|

Saturday, February 6, 2016 1930ET

Market Timing Charts, Analysis & Commentary for Issue #130

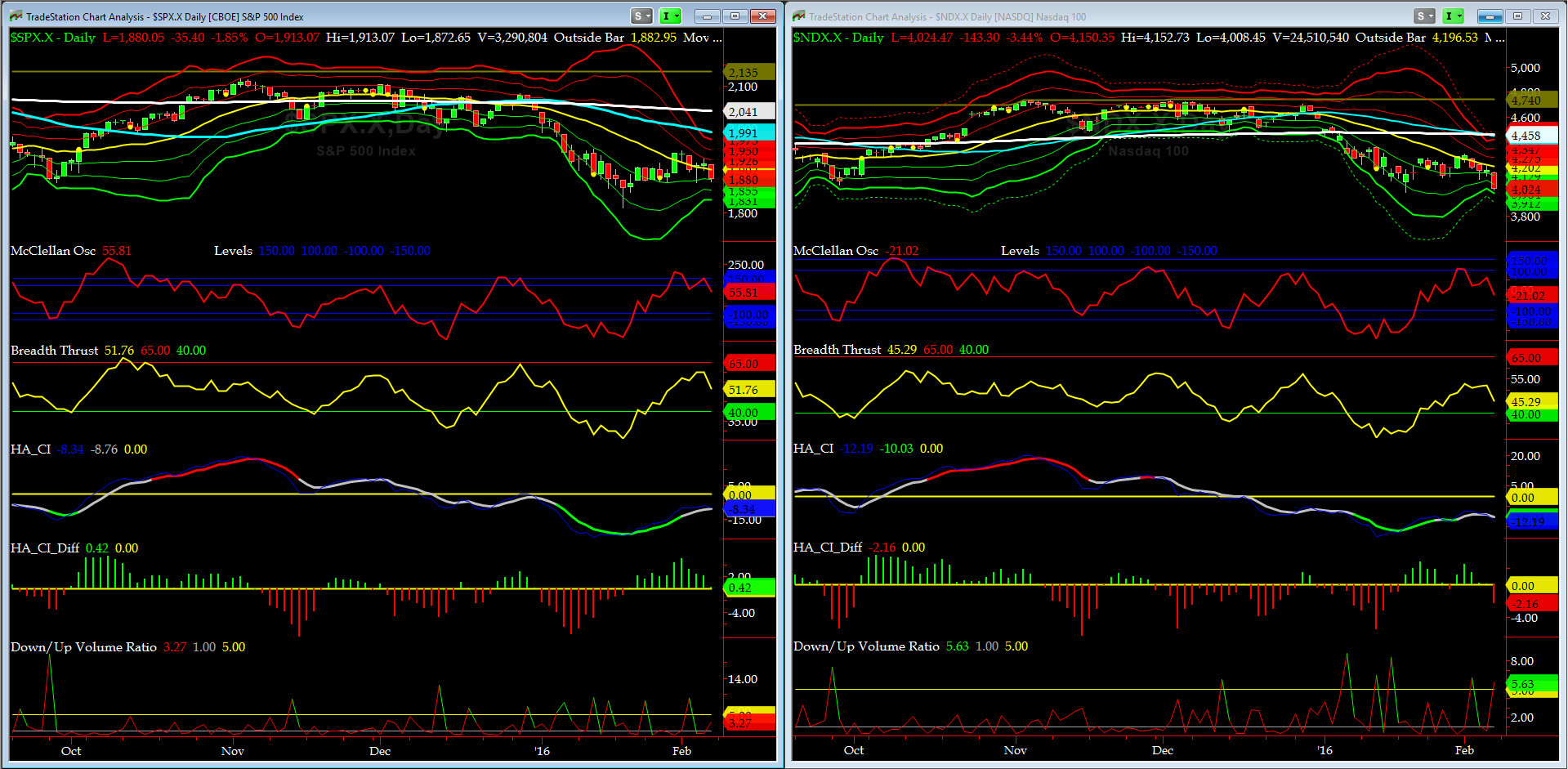

Timer Charts of S&P-500 Cash Index (SPX) + NASDAQ-100 Cash Index (NDX)

