|

Tuesday, January 21, 2019, 1425ET

Market Timing Charts, Analysis & Commentary for Issue #318

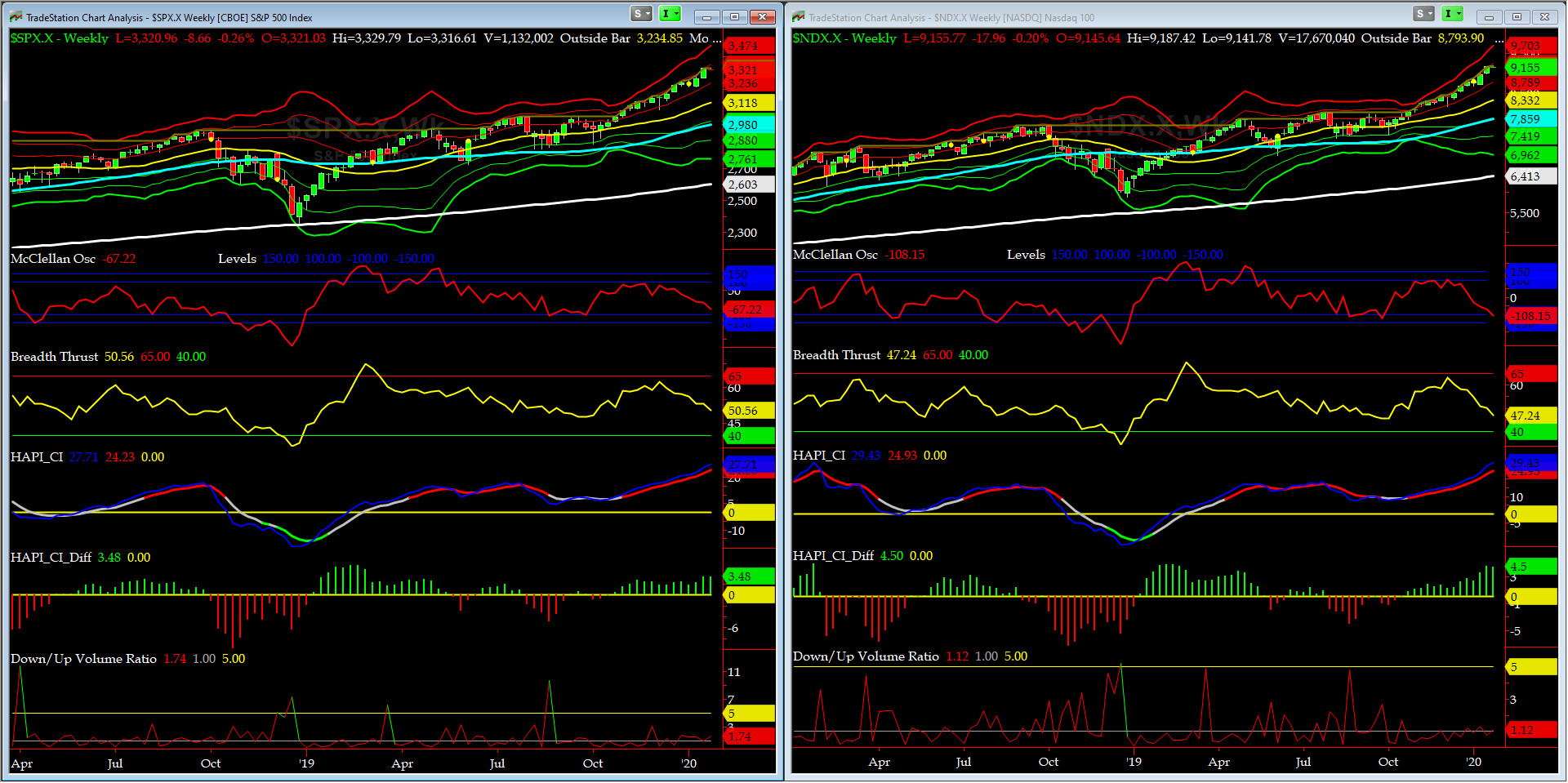

Timer Charts of S&P-500 Cash Index (SPX) + NASDAQ-100 Cash Index (NDX)

Most recent S&P-500 Cash Index (SPX) Close: 3234 up +11 (up +0.34%) for the 12 trading days ending on Tuesday, December 24, 2019, which closed very near its +2 sigma.

