|

|

|

|

|

|

|

|

|

Proactive Market Timing Proactive Market Timing

|

|

|

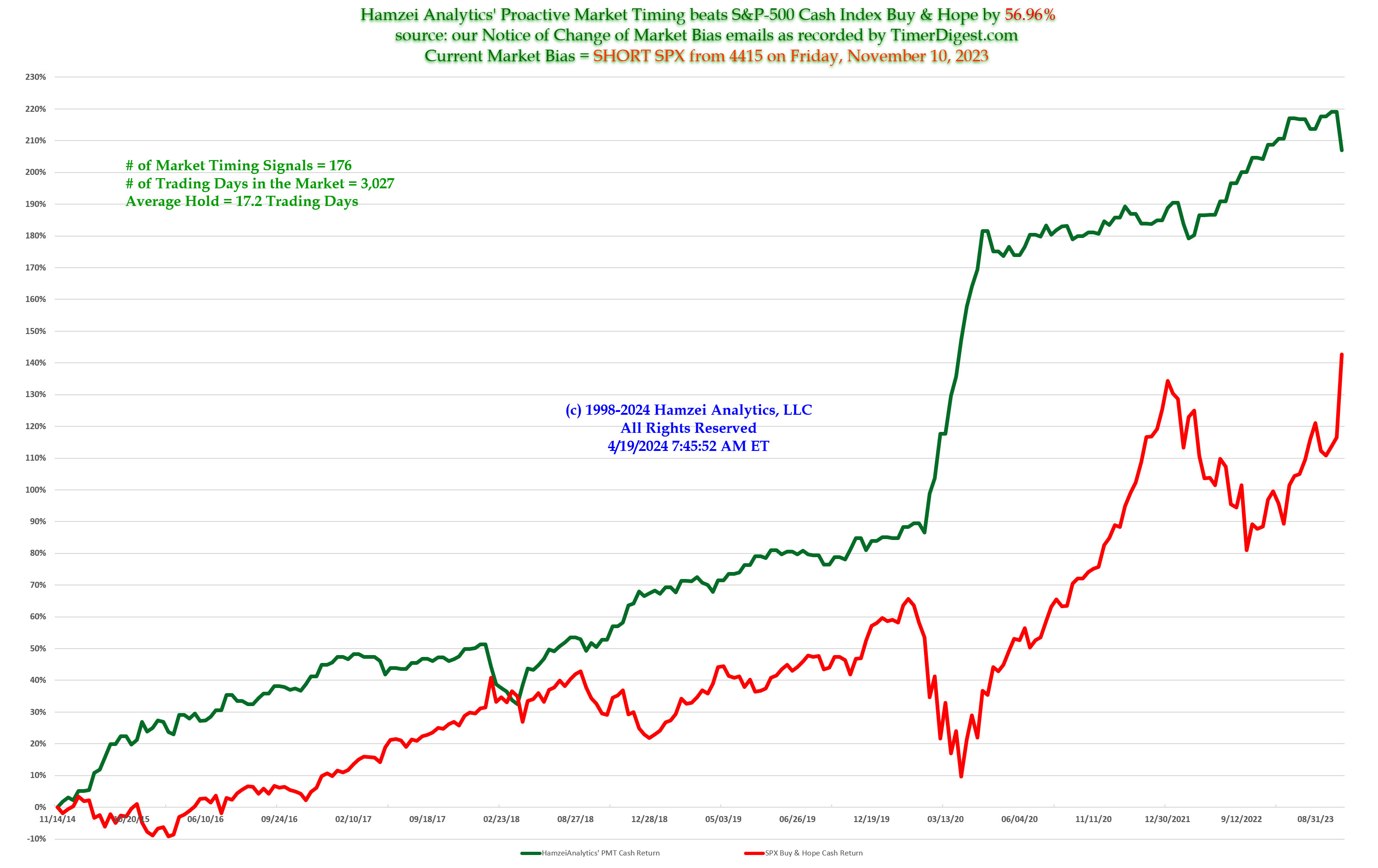

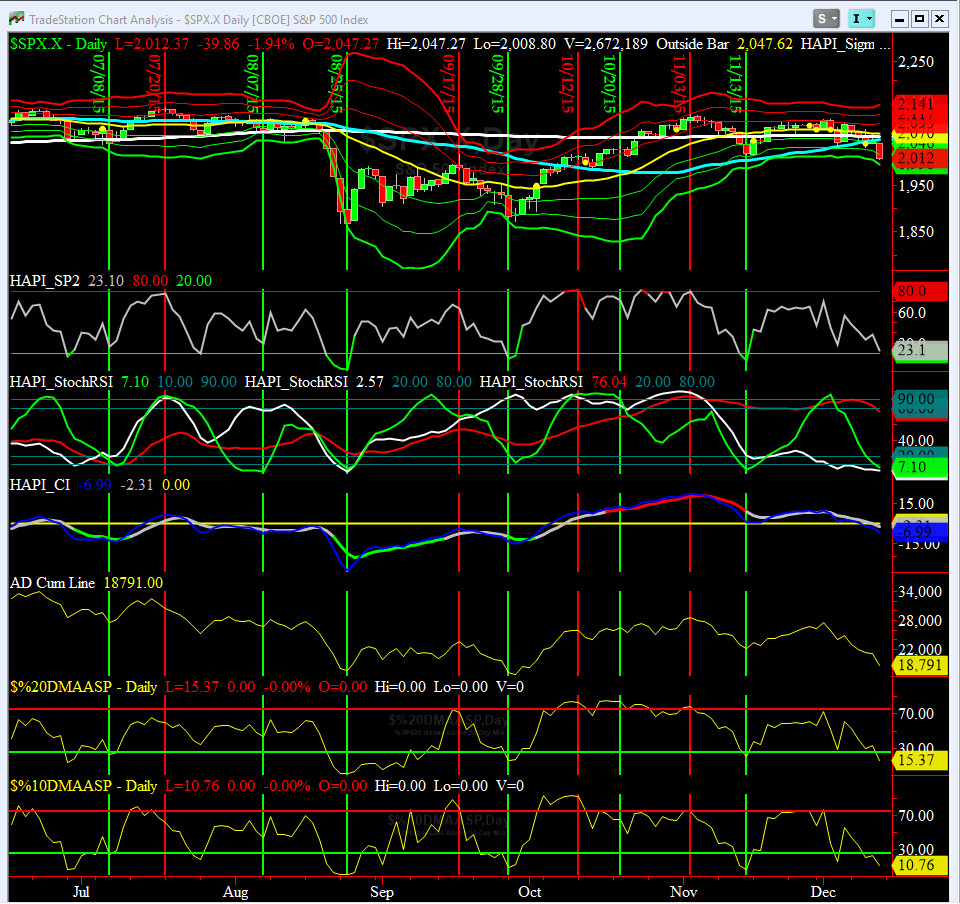

Most Recent PMT vs SPX Performance Chart

|

|

|

|

Monday, December 14, 2015, 1050ET

Companion Chart for Market Bias Review, Issue #122

|

|

|

|

|

|

Monday Morning, December 14, 2015, 0800ET

Market Bias Review, Issue #122

Most recent S&P-500 Cash Index (SPX): 2012.37 down 79.32 (down +3.8%) for the week ending on Friday, December 11th, 2015, which closed near its -2.5 sigma.

SPX ALL TIME INTRADAY HIGH = 2134.72 (reached on Wednesday, May 20th, 2015)

SPX ALL TIME CLOSING HIGH = 2130.82 (reached on Thursday, May 21st, 2015)

Current DAILY +2 Sigma SPX = 2117 with WEEKLY +2 Sigma = 2151

Current DAILY 0 Sigma (20 day MA) SPX = 2070 with WEEKLY 0 Sigma = 2028

Current DAILY -2 Sigma SPX = 2022 with WEEKLY -2 Sigma = 1905

50-Day MA SPX =2056 or -2.1% above SPX (max observed in last 5 yrs = +8.6%, min = -9.3% )

200-Day MA SPX = 2063 or -2.5% above SPX (max observed in last 5 yrs = 15.2%, min = -14%)

VIX = 24.38 which closed Friday over its +3 sigma (remember it’s the VIX’s vol pattern (its sigma channels) that matters, and not the level of VIX itself (this is per Dr. Robert Whaley, a great mentor and the inventor of original VIX, now called VXO. VIX usually peaks around a test of its +4 sigma))