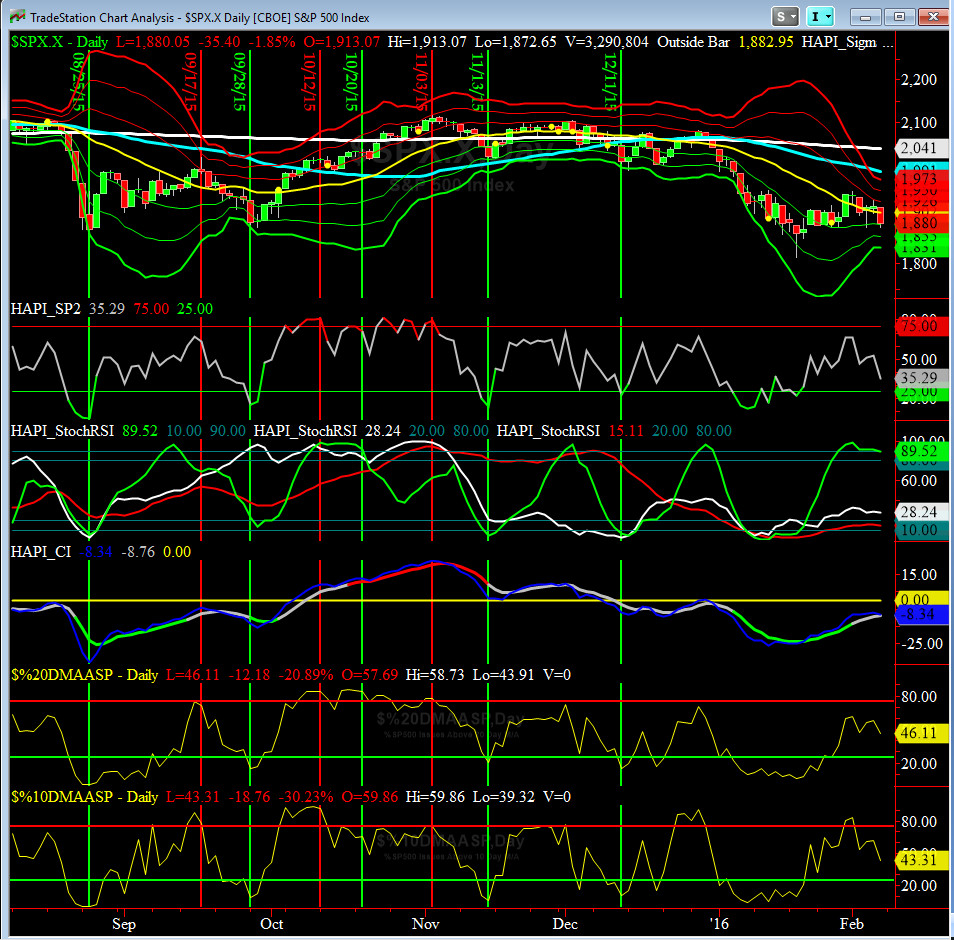

Most recent S&P-500 Cash Index (SPX): 1880.05 down -60.19 (down -3.1%) for the week ending on Friday, February 5th, 2016, which closed at its -1 sigma.

SPX ALL TIME INTRADAY HIGH = 2134.72 (reached on Wednesday, May 20th, 2015)

SPX ALL TIME CLOSING HIGH = 2130.82 (reached on Thursday, May 21st, 2015)

Current DAILY +2 Sigma SPX = 1950 with WEEKLY +2 Sigma = 2153

Current DAILY 0 Sigma (20 day MA) SPX = 1902 with WEEKLY 0 Sigma = 2007

Current DAILY -2 Sigma SPX = 1855 with WEEKLY -2 Sigma = 1860

NYSE McClellan Oscillator = +56 (-150 is start of the O/S area; around -275 to -300 area or lower, we go into the “launch-pad” mode, over +150, we are in O/B area)

NYSE Breadth Thrust = 51.5 (40 is considered as oversold and 65 as overbought)

Worth noting is Down to Up Volume Ratio in NAZZ far outpaced NYSE on Friday.

