|

Sunday, February 3, 2019, 1545ET

Market Timing Charts, Analysis & Commentary for Issue #278

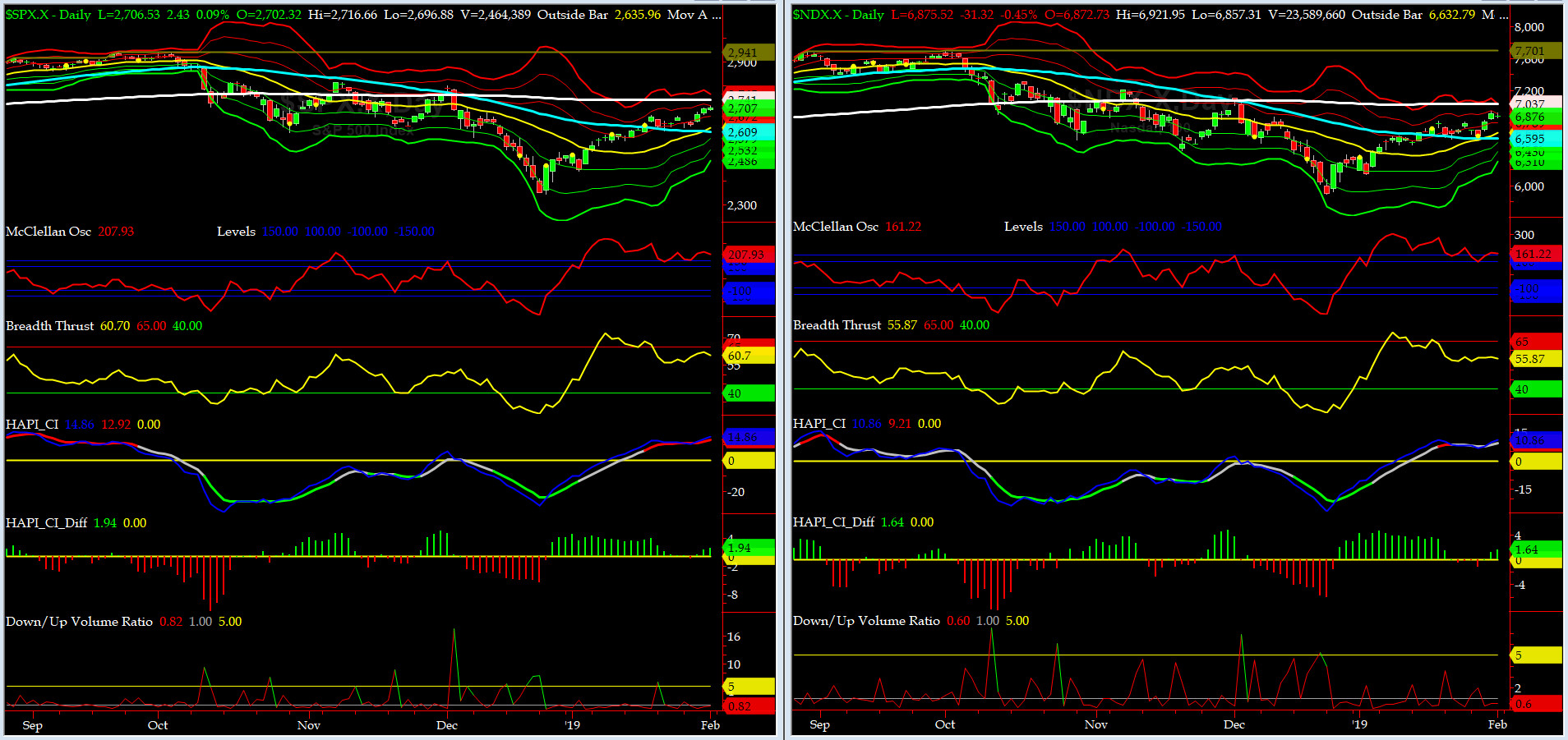

Timer Charts of S&P-500 Cash Index (SPX) + NASDAQ-100 Cash Index (NDX)

Most recent S&P-500 Cash Index (SPX): 2706 up +41 (up +1.5%) for the week ending on Friday, February 1, 2019, which closed above its +1.5 sigma.