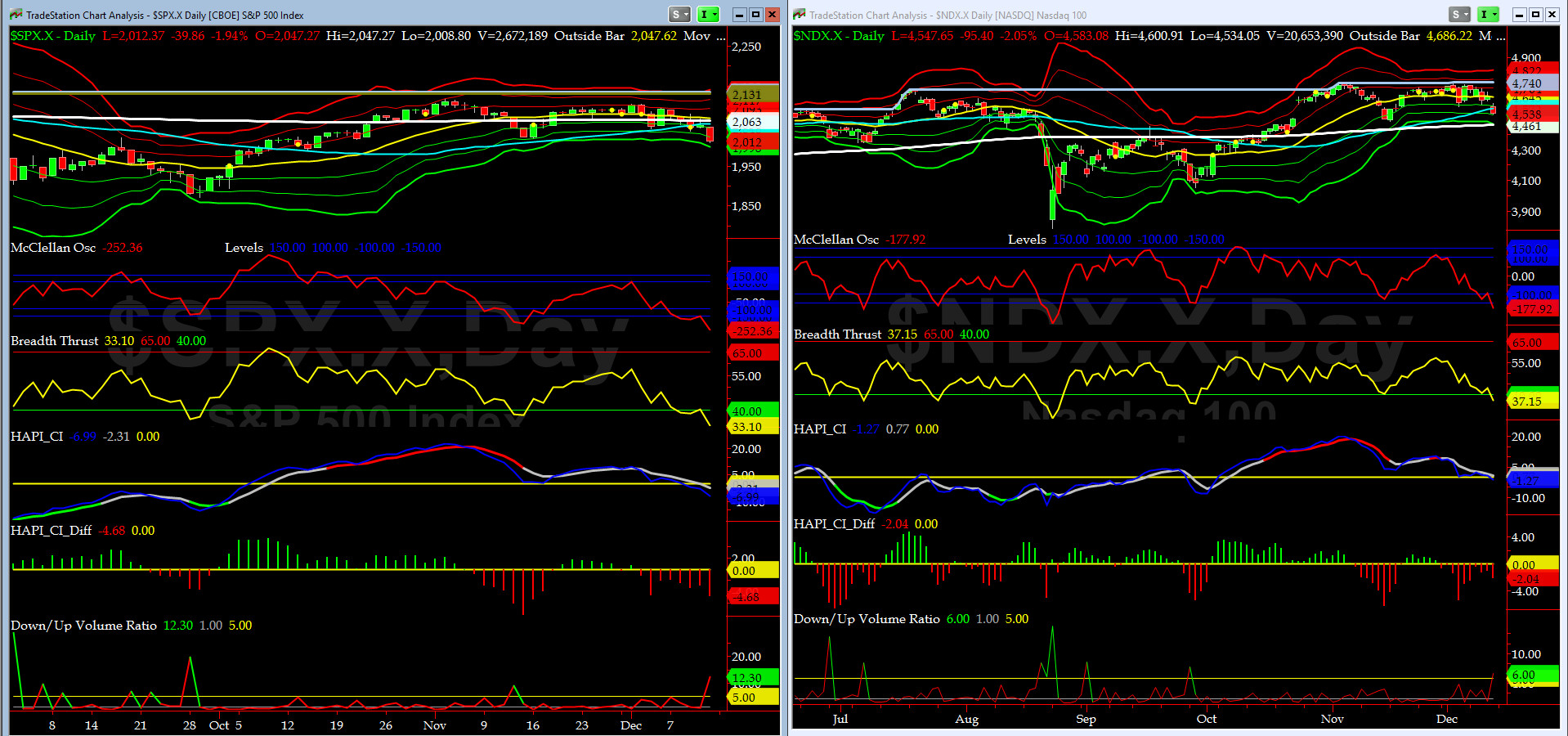

NYSE McClellan Oscillator = -252.4 (-150 is start of the O/S area; around -275 to -300 area or lower, we go into the “launch-pad” mode, over +150, we are in O/B area)

NYSE Breadth Thrust = 33.1(40 is considered as oversold and 65 as overbought)

WEEKLY Timing Model = on a BUY Signal since Friday 11/27/15 CLOSE

DAILY Timing Model = on a SELL Signal since Thursday 12/3/15 CLOSE

Max SPX 52wk-highs reading last week = 25 (over 120-140, the local maxima is in)

Max SPX 52wk-Lows reading last week = 26 (over 40-60, the local minima is in)

HA_SP1 = near its +0.5 Sigma

HA_Momo = -8.16 (reversals most likely occur above +10 or below -10)

HA_SP2 = 23.1(Buy signal <= 20, Sell Signal >= 80)

3-mo. VX Futures Spread (long JAN short APR) = +0.20 (-3 to -2.5 SELL signal, 0 BUY Signal)

SPX SKEW (Tail Risk) = 146.5 (normal = 120-125, range 100-150)

Our current SPX Bias with Timer Digest: LONG SPX as of Tuesday, October 20th, 2015 Close at 2030.77

Our previous Bias: SHORT SPX (since Tuesday, October 6th, 2015 Close at 1979.92)

This WEEK’s Bias = LONG SPY Call Spreads into FOMC & DEC OX.

Profit Target = 2070

Money Management Stop = 2000

BOTTOM LINE: We are short-term OverSold. We should see, at minimum, a bounce and then next 2 weeks should be quiet with upside bias. Also expecting the vols to come down a bit this week and then accelerate downward in the next 2 weeks.

NOTE: All LEVELS mentioned here have been, are, and will be, based on the S&P-500 SPX Cash Index, and not the ES Futures. Tomorrow after the first hour is complete, we will post here a companion chart showing critical short-term WEEKLY levels to watch for possible “retest failures.”