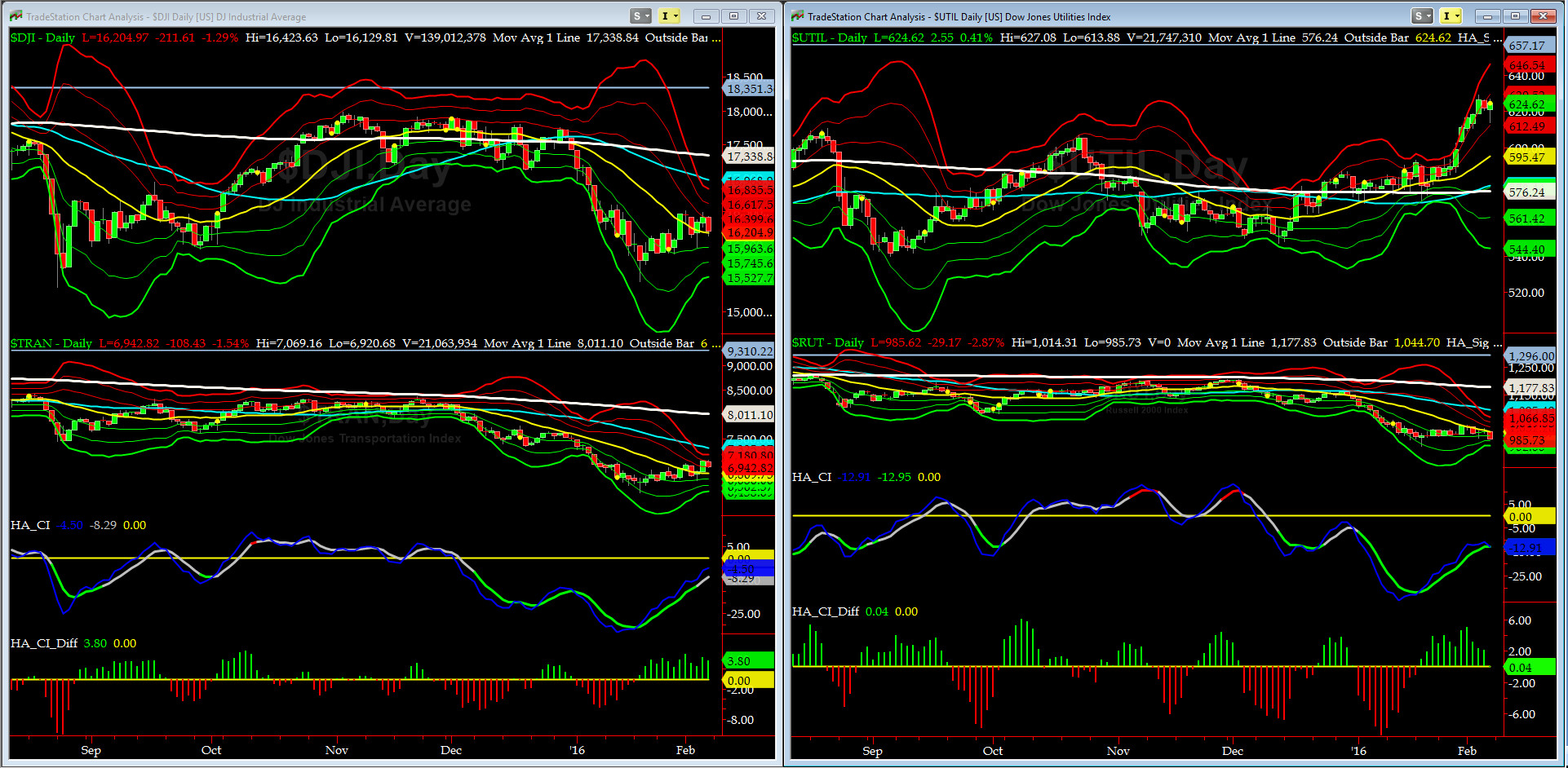

Canaries [in the Coal Mine] Chart for DJ TRAN & RUT Indices

200-Day MA DJ TRAN = 8011 or -13.3% above DJ TRAN (max observed in last 5 yrs = 20.2%, min = -20.3%)

200-Day MA RUT = 1178 or -16.3% above RUT (max observed in last 5 yrs = 21.3%, min = -22.6%)

DJ Transports (proxy for economic conditions 6 to 9 months hence) is in a channel breakout.

Russell 2000 Small Caps (proxy for RISK ON/OFF) sold off pretty hard on Friday, much to the dismay of RISK-ON weakhand players!!

