|

Tuesday, October 13, 2020, 0915ET

Market Timing Charts, Analysis & Commentary for Issue #338

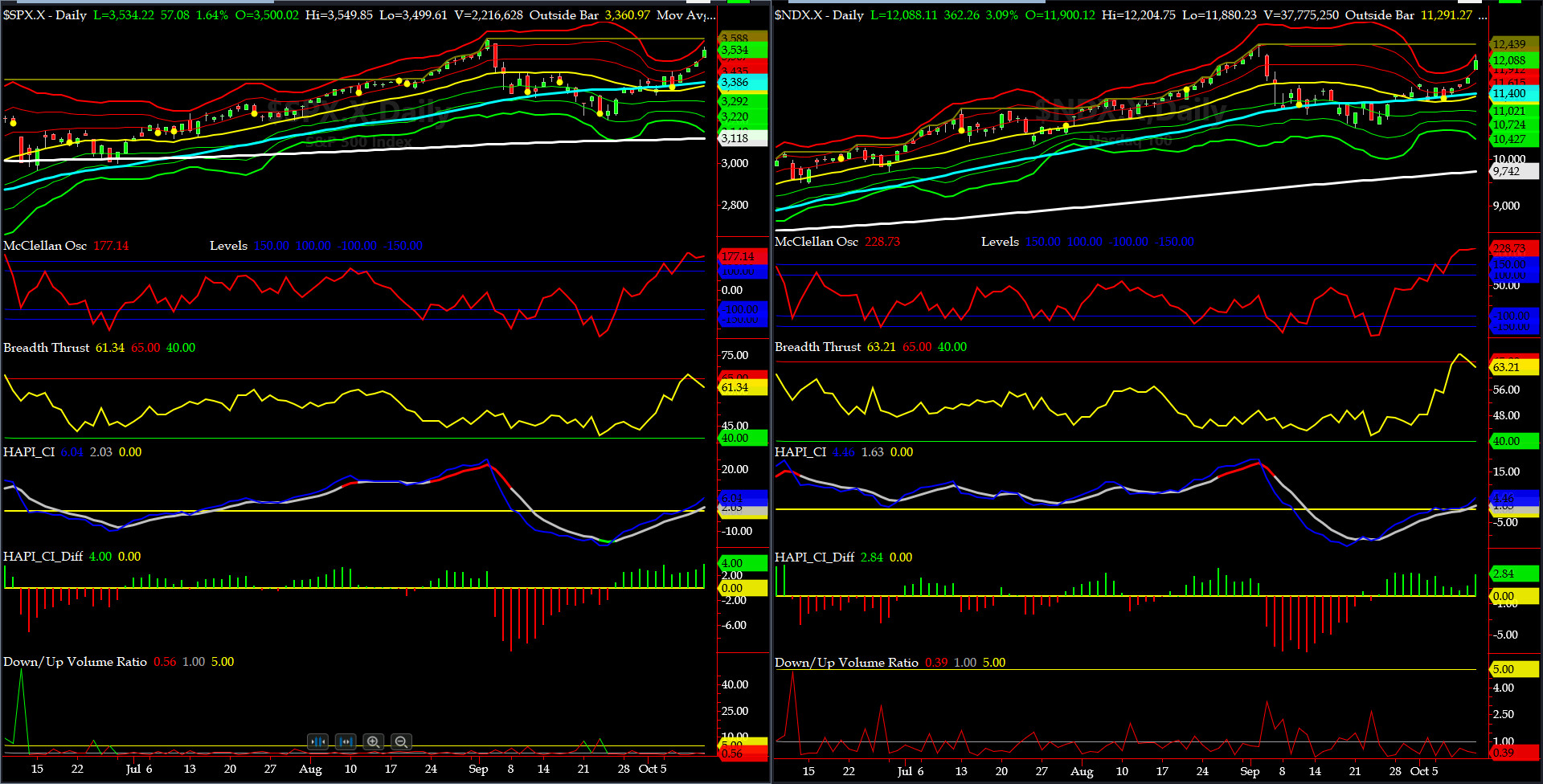

Timer Charts of S&P-500 Cash Index (SPX) + NASDAQ-100 Cash Index (NDX)

Most recent S&P-500 Cash Index (SPX) Close: 3218 down -6 (down -0.2%) for the seven trading days ending on Tuesday, July 28, 2020, which closed very near its plus 0.5 sigma.