DJIA ALL TIME INTRADAY HIGH = 28871 reached on Thursday, January 2, 2020

DJT ALL TIME INTRADAY HIGH = 11623 reached on Friday, September 14, 2018

SPX ALL TIME INTRADAY HIGH = 3258 reached on Thursday, January 2, 2020

NDX ALL TIME INTRADAY HIGH = 8873 reached on Thursday, January 2, 2020

RUT ALL TIME INTRADAY HIGH = 1742 reached on Friday, August 31, 2018

Current DAILY +2 Sigma SPX = 3277 with WEEKLY +2 Sigma = 3275

Current DAILY 0 Sigma SPX = 3194 with WEEKLY 0 Sigma = 3058

Current DAILY -2 Sigma SPX = 3112 with WEEKLY -2 Sigma = 2841

NYSE McClellan Oscillator = +35 (-150 is start of the O/S area; around -275 to -300 area or lower, we go into the “launch-pad” mode; over +150, we are in O/B area)

NYSE Breadth Thrust = 55.1 (40 is considered as oversold and 65 as overbought)

This market is BID no more..... as in the recent past, exogenous news have a way of taking over. stay tuned, we shall take one day at the time.

DeTrenders Charts for SPX, NDX, TRAN & RUT Indices

200-Day MA DJ TRAN = 10,504 or 3.9% ABOVE the DJ TRAN (max observed in last 7 yrs = 20.2%, min = -20.3%)

200-Day MA RUT = 1557 or 6.6% ABOVE RUT (max observed in last 7 yrs = 21.3%, min = -22.6%)

50-Day MA SPX = 3128 or 3.4% BELOW SPX (max observed in last 7 yrs = +8.6%, min = -9.3%)

200-Day MA SPX = 2970 or 8.9% BELOW SPX (max observed in last 7 yrs = 15.2%, min = -14%)

DJ Transportation Index (proxy for economic conditions 6 to 9 months hence) had a nice week but pulled back on Friday.

Russell 2000 Small Caps Index (proxy for Risk ON/OFF) had a great week but also pulled back on Friday. RISK ON remains so-so.

All EIGHT of our EIGHT DeTrenders are in the POSITIVE territory. The DeTrenders for DJ Tran & RUT will continue to be harbingers of future price behavior in broad indices.