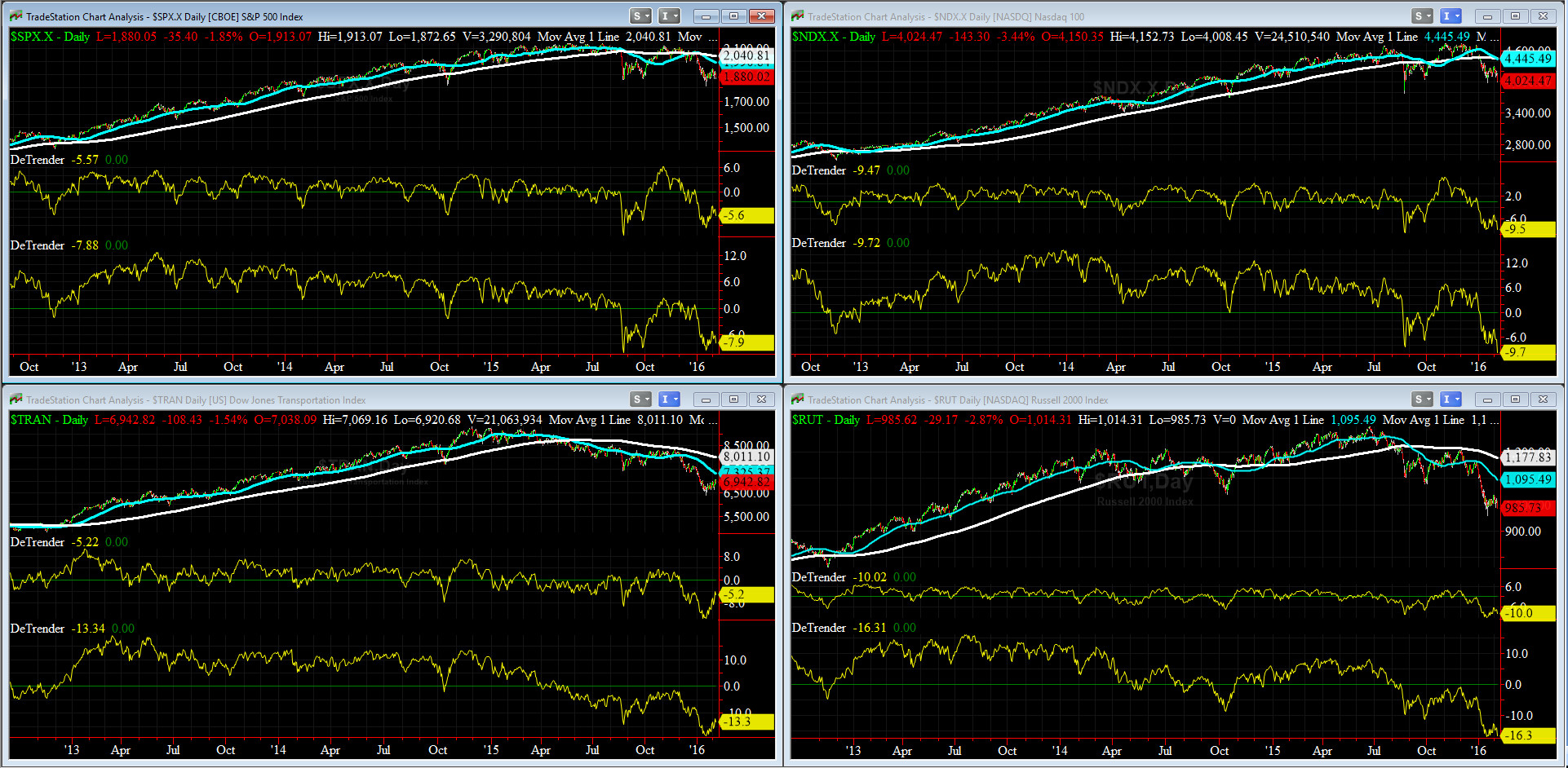

DeTrenders Charts for SPX, NDX, TRAN & RUT Indices

50-Day MA SPX =2008 or -3.4% above SPX (max observed in last 5 yrs = +8.6%, min = -9.3% )

200-Day MA SPX = 2046 or -5.1% above SPX (max observed in last 5 yrs = 15.2%, min = -14%)

All of our Eight DeTrenders are still negative but now they are all reversed up.