DJIA ALL TIME INTRADAY HIGH = 29568 reached on Wednesday, February 12, 2020

DJT ALL TIME INTRADAY HIGH = 11945 reached on Monday, October 12, 2020

SPX ALL TIME INTRADAY HIGH = 3588 reached on Wednesday, September 2, 2020

NDX ALL TIME INTRADAY HIGH = 8873 reached on Wednesday, September 2, 2020

RUT ALL TIME INTRADAY HIGH = 1742 reached on Friday, August 31, 2018

Current DAILY +2 Sigma SPX = 3507 with WEEKLY +2 Sigma = 3578

Current DAILY 0 Sigma SPX = 3363 with WEEKLY 0 Sigma = 3287

Current DAILY -2 Sigma SPX = 3220 with WEEKLY -2 Sigma = 2996

NYSE McClellan Oscillator = +177 (-150 is start of the O/S area; around -275 to -300 area or lower, we go into the “launch-pad” mode; over +150, we are in O/B area)

NYSE Breadth Thrust = 61.3(40 is considered as oversold and 65 as overbought)

DeTrenders Charts for SPX, NDX, TRAN & RUT Indices

200-Day MA DJ TRAN = 9730 or 22.1% BELOW the DJ TRAN (max observed in last 7 yrs = 20.2%, min = -20.3%)

200-Day MA RUT = 1453 or 13.5% BELOW RUT (max observed in last 7 yrs = 21.3%, min = -22.6%)

50-Day MA SPX = 3385 or 4.4% BELOW SPX (max observed in last 7 yrs = +8.6%, min = -9.3%)

200-Day MA SPX = 3118 or 13.3% BELOW SPX (max observed in last 7 yrs = 15.2%, min = -14%)

DJ Transportation Index (proxy for economic conditions 6 to 9 months hence) had an excellent week making sequential ATHs.

Russell 2000 Small Caps Index (proxy for Risk ON/OFF) also put in a great week following DJ TRAN pattern.

Again, ALL of our EIGHT DeTrenders are in the POSITIVE territory. The DeTrenders for DJ Tran & RUT will continue to be harbingers of future price behavior in broad indices.

HA_SP1_Momo Chart

WEEKLY Timing Model = on a BUY Signal since Friday, June 19, 2020 CLOSE at 3097

DAILY Timing Model = on a BUY Signal since Wednesday, Sept 30, 2020 CLOSE at 3363

Max SPX 52wk-highs reading last week = 70 (over 120-140, the local maxima is in)

Max SPX 52wk-Lows reading last week = 1 (over 40-60, the local minima is in)

HA_SP1 again closed near its plus 2 sigma channels

HA_Momo = +9.1 (reversals most likely occur above +10 or below -10)

Components of SPX above their respective 200-day MA Chart

This scoring indicator rallied up to 75% and still pointing up. Once it gets past 80%, we have to get vigilant as we are entering heavy overbought area.

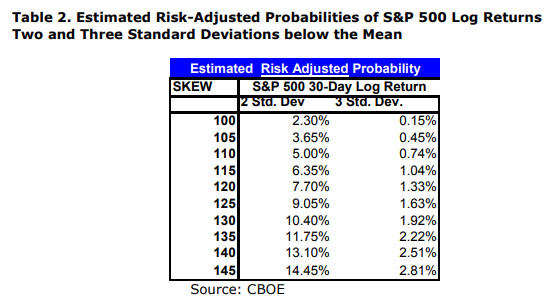

SPX SKEW (Downside Tail Risk) Chart

This week SPX SKEW (Downside Tail Risk) eased off on Thursday (SKEW is NOT computed every day any more) and closed at ~124, now about its plus 1/2 sigma (normal = 115, range 100-150).

