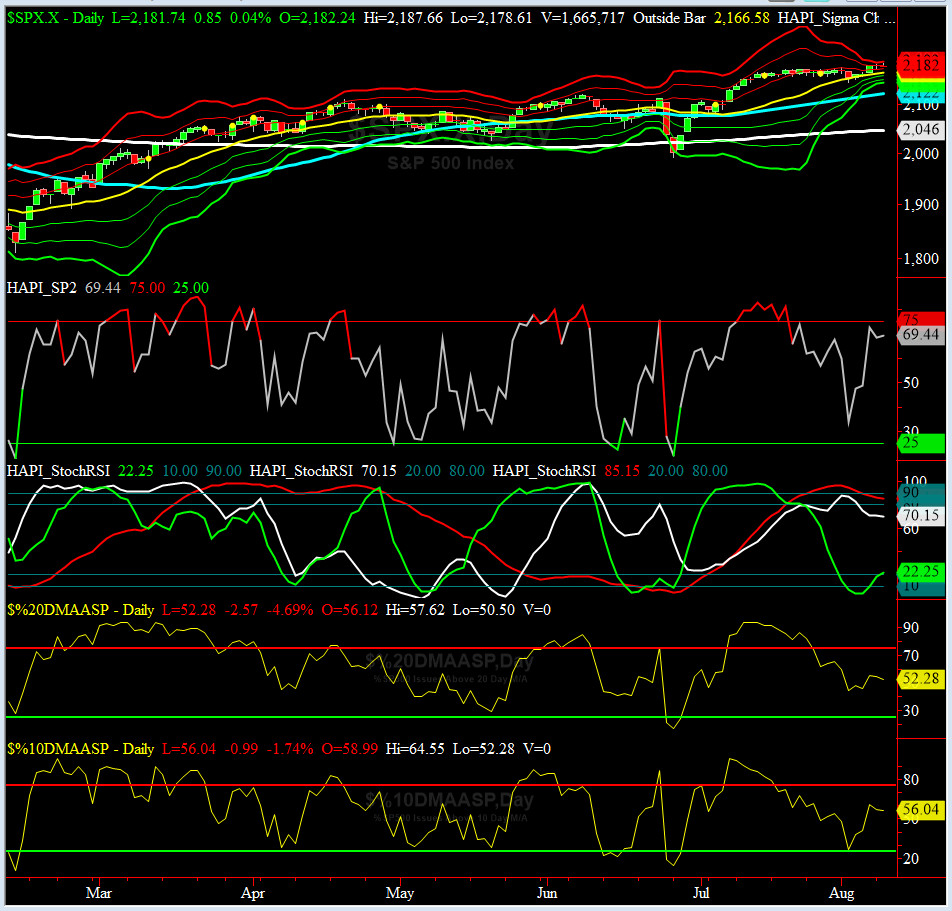

HA_SP2 Chart

SPX SKEW (Tail Risk) Chart

Our current Market Bias with Timer Digest is SHORT SPX as of Monday August 1 Close 2170.84

Our previous Market Bias was FLAT SPX as of Friday July 22 Close 2152.14

This WEEK’s Trade = SHORT the Market using SPX or SPY Put Spreads

SPX First Profit Target = 2130

SPX Second Profit Target = 2100

SPX Money Management Stop = 2195

BOTTOM LINE: Post July NFP (+255K print vs +180K con), we have remained very overbought on most indicators (although we are witnessing some divergences, namely, in HA SP1 & SP2, almost all DeTrenders except NDX's and Crude Oil in relative performance basis). We shall cautiously risk no more than a tad over 1% (STOP LOSS).

Note: Once one of our SPX targets is hit (Profit or Money Management), our Option/ETF trade for that week is over. Go to Cash and wait for the next PMT Issue.

Fari Hamzei

|