DJIA ALL TIME INTRADAY HIGH = 26951 (reached on Wednesday, October 3, 2018)

DJ TRAN ALL TIME INTRADAY HIGH = 11623 (reached on Friday, September 14, 2018)

SPX ALL TIME INTRADAY HIGH = 2941 (reached on Friday, September 21, 2018)

NDX ALL TIME INTRADAY HIGH = 7700 (reached on Thursday, October 1, 2018)

RUT ALL TIME INTRADAY HIGH = 1742 (reached on Friday, August 31, 2018)

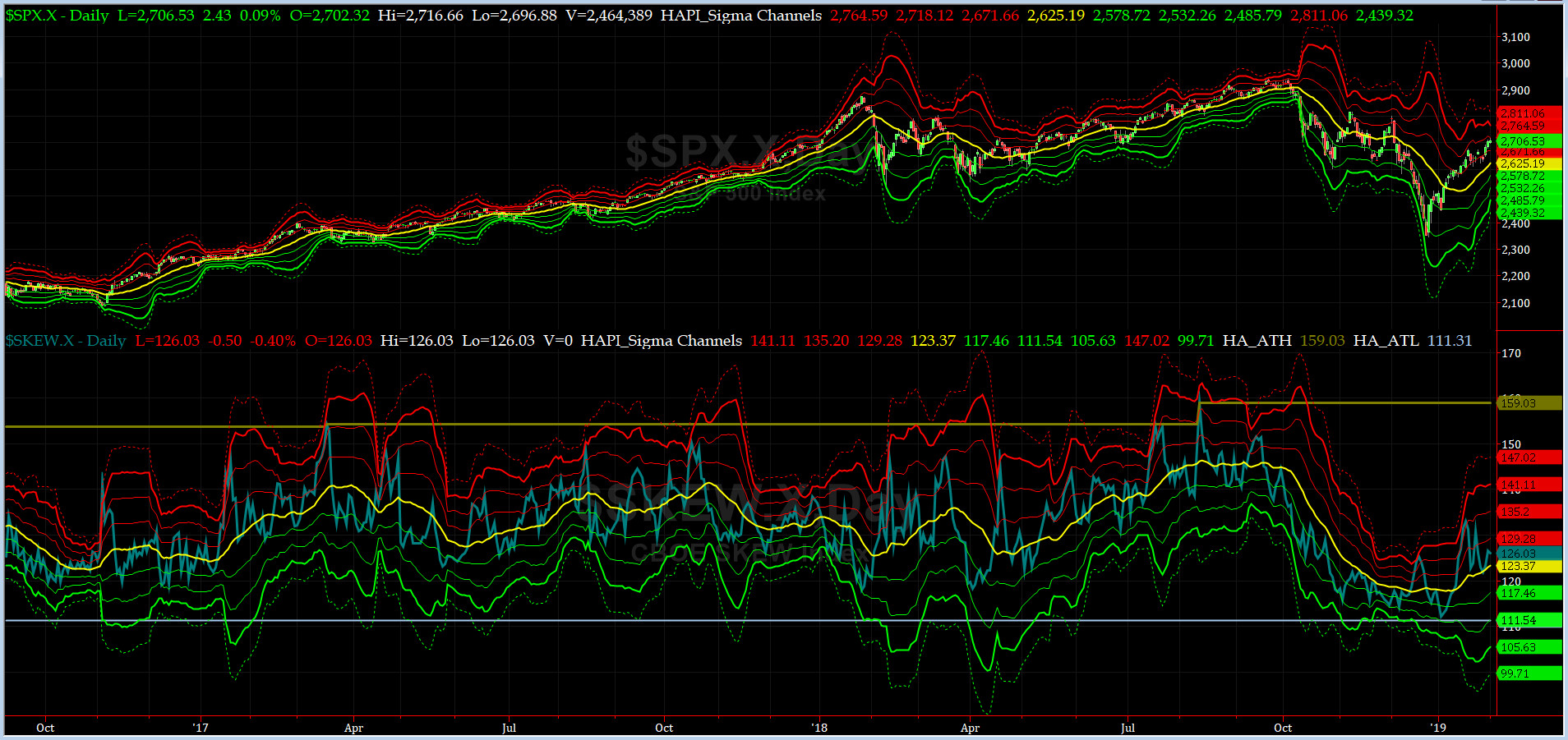

Current DAILY +2 Sigma SPX = 2718 with WEEKLY +2 Sigma = 2954

Current DAILY 0 Sigma SPX = 2625 with WEEKLY 0 Sigma = 2693

Current DAILY -2 Sigma SPX = 2532 with WEEKLY -2 Sigma = 2432

NYSE McClellan Oscillator = +208 (-150 is start of the O/S area; around -275 to -300 area or lower, we go into the “launch-pad” mode; over +150, we are in O/B area)

NYSE Breadth Thrust = 60.7 (40 is considered as oversold and 65 as overbought)

With disappointing AMZN guidance & a great JAN NFP, we rallied a tad on Friday, but overall it was a good week for the longs.

Canaries [in the Coal Mine] Chart for DJ TRAN & RUT Indices

200-Day MA DJ TRAN = 10,568 or 4.2 ABOVE DJ TRAN (max observed in last 7 yrs = 20.2%, min = -20.3%)

200-Day MA RUT = 1589 or 5.5% ABOVE RUT (max observed in last 7 yrs = 21.3%, min = -22.6%)

DJ Transportation Index (proxy for economic conditions 6 to 9 months hence) had a nice rally.

Russell 2000 Small Caps Index (proxy for Risk ON/OFF) also had a nice rally. RISK is creeping back in.

DeTrenders Charts for SPX, NDX, TRAN & RUT Indices

50-Day MA SPX = 2609 or 3.7% BELOW SPX (max observed in last 7 yrs = +8.6%, min = -9.3%)

200-Day MA SPX = 2741 or 1.3% ABOVE SPX (max observed in last 7 yrs = 15.2%, min = -14%)

Four out of EIGHT of our DeTrenders (all 50DTs) are now in the NEGATIVE territory. The DeTrenders for DJ Tran & RUT will continue to be harbingers of future price behavior in broad indices.