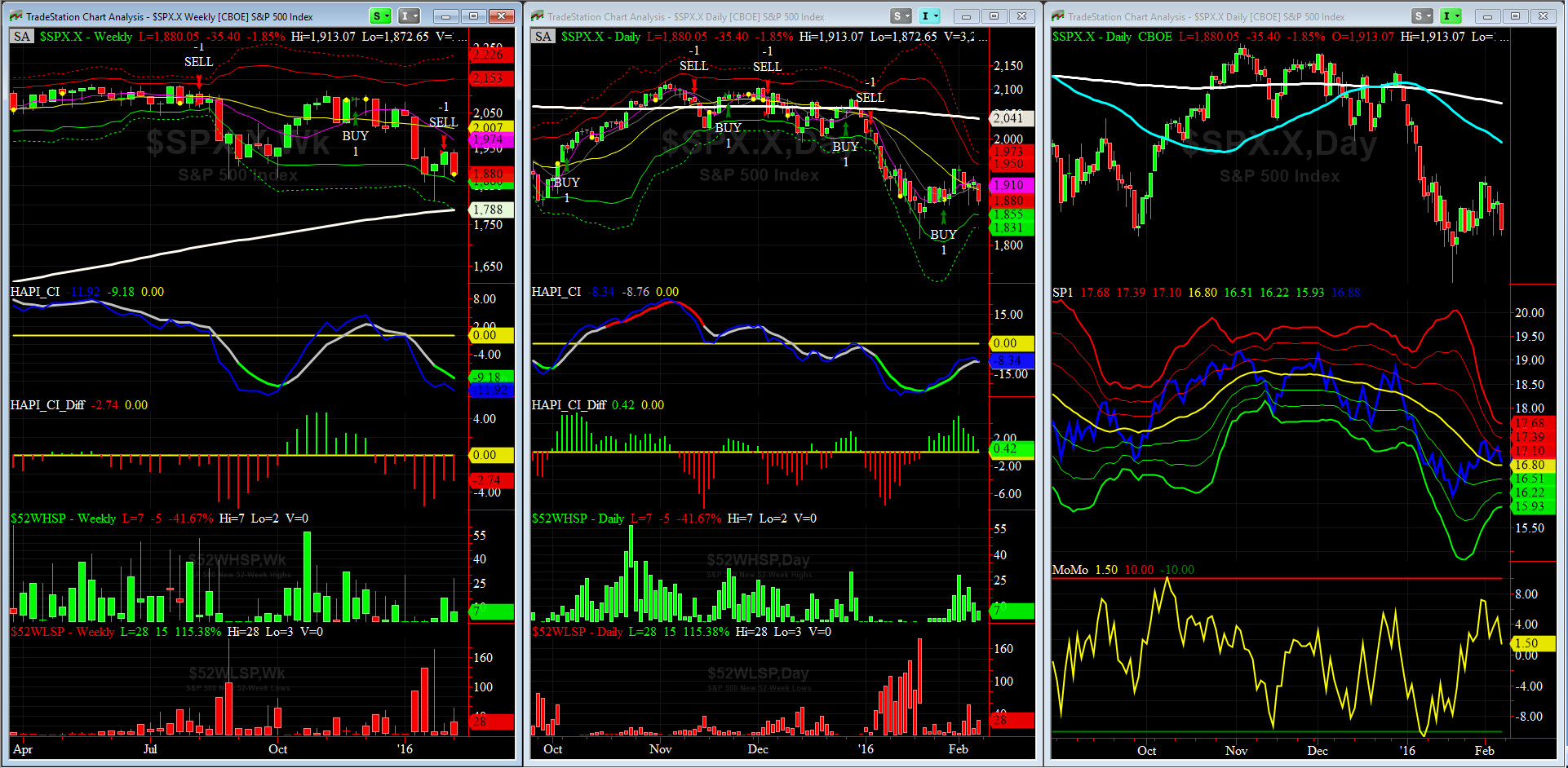

HA_SP1_momo Chart

WEEKLY Timing Model = on a SELL Signal since Friday 1/29/16 CLOSE

DAILY Timing Model = on a BUY Signal since Tuesday 1/27/16 CLOSE

Max SPX 52wk-highs reading last week = 28 (over 120-140, the local maxima is in)

Max SPX 52wk-Lows reading last week = 56 (over 40-60, the local minima is in)

HA_SP1 = at its zero Sigma

HA_Momo = +1.50 (reversals most likely occur above +10 or below -10)