Fari Hamzei

|

|

|

|

|

|

Monday, December 14, 0115ET

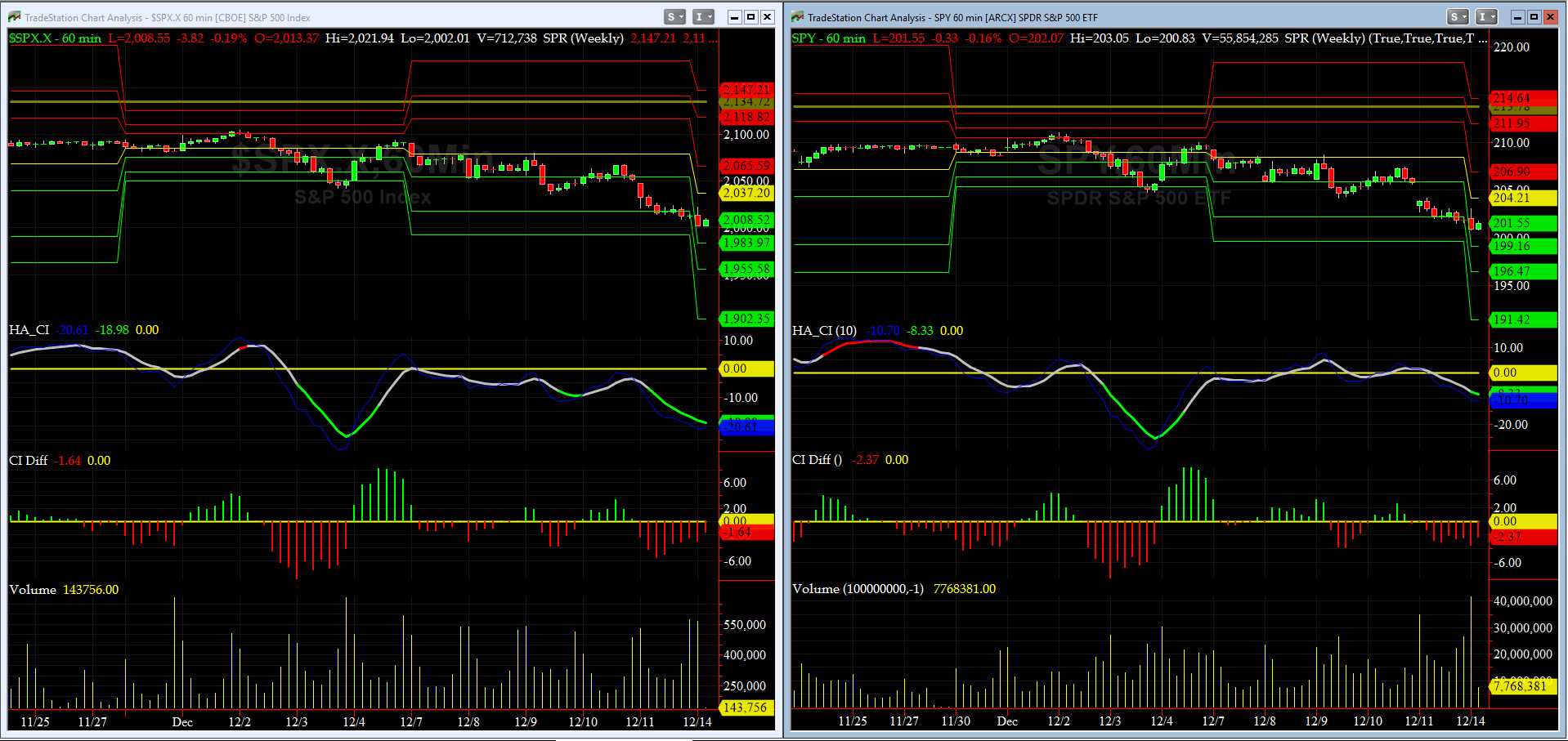

Market Timing Charts & Comments

Timer Chart of S&P-500 Cash Index (SPX)

Past week, SPX finally woke up to the rough patch called "energy junk bonds." While we have talked about this event ad nauseam since last January on major commentary platforms, frankly its late timing surprised us and our short-term Timer Digest ranking too a big hit (though our stop was hit on Monday). Oh, well... we shall move on to the next battle. on Friday, NYSE McClellan Osc closed at -252.4 and Breadth Thrust was at 33.10. We are short-term OverSold.