HA_SP1_Momo Chart

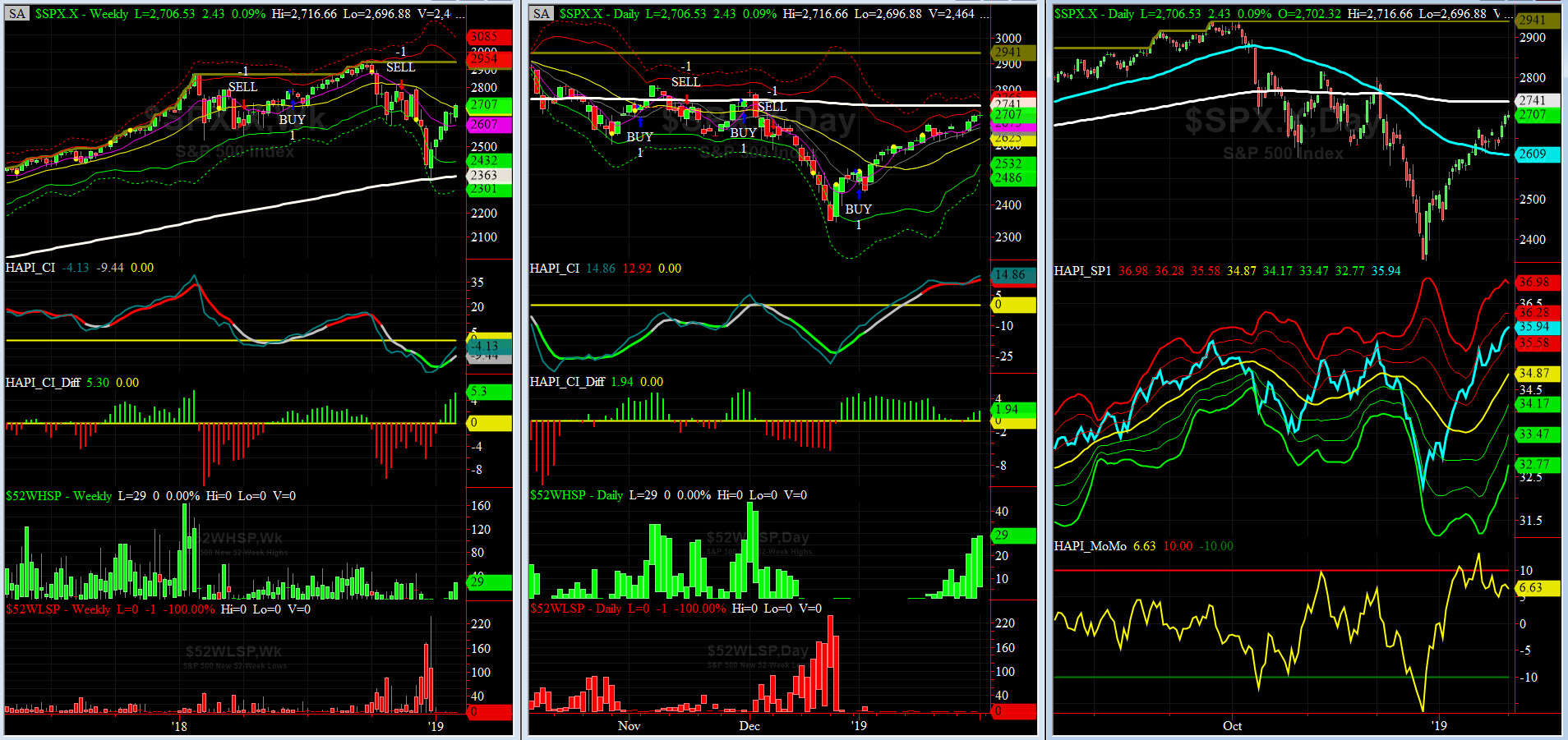

WEEKLY Timing Model = on a SELL Signal since Friday, November 16, 2018 CLOSE at 2736

DAILY Timing Model = on a BUY Signal since Wednesday, January 2, 2019 CLOSE at 2510

Max SPX 52wk-highs reading last week = 29 (over 120-140, the local maxima is in)

Max SPX 52wk-Lows reading last week = 0(over 40-60, the local minima is in)

HA_SP1 closed near its +1.5 sigma channels

HA_Momo = +6.6 (reversals most likely occur above +10 or below -10)

Vol of the Vols Chart

Spot VIX currently stands at 16.1, at about its -2 sigma (remember it's the VIX volatility pattern aka "its sigma channels" that matters, and not the level of VIX itself (this is per Dr. Robert Whaley, a great mentor and inventor of original VIX, now called VXO). VIX usually peaks around a test of its +4 sigma).

VIX sold off last week. VXN (VIX for NASDAQ) was more mixed.

5-day TRIN & TRINQ Charts

Both NYSE & NASDAQ 5-day TRINs continue to be in NEUTRAL zones. No signal here.