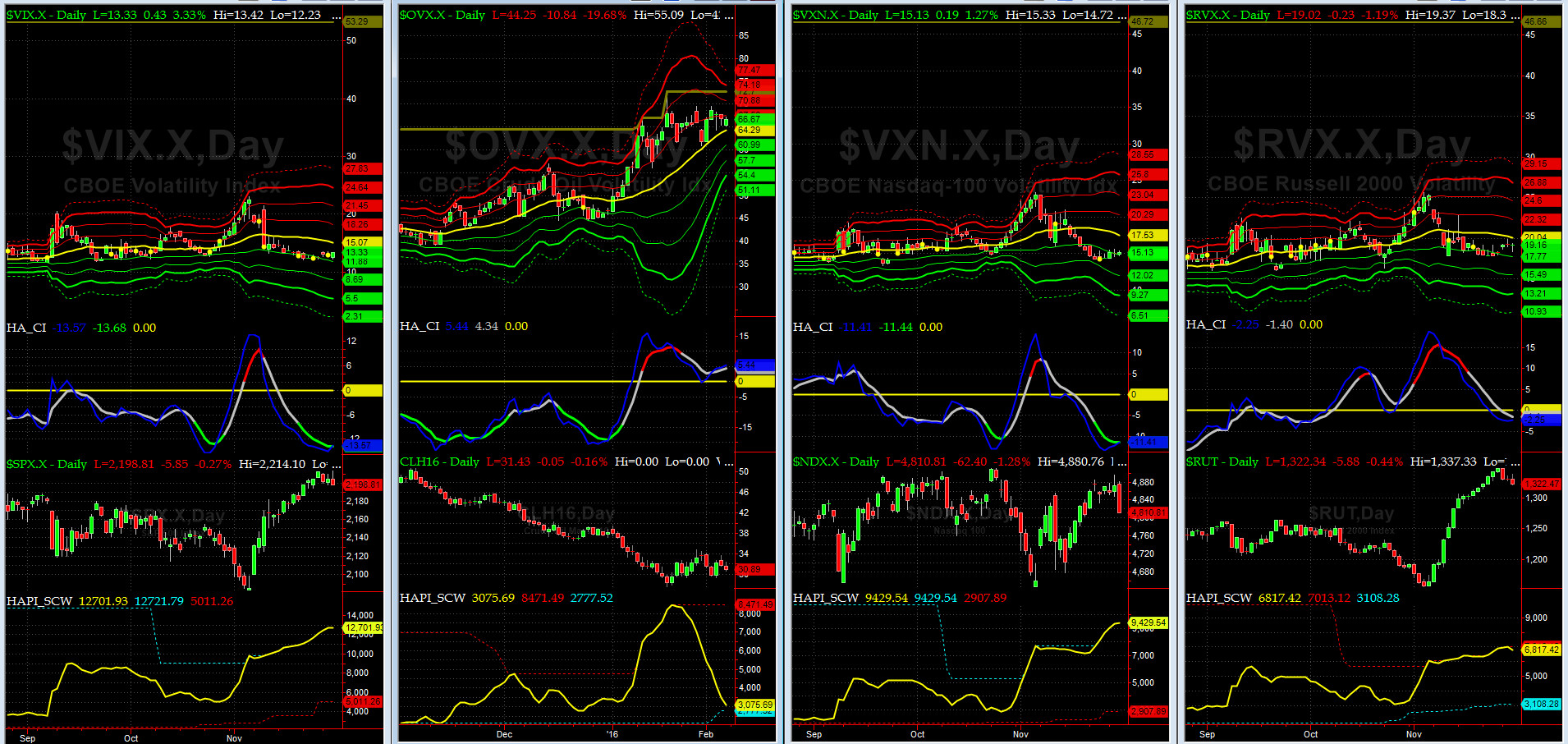

Vol of the Vols Chart

VIX = 24.4 which is just below its zero sigma (remember it’s the VIX’s vol pattern (its sigma channels) that matters, and not the level of VIX itself (this is per Dr. Robert Whaley, a great mentor and the inventor of original VIX, now called VXO. VIX usually peaks around a test of its +4 sigma).

As stated here last week, this shockwave is over, at least for now, till the next shoe drops.