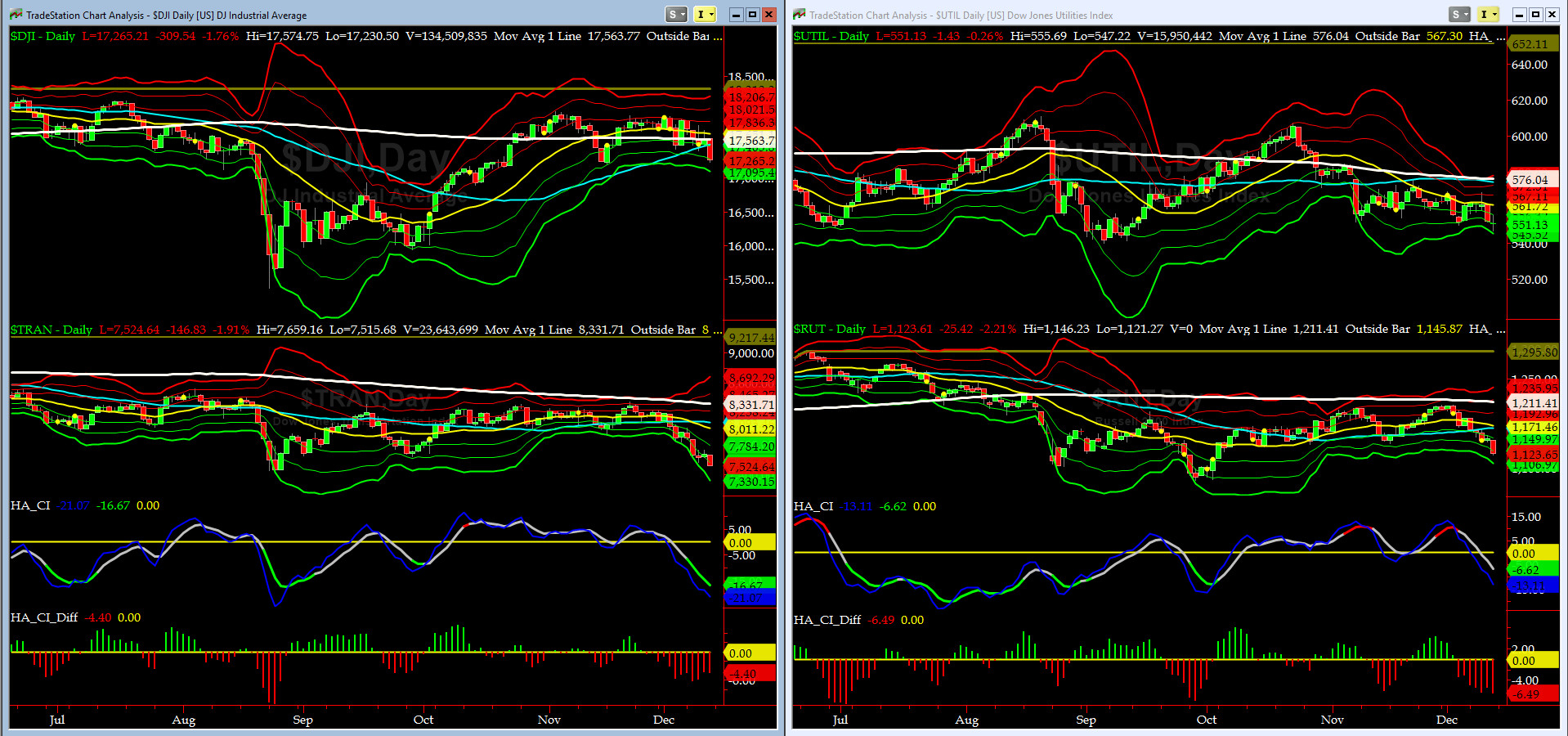

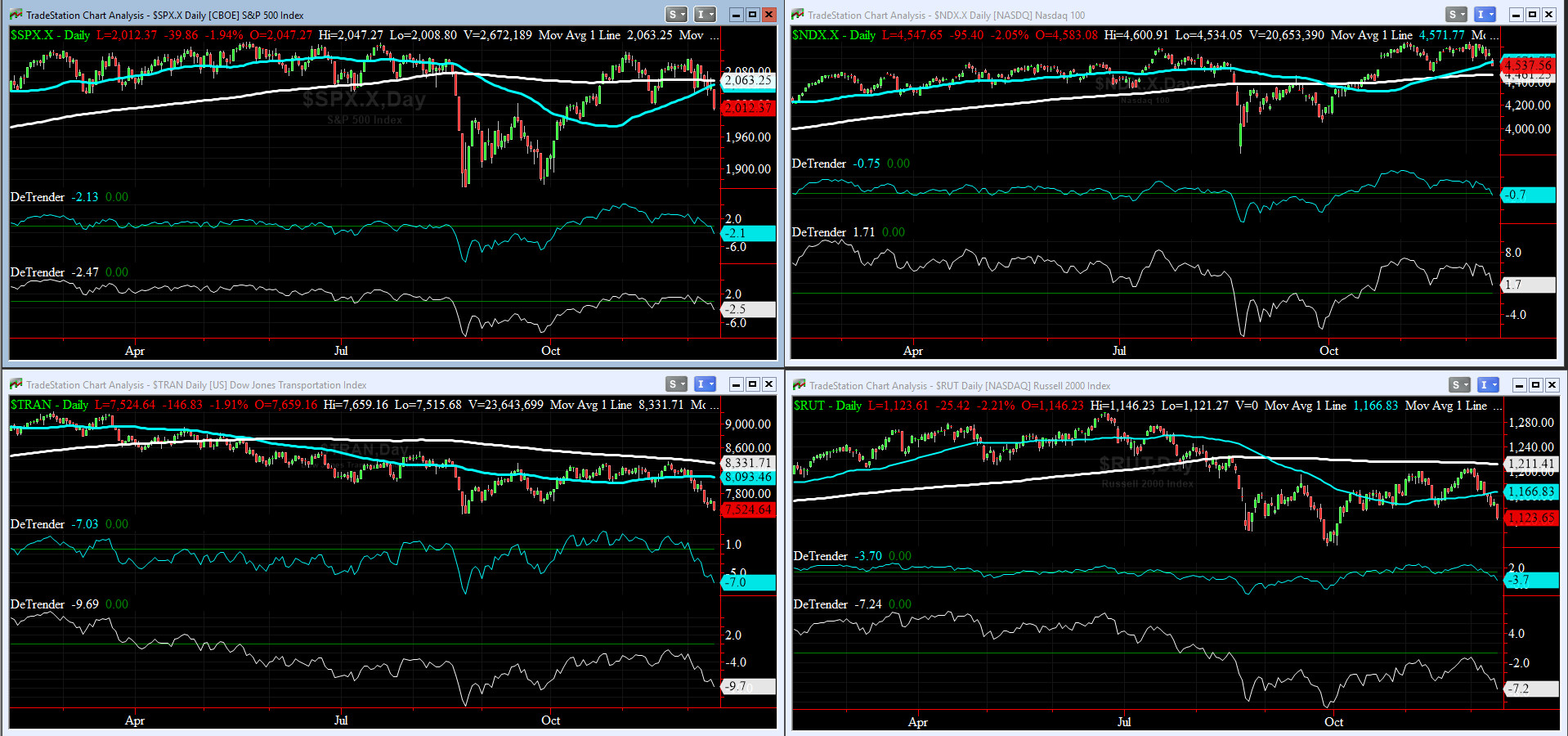

Canaries [in the Coal Mine] Chart for DJ TRAN & RUT Indices

On Friday, the DJ Transports (proxy for economic conditions 6 to 9 months hence) having been bounced off its -3 sigma in the prior week, continued to sell off but at a slower rate following its -2 sigma band. Russell 2000 Small Caps (RUT, a proxy of RISK ON/OFF) punched thru its 50-bar and closed about its -2 sigma. RISK is OFF for now.

DeTrenders Charts for SPX, NDX, TRAN & RUT Indices

As of Friday Close, SEVEN out of our EIGHT 50DTs & 200DTs are negative, while only NDX 200DT is positive.