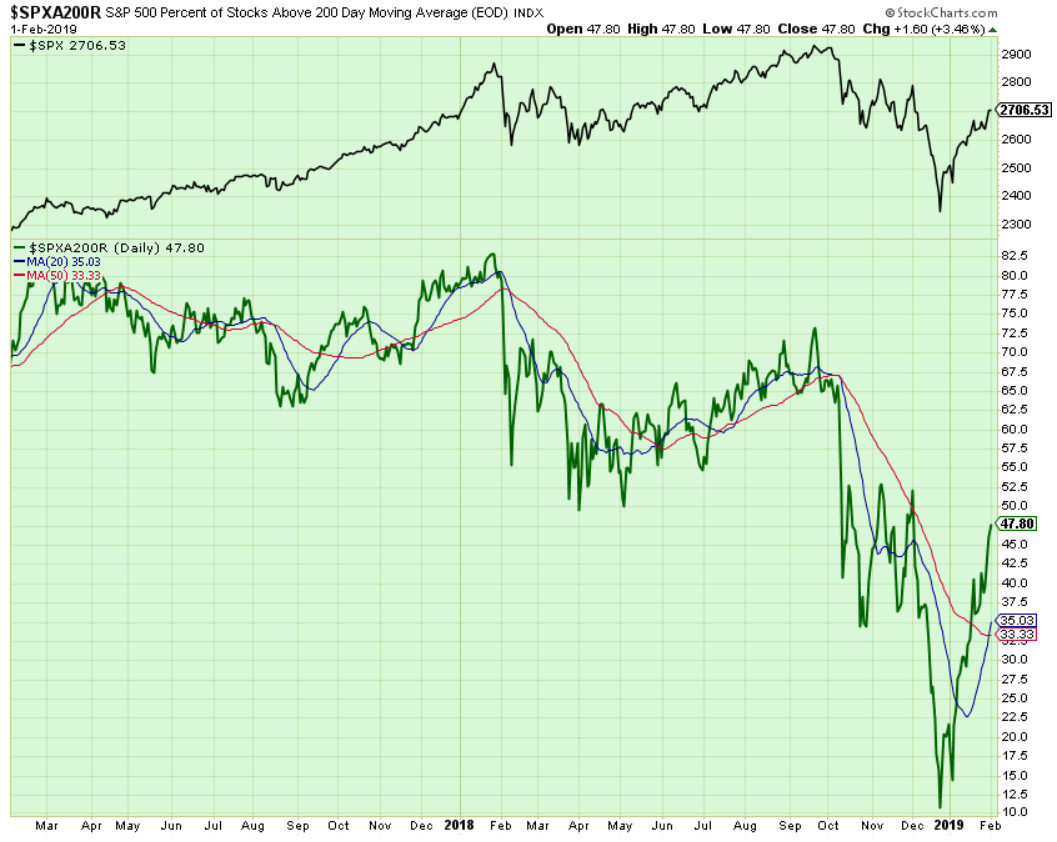

Components of SPX above their respective 200day MA Chart

This scoring indicator rallied to 47.8% area. Next target is to cross 50% LIS.

SPX SKEW (Tail Risk) Chart

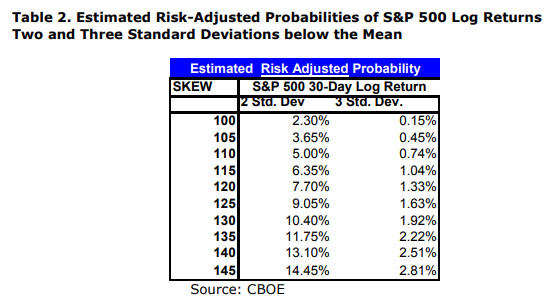

On Friday, SPX SKEW (Tail Risk) closed near 126, now about its +0.5 sigma (normal = 120-125, range 100-150).

All quiet on the Eastern & Mid-Western Fronts, again? YES (Capt Tiko says so again)....

How to interpret the value of SPX SKEW? (from CBOE white paper on SKEW)

3-month VIX Futures Spread(VX) Chart

This popular timing indicator, (now long FEB19, & short MAY19 VIX Futures) again closed at -0.9 which says SPX is in NEUTRAL.

HA_SP2 Chart

HA_SP2 = 78.5 (Buy signal <= 25, Sell Signal >= 75)

Our coveted SP2 prop indicator dopped then rallied back into the uber OVERBOUGHT zone. Look for potential bearish divergences.