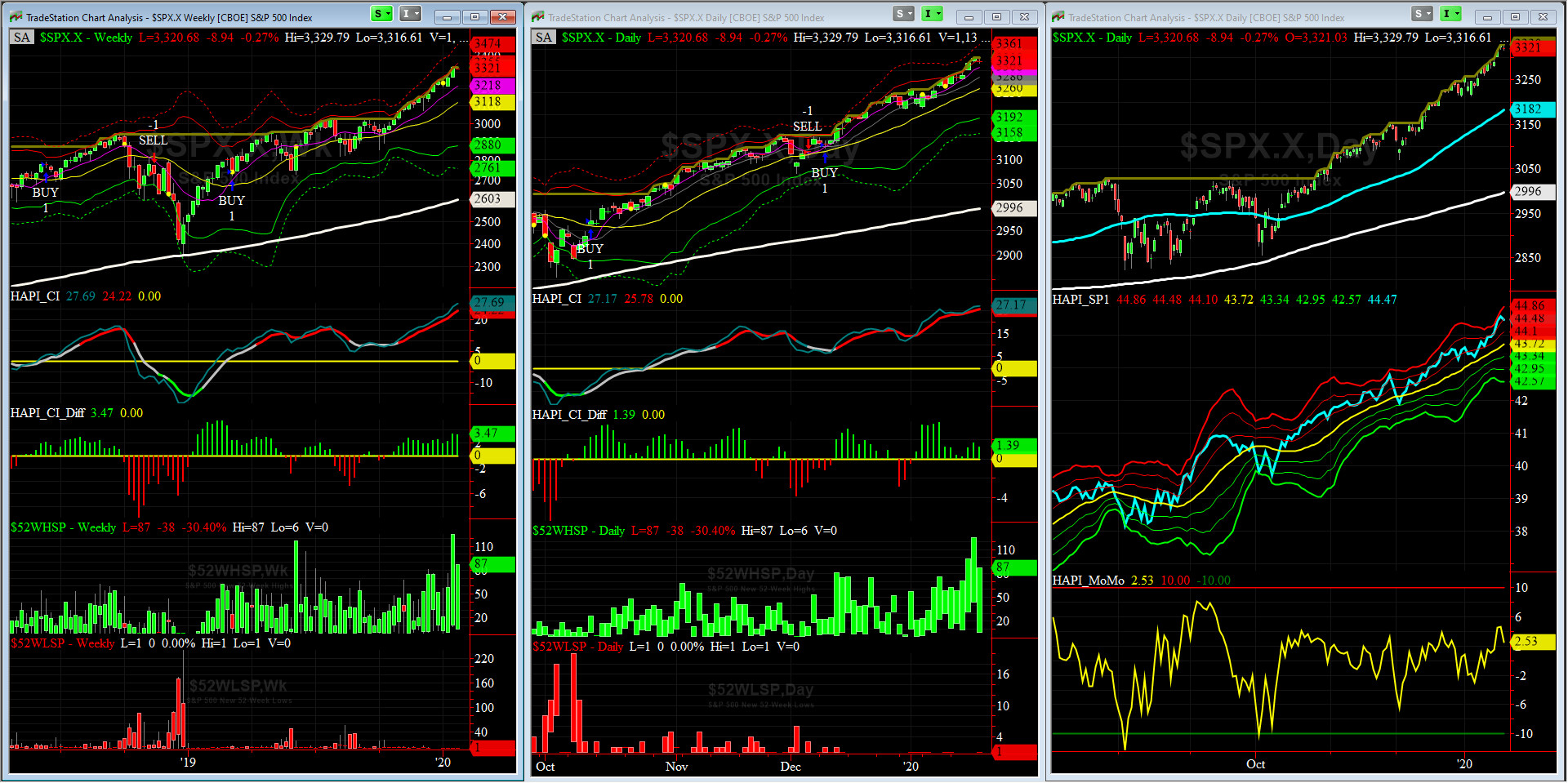

HA_SP1_Momo Chart

WEEKLY Timing Model = on a BUY Signal since Friday, March 8, 2019 CLOSE at 2743

DAILY Timing Model = on a BUY Signal since Tuesday, December 10, 2019 CLOSE at 3132

Max SPX 52wk-highs reading last week = 57 (over 120-140, the local maxima is in)

Max SPX 52wk-Lows reading last week = 1 (over 40-60, the local minima is in)

HA_SP1 closed near its +1 sigma channels

HA_Momo = -1.75 (reversals most likely occur above +10 or below -10)

