|

Saturday, November 26, 2016, 2330ET

Market Timing Charts, Analysis & Commentary for Issue #169

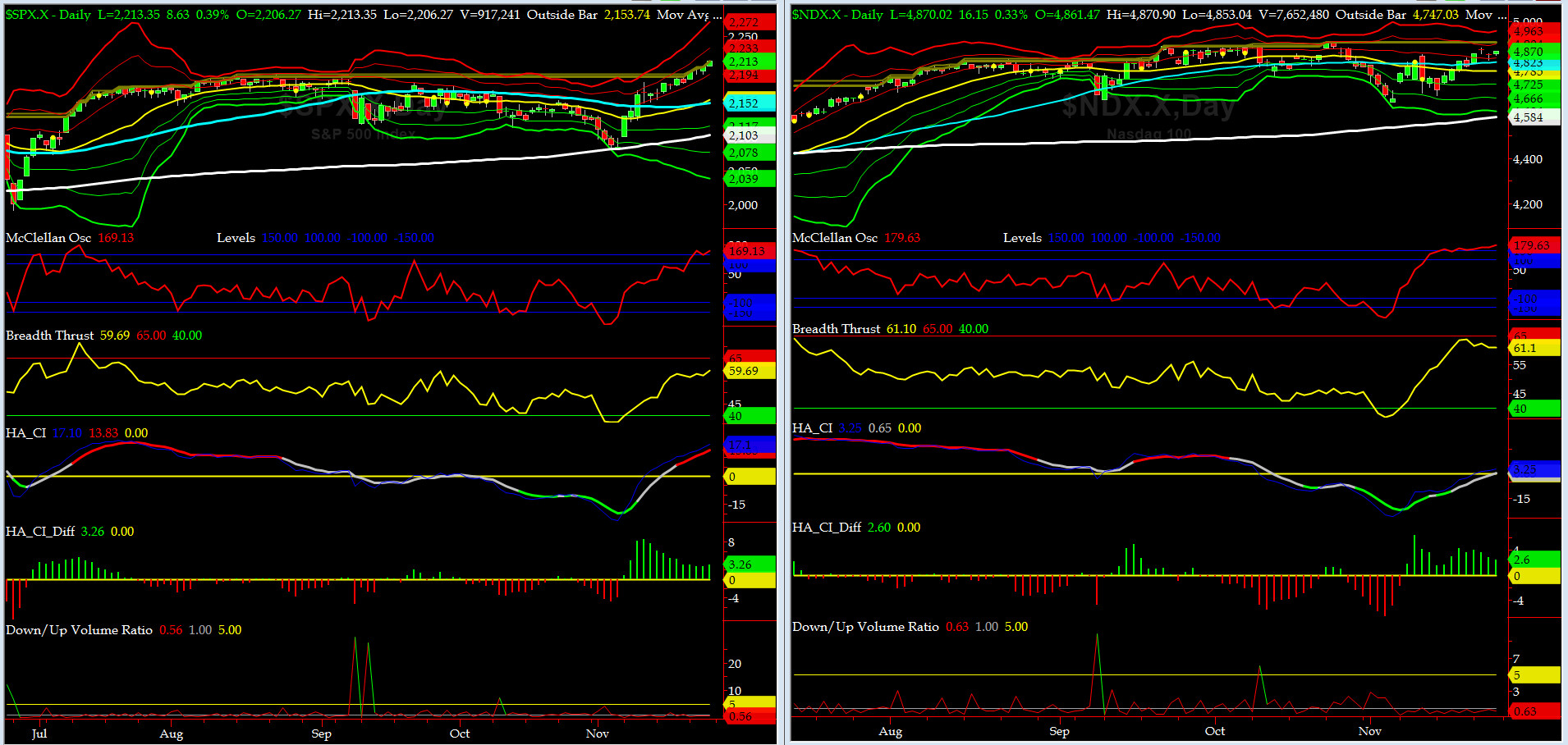

Timer Charts of S&P-500 Cash Index (SPX) + NASDAQ-100 Cash Index (NDX)

Most recent S&P-500 Cash Index (SPX): 2213.35 up +31.45 (up +1.44%) for the week ending Friday, November 26th, 2016, which closed again at about its +1.5 sigma.