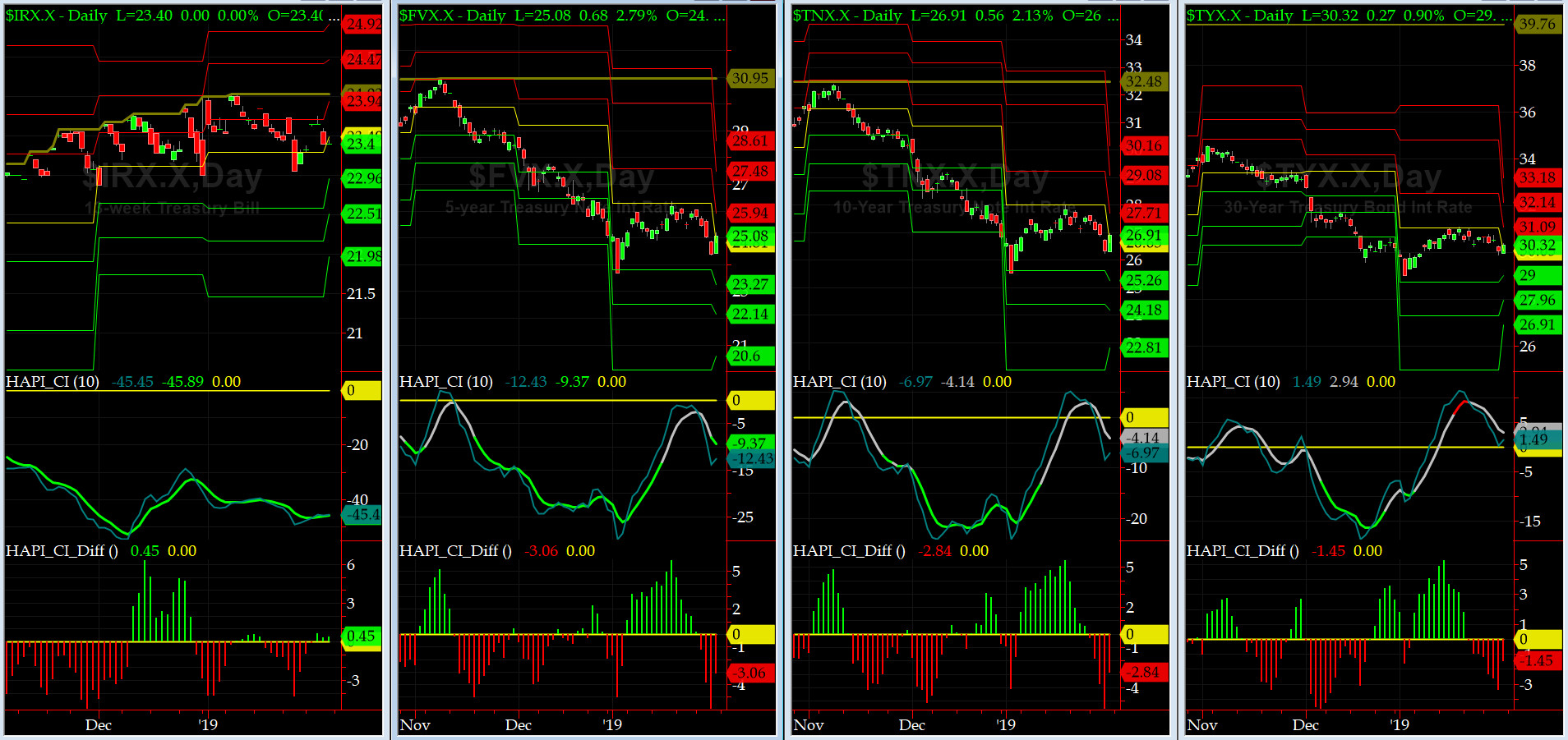

US Treasury T-Notes & T-Bonds Yields Chart

This week the YTMs dropped and then rallied on Friday, so effectively, they went nowhere fast.

Fari Hamzei

|