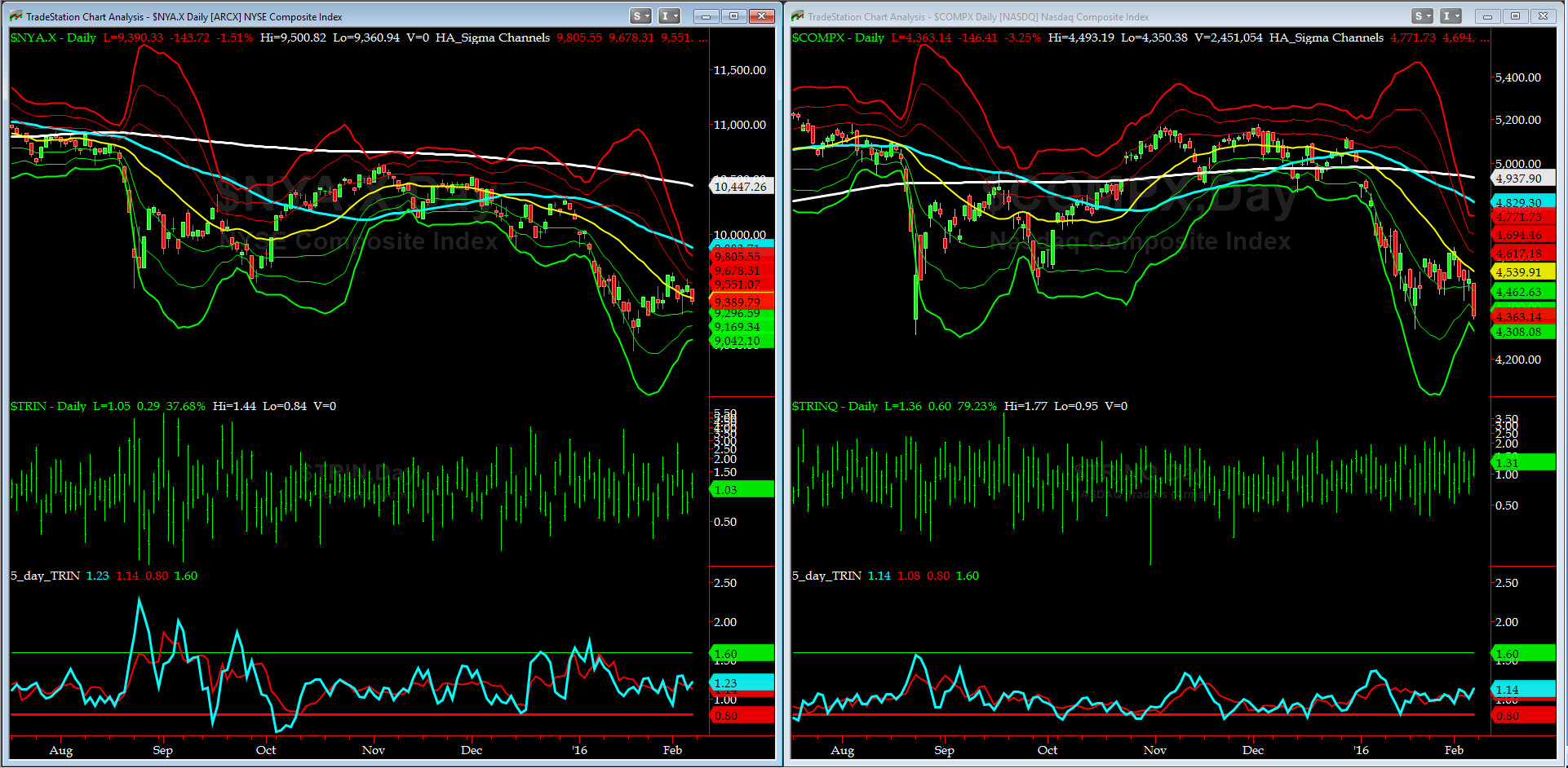

5-day TRIN & TRINQ Charts

Both 5-day TRIN (for NYSE) and 5-day TRINQ (for NASDAQ) closed, again, very neutral.

Components of SPX above their respective 200day MA Chart

We did not get passed 30% level and ended up shooting down to 25%. This reading could be a tell this week. We shall keep an eye on it every day after the close.

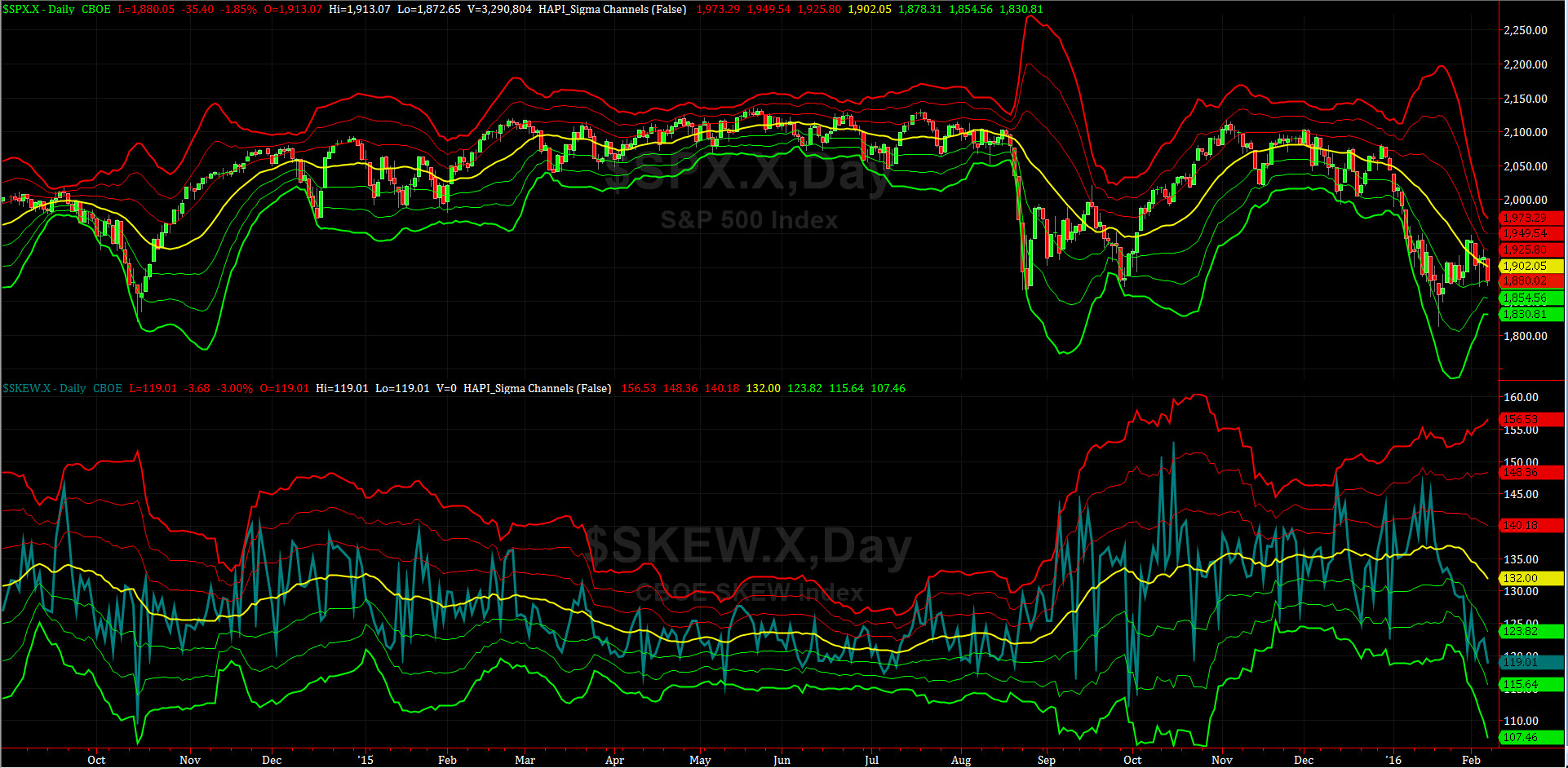

SPX SKEW (Tail Risk) Chart

SPX SKEW (Tail Risk) = 119 and about its -1.5 sigma (normal = 120-125, range 100-150)

All Quiet on the MidWestern Front? It should not be, given the recent price action.