SPX ALL TIME INTRADAY HIGH = 2213.35 (reached on Friday, November 25, 2016)

SPX ALL TIME CLOSING HIGH = 2213.35 (reached on Friday, November 25, 2016)

Current DAILY +2 Sigma SPX = 2203 with WEEKLY +2 Sigma = 2207

Current DAILY 0 Sigma (20 day MA) SPX = 2143 with WEEKLY 0 Sigma = 2156

Current DAILY -2 Sigma SPX = 2083 with WEEKLY -2 Sigma = 2105

NYSE McClellan Oscillator = +169 (-150 is start of the O/S area; around -275 to -300 area or lower, we go into the “launch-pad” mode, over +150, we are in O/B area)

NYSE Breadth Thrust = 59.7 (40 is considered as oversold and 65 as overbought)

Ceteris paribus, we still plan to stay long SPX into next FOMC Meeting (Dec 13-14).

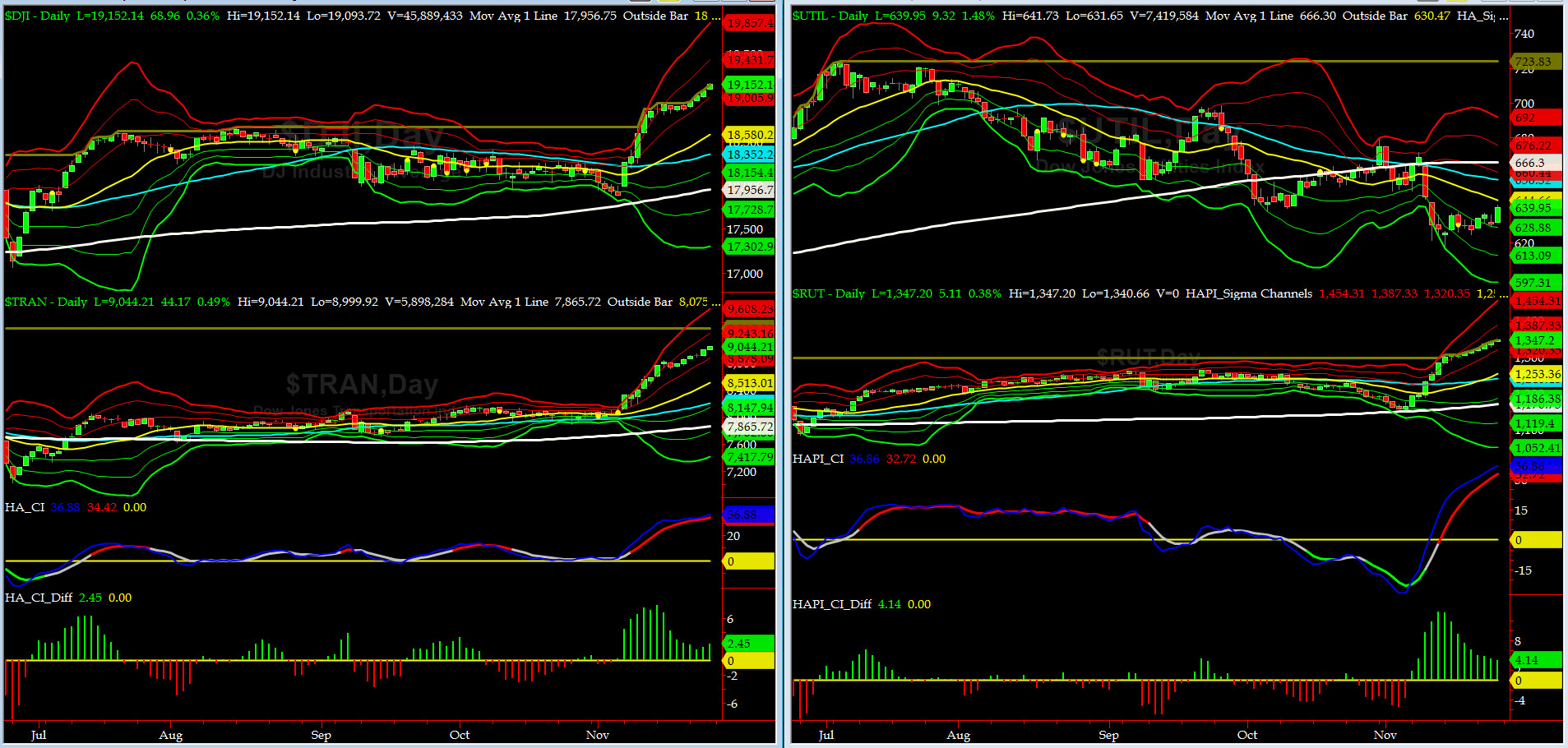

Canaries [in the Coal Mine] Chart for DJ TRAN & RUT Indices

200-Day MA DJ TRAN = 7865 or 15% below DJ TRAN (max observed in last 5 yrs = 20.2%, min = -20.3%)

200-Day MA RUT = 1170 or 15.1% below RUT (max observed in last 5 yrs = 21.3%, min = -22.6%)

DJ Transports (proxy for economic conditions 6 to 9 months hence) had another awesome week.

Russell 2000 small caps (proxy for Risk ON/OFF) had another tremendous week and rose by another 2.4%. RISK is definitely ON.

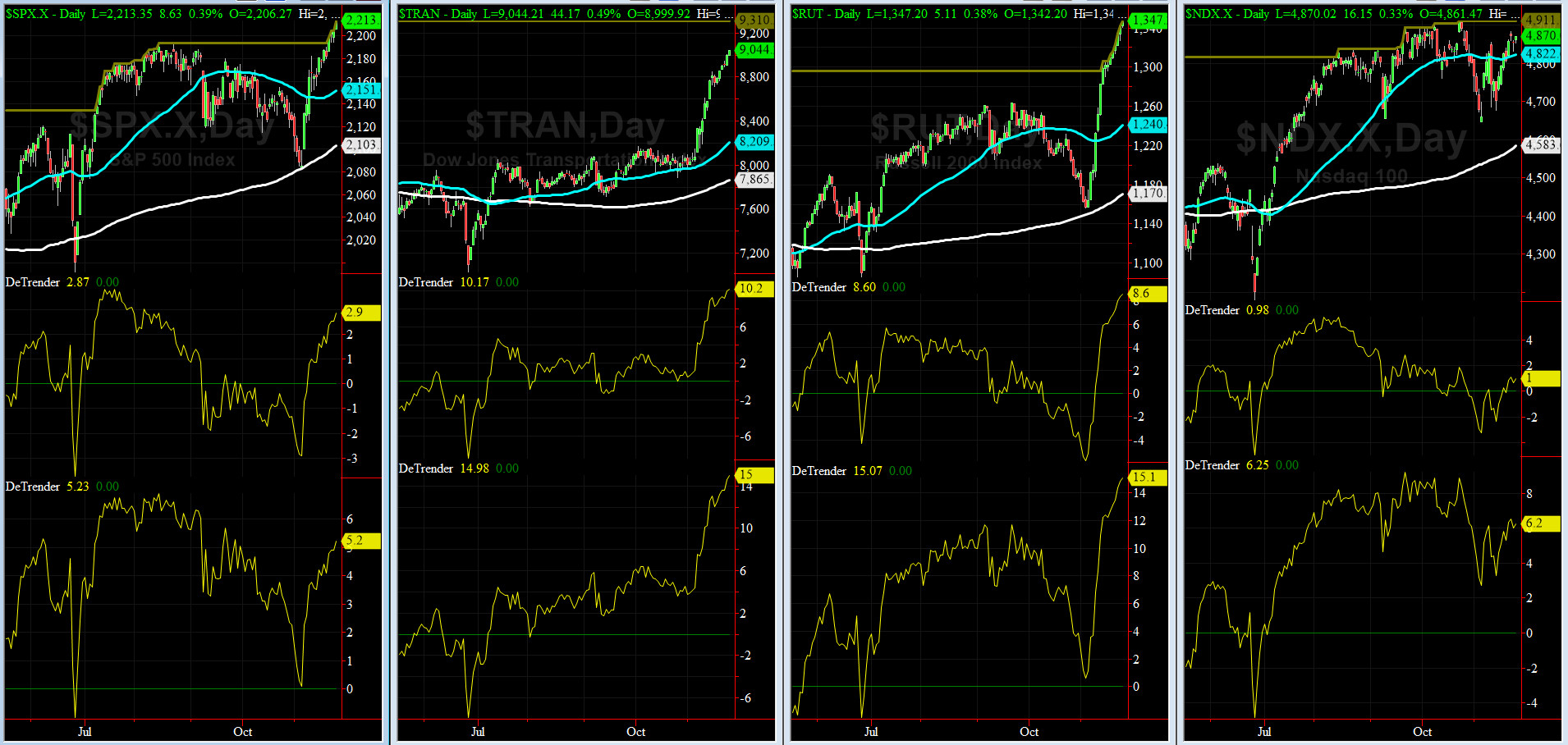

DeTrenders Charts for SPX, NDX, TRAN & RUT Indices

50-Day MA SPX = 2151 or 2.9 below SPX closed on Friday (max observed in last 5 yrs = +8.6%, min = -9.3%)