All quiet on the Eastern & Mid-Western Fronts? HRH Admiral Tiko, KCPE, says Maybe....

How to interpret the value of SPX SKEW? (from CBOE white paper on SKEW)

3-month VIX Futures Spread(VX) Chart

This shifted timing indicator for identifying tradable bottoms, (now long AUG20, & short NOV20 VIX Futures) hit -1.26 at the Close on Monday. This is another near overbought reading.

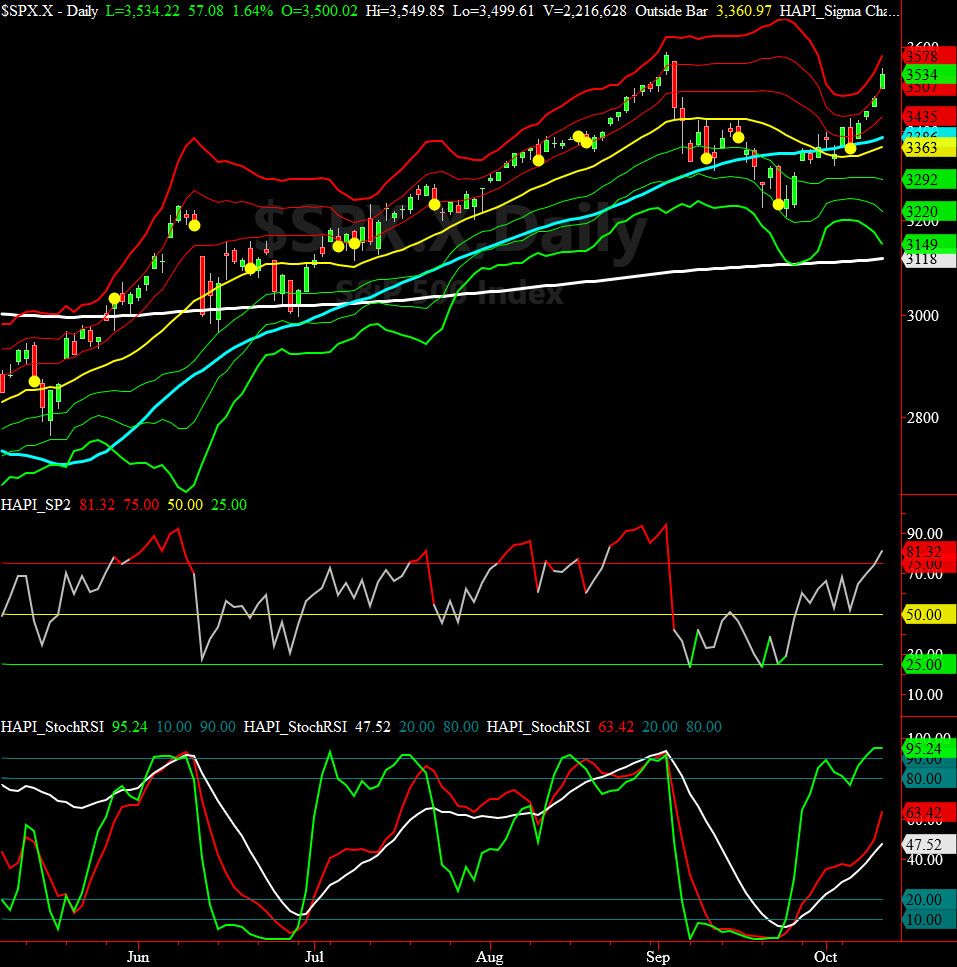

HA_SP2 Chart

HA_SP2 = 81.3 (Buy signal <= 30, Sell Signal >= 70)

This fantastic timing indicator says we are slightly overbought here.

Fari Hamzei

|