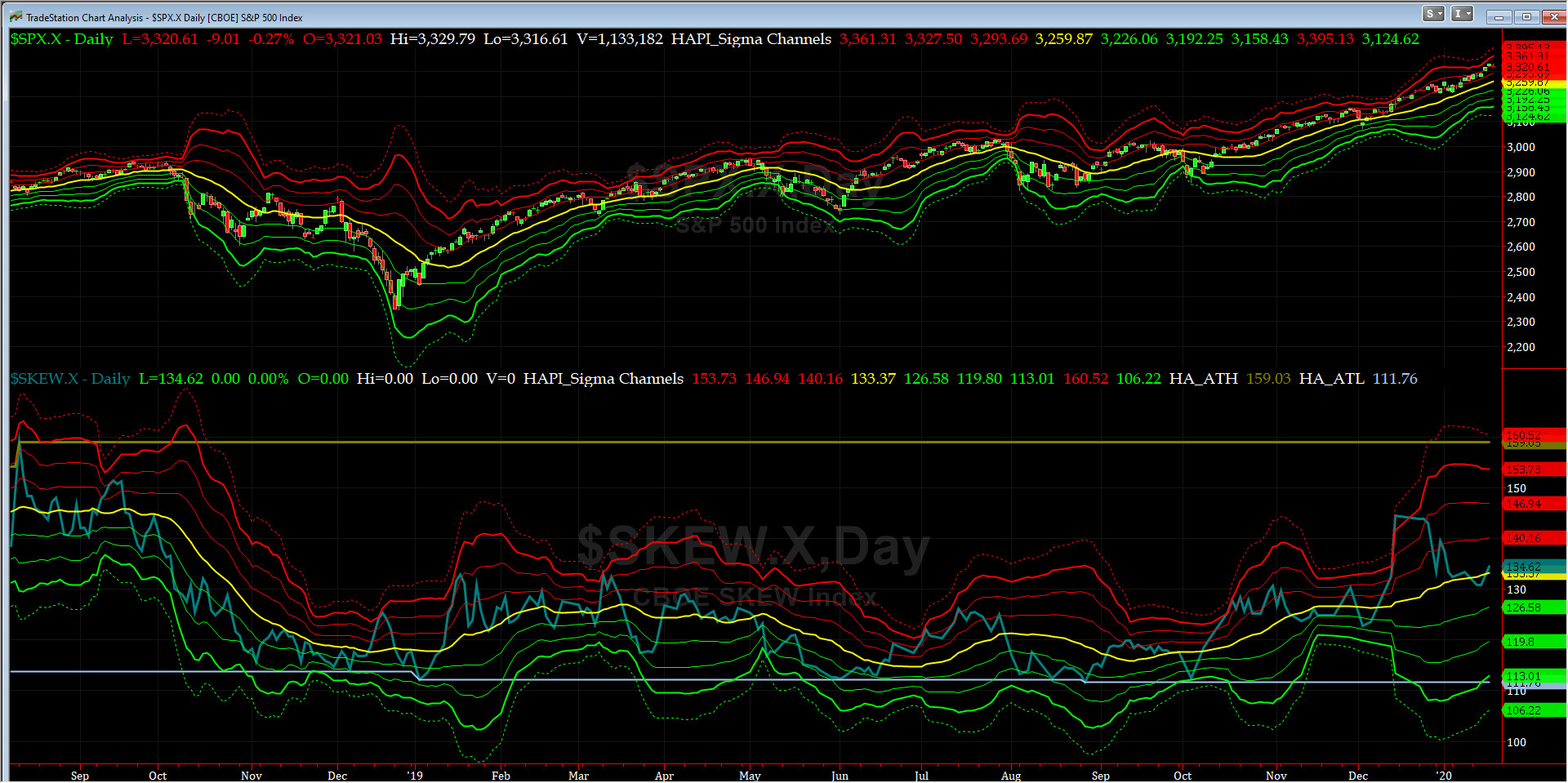

SPX SKEW (Downside Tail Risk) Chart

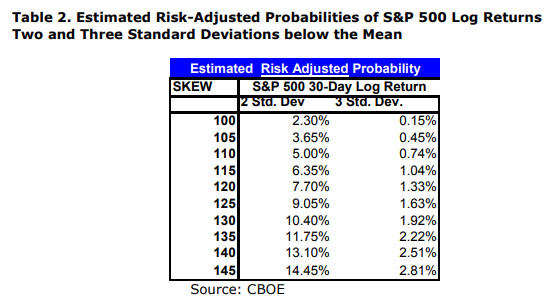

Since December 13, SPX SKEW (Downside Tail Risk) has eased off and closed on Friday at 133, now about its zero sigma (normal = 115, range 100-150).

All quiet on the Eastern & Mid-Western Fronts? our beloved & newly promoted Vice Admiral Tiko, KCPE, says NO MAS.

How to interpret the value of SPX SKEW? (from CBOE white paper on SKEW)

3-month VIX Futures Spread(VX) Chart

This popular timing indicator for identifying tradable bottoms, (now long JAN20, & short APR20 VIX Futures) hit -2.23 Friday at the Close.

HA_SP2 Chart

HA_SP2 = 55.7 (Buy signal <= 25, Sell Signal >= 75)

This indicator says we are in neutral zone for now but the tilt is to the downside.

Fari Hamzei

|