200-Day MA SPX = 2103 or 5.2% below SPX (max observed in last 5 yrs = 15.2%, min = -14%)

None of our 8 De Trenders are negative. The De Trenders for DJ TRAN & RUT will continue to be harbingers of future price behavior in broad indices.

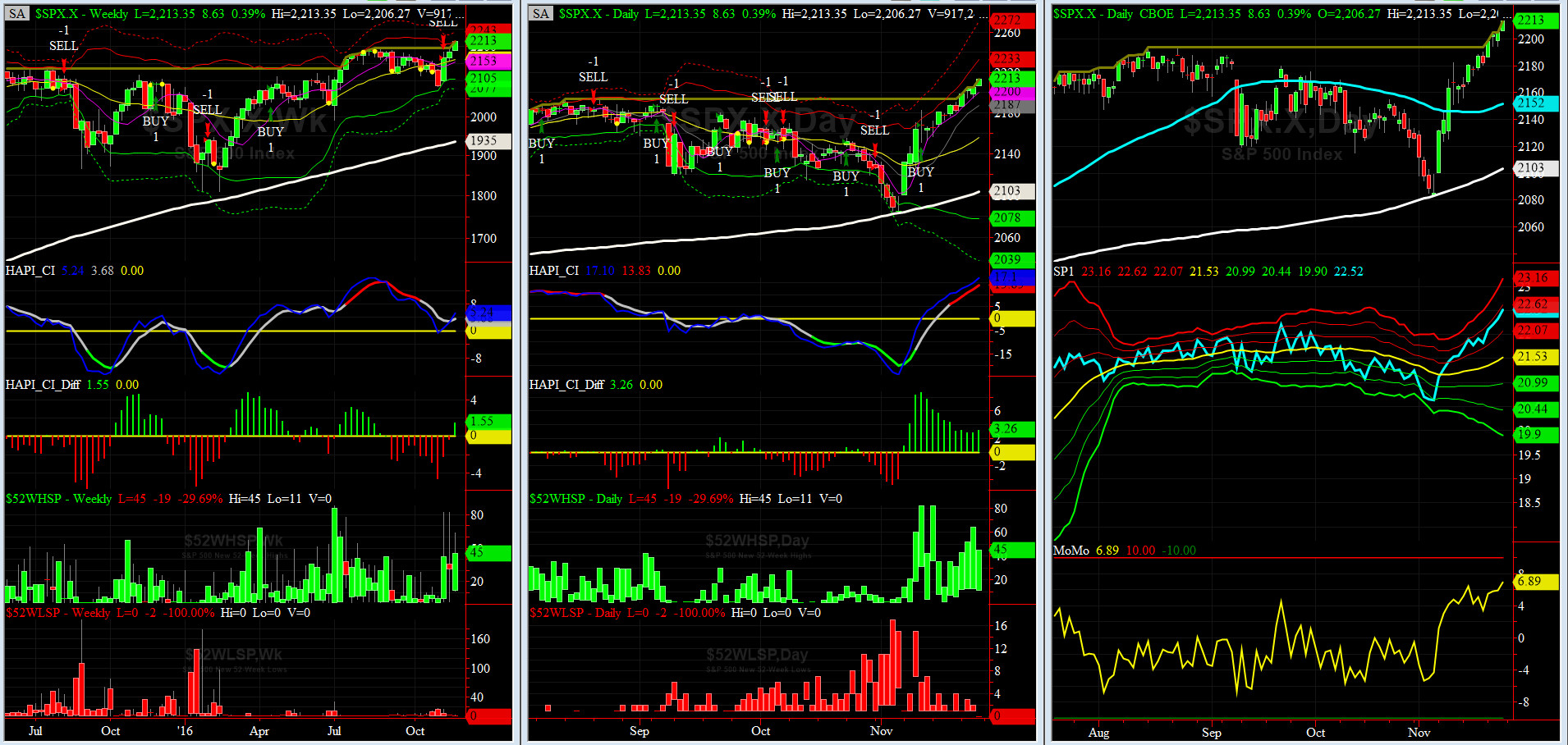

HA_SP1_Momo Chart

WEEKLY Timing Model = on a SELL Signal since Friday 11/11/16 CLOSE at 2164

DAILY Timing Model = on a BUY Signal since Thursday 11/10/16 CLOSE at 2167

Max SPX 52wk-highs reading last week = 64 (over 120-140, the local maxima is in)

Max SPX 52wk-Lows reading last week = 3 (over 40-60, the local minima is in)

HA_SP1 = very near its +2 sigma channels

HA_Momo = +6.9 (reversals most likely occur above +10 or below -10)

Vol of the Vols Chart

VIX is currently testing its -1 sigma level at 12.34 (remember it’s the VIX’s vol pattern (its sigma channels) that matters, and not the level of VIX itself (this is per Dr. Robert Whaley, a great mentor and the inventor of original VIX, now called VXO). VIX usually peaks around a test of its +4 sigma).

The current shock wave is over. Crude Oil Vol spiked this week.

5-day TRIN & TRINQ Charts

Both NYSE & NASDAQ 5-day TRINs are in NEUTRAL zones.

Components of SPX above their respective 200day MA Chart

This scoring indicator continued to rally and crossed 70%. Again, every night this past week, my XO, @Capt_Tiko, checked this indicator after his evening meal (#TunaPower). He now has his eyes set for 75% to 80% for the peak of current rally.

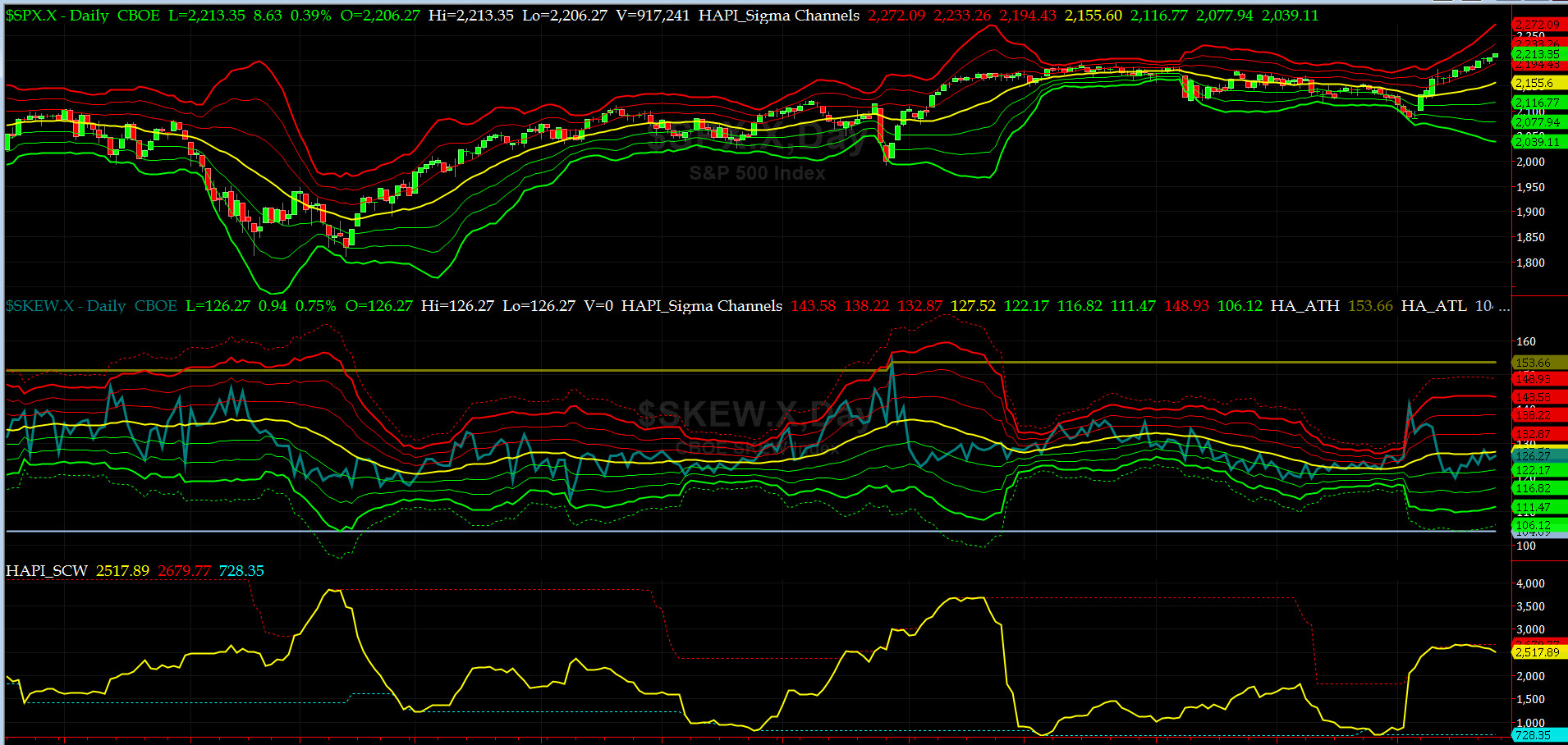

SPX SKEW (Tail Risk) Chart

Last week SPX SKEW (Tail Risk) first sank to its -1 sigma level and then rose to close at 126 this week, which is almost its zero sigma level (normal = 120-125, range 100-150).

All is quiet on the Eastern Front (WASH-BOS Elite Corridor).

3-month VIX Futures Spread(VX) Chart

Our 3-month VIX Futures Spread (LONG DEC16 & SHORT MAR17) closed at -3.51 on Friday. This spread showed moderate pullback, as indices continued the grind higher.

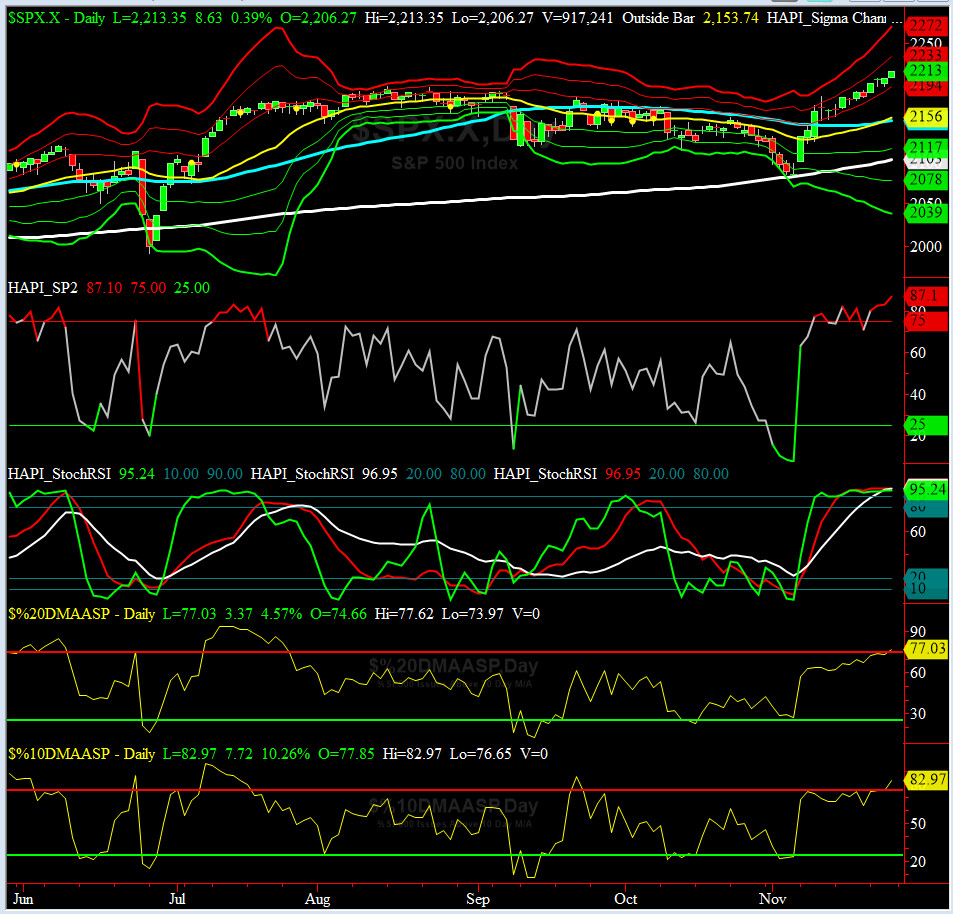

HA_SP2 Chart

HA_SP2 = 87.1 (Buy signal <= 25, Sell Signal >= 75)

This indicator is signalling extreme overbought reading now. Even @Capt_Tiko is getting somewhat apprehensive.

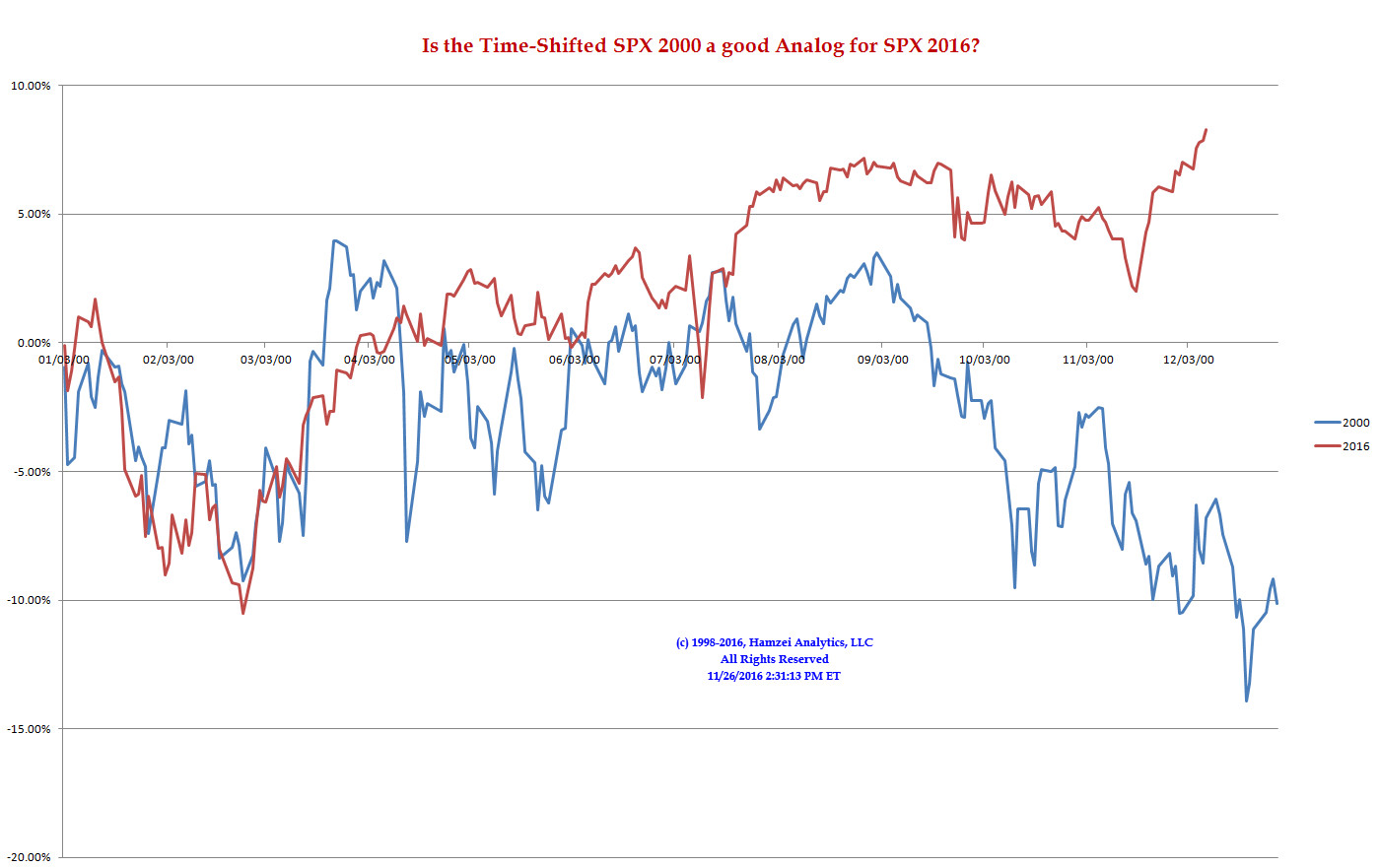

SPX 2000 Analog for SPX 2016

This Analog Chart is beyond its shelf life. RIP.

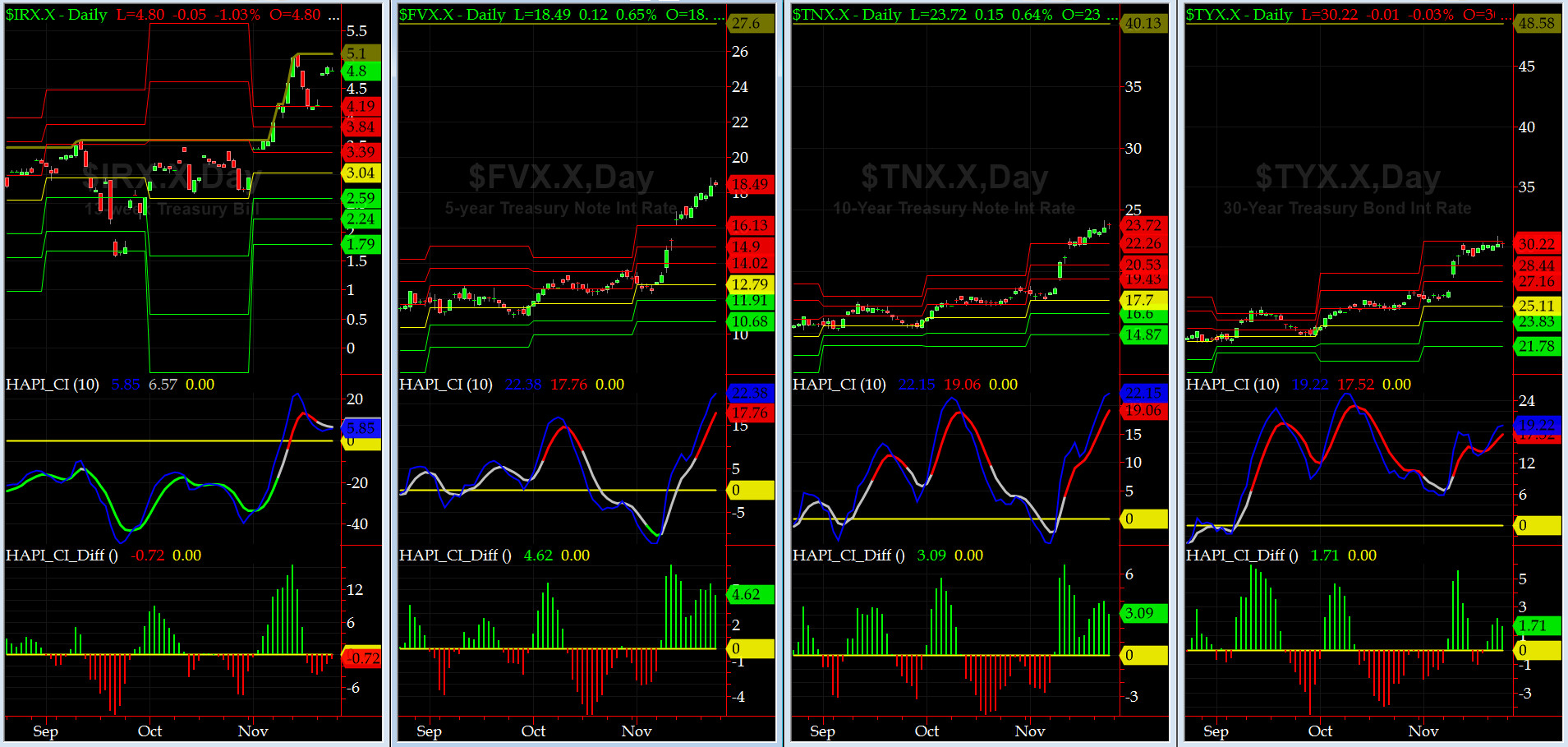

US Treasury T-Notes & T-Bonds Yields Chart

This weekend we added ATH for last 7 years to each chart. It will give us a better prespective as YTMs rally here as DJT starts to put into action his econ plan (he had a plan? asks Tiko LOL).

The YTMs on Treasury Complex shot up again on both ends and the middle of the yield curve.

Fari Hamzei

|