This is a very interesting reading. We think SPX tail options are mispriced here, but then again what do we know. After all, a PDI is no Admiral, LOL.

3-month VIX Futures Spread(VX) Chart

Our 3-month VIX Futures Spread (LONG FEB16 SHORT MAY16), closed Friday at +1.38. That's neutral for now.

HA_SP2 Chart

HA_SP2 = 35.3 (Buy signal <= 25, Sell Signal >= 75)

At ~35, this prop indicator is near neutral.

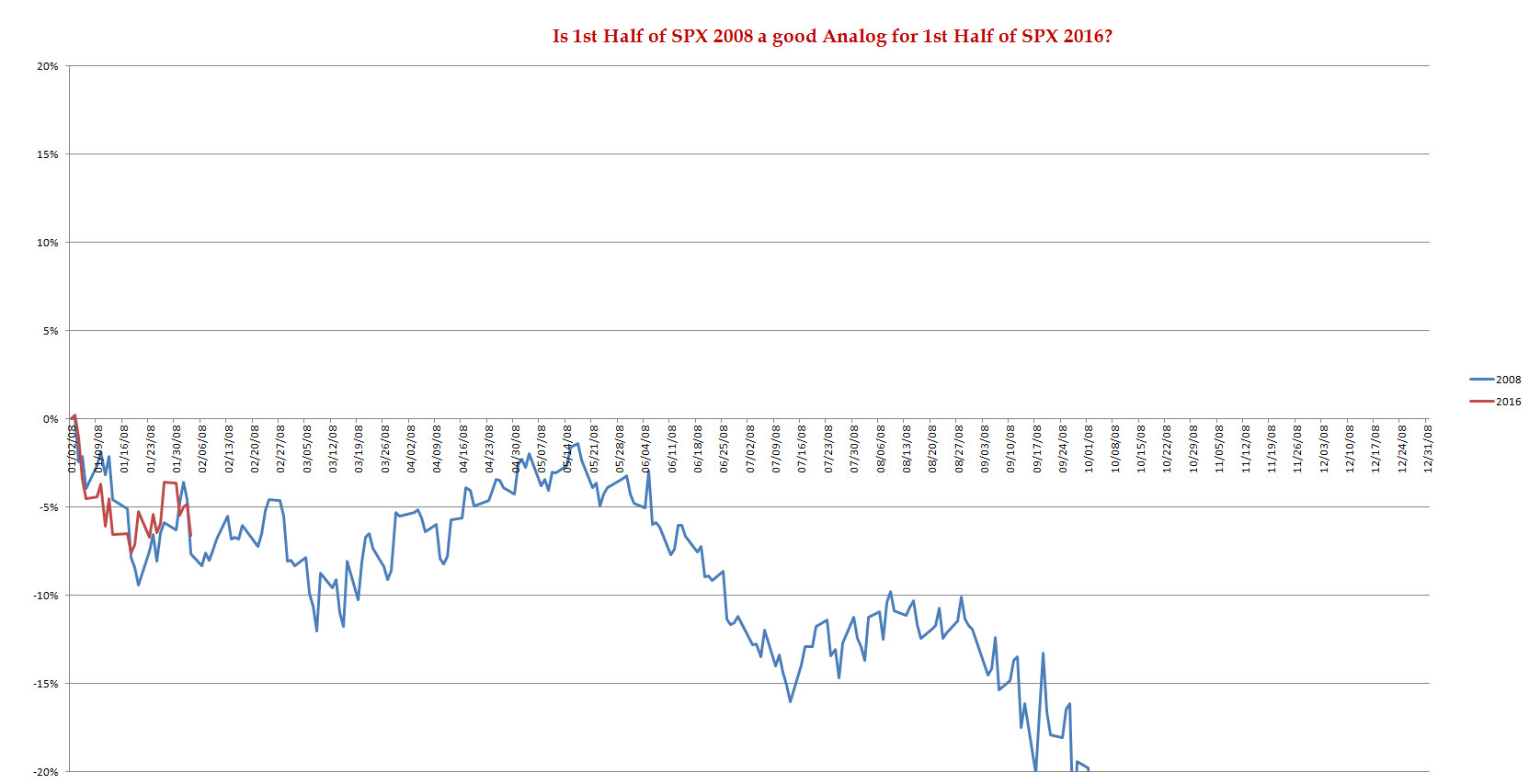

SPX 2008 Analog for SPX 2016

My co-pilot, @Capt_Tiko, continues to anxiously track the 2008 price action. He tells us that 2016 is a lot like 2008 at least for first quarter or even may be firt half. Only time will tell. We think we should also watch 2011 & 2012 Analogs.

US