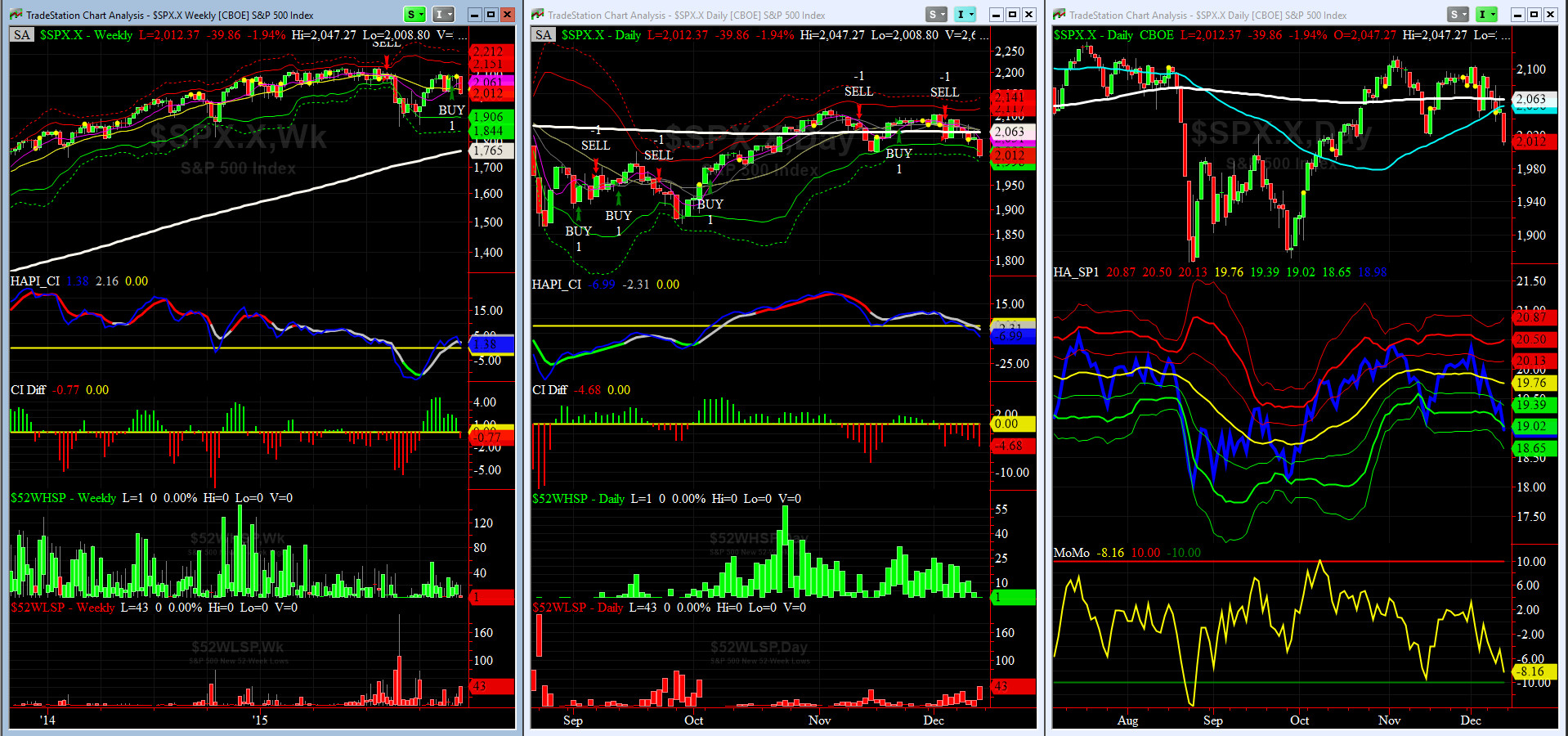

HA_SP1_momo Chart

Our WEEKLY Timing Model went to a BUY on Friday, Nov 27, and our DAILY Timing Model to a SELL as of December 3.

HA_SP1 is around it -2 sigma & HA_momo is now at -8.2. The new 52wk lows for SPX rose oto 43 (40 is generally acceopted as the threshold for reversal).

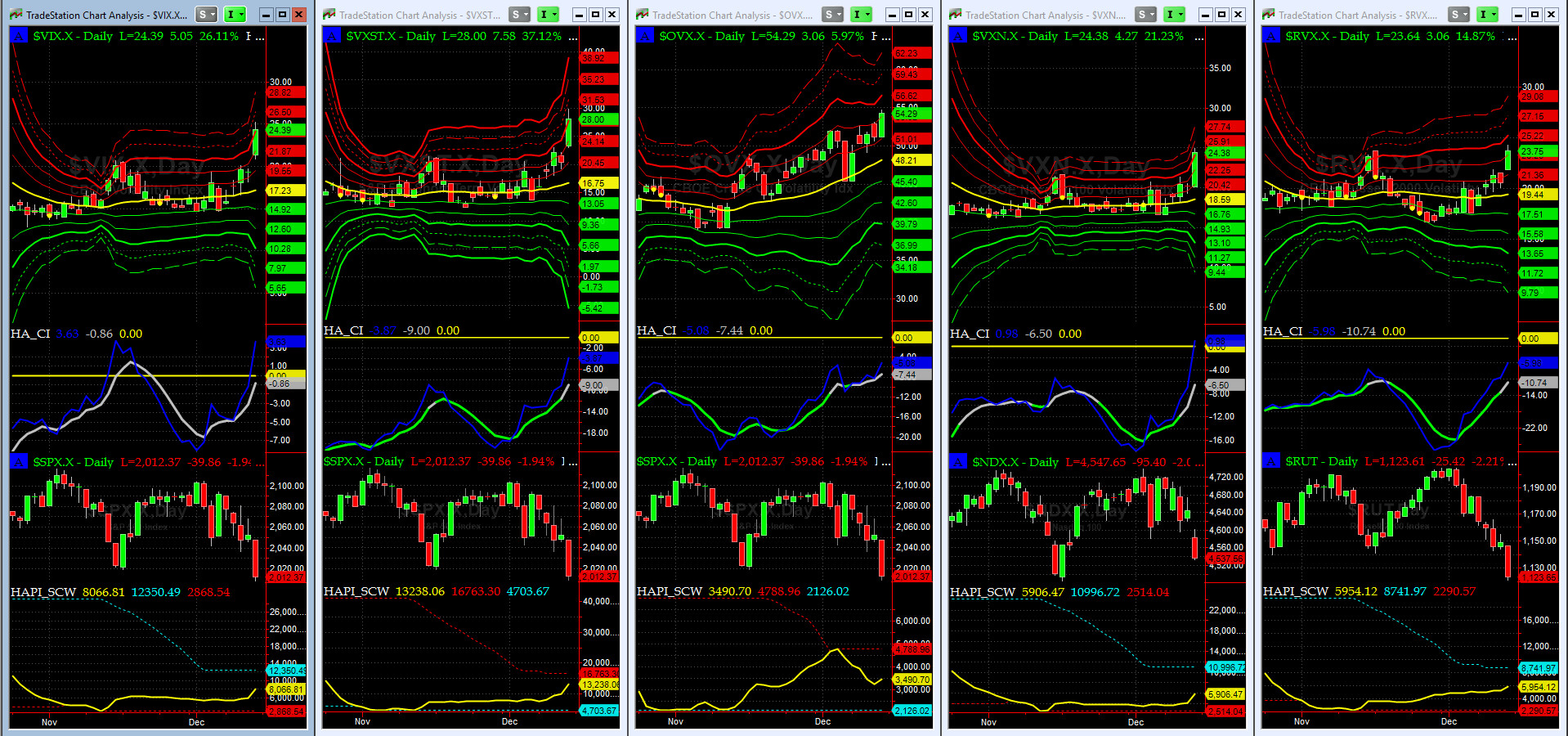

Vol of the Vols Chart

Final vol shockwave for 2015 is in progress. We need to see a +4 or better yet a +5 sigma reading in VIX to call it over. stay tuned.

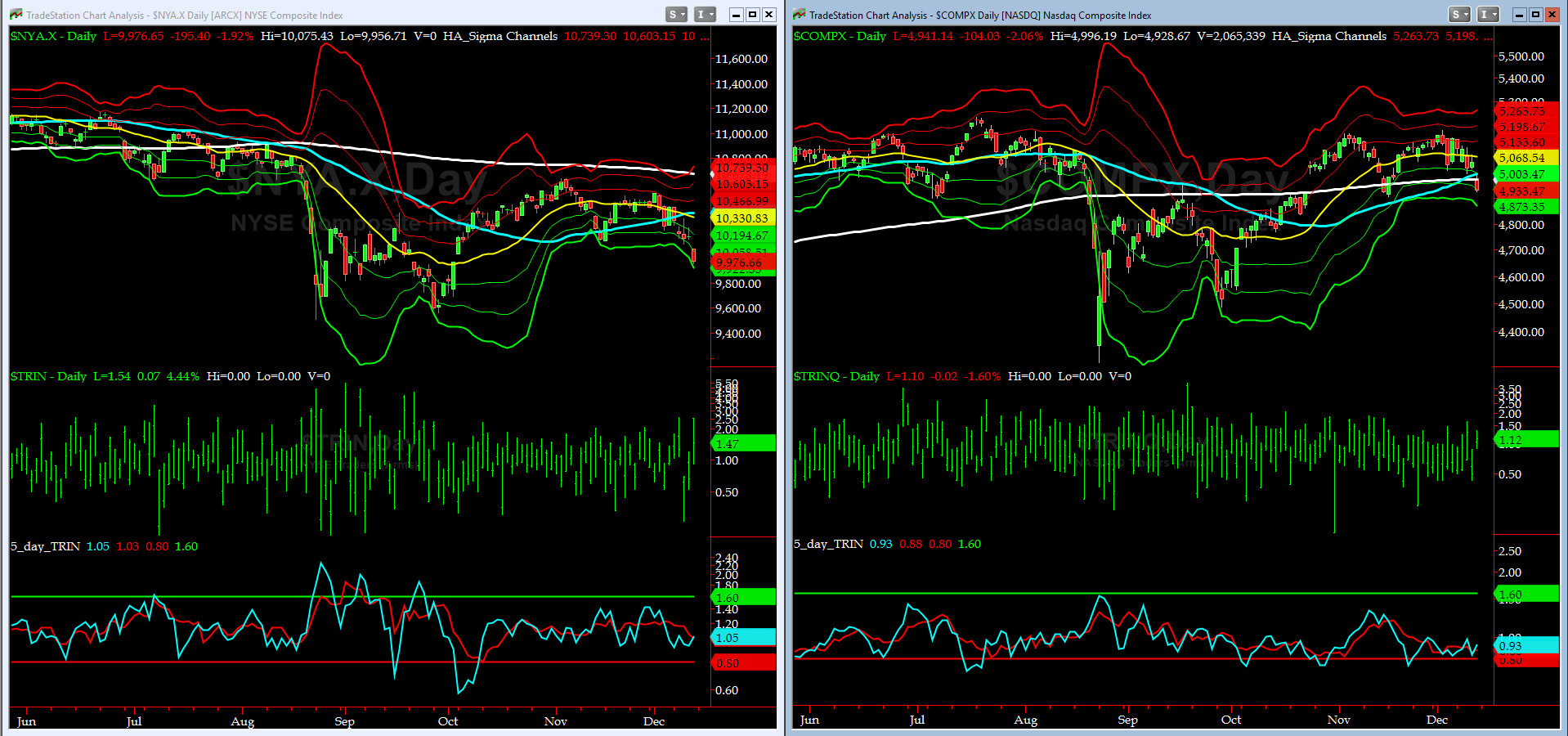

5-day TRIN & TRINQ Charts

As of Friday Close, the 5-day TRIN (for NYSE) is neutral (still about 1.0) while TRINQ (for NASDAQ) almost touched its SELL zone (0.80 or lower) with 0.84 reading.

Components of SPX above their respective 200day MA Chart

This scoring indicator, last week, broke thru 50%, then 40% and finally settled at 38% level last Friday. If we do NOT bounce back, next target is 20% to 25% zone.

SPX SKEW (Tail Risk) Chart

After Friday Close, SPX SKEW (Tail Risk) jumoped to 146.5 (at its +2.5 sigma). This coming week, with final FOMC and OX for CY 2015 on deck, we should see very interesting readings in SPX SKEW. My co-pilot, @Capt_Tiko, will be glued to the screens for each daily SPX SKEW settlement data.

3-month VIX Futures Spread(VX) Chart

Our 3-month VIX Futures Spread (Long JAN16 Short APR16), was at +0.20 when Globex opened tonight at 1800ET (again, this indicator is saying low should be in).

HA_SP2 Chart

At 23, this prop indicator is very near its OverSold zone (20 or lower).

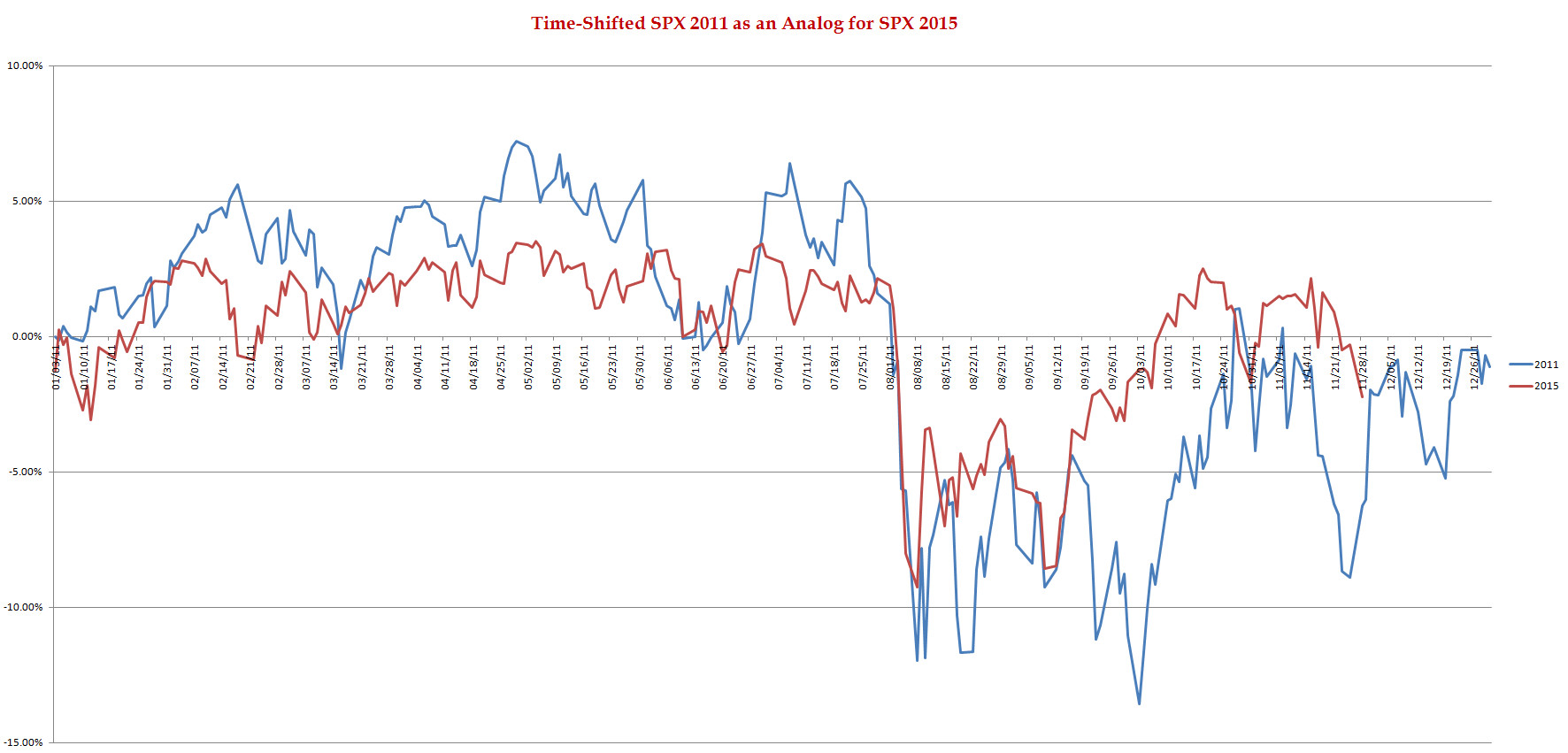

SPX 2011 Time-Shifted Analog for SPX 2015

The Time-Shifted 2011 Analog Chart, in its final days, showed some life but with a delay (which threw us off) and with not as big of a negative amplitude we have written & expected some 3 weeks ago.

US Treasury T-Notes & T-Bonds Yields Chart

This past week, all YTMs retreated as equities sold off sharply with 30yur breaking its December MONTHLY Support 1 Level.

Good luck this week,

Fari Hamzei

|

|

|

|

|

|

Customer Care:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HA YouTube Channel ::: HA Blog ::: Testimonials ::: Tutorials & FAQs ::: Privacy Policy

|

Trading Derivatives (Options & Futures) contains substantial risk and is not for every investor. An investor could potentially lose all or more than his/her initial investment.

Only risk capital should be used for trading and only those with sufficient risk capital should consider trading derivatives. Past performance is not

necessarily indicative of future results. Testimonials appearing on this website may not be representative of other clients or customers

and are not a guarantee of future performance or success.

|

| (c) 1998-2025, Hamzei Analytics, LLC.® All Rights Reserved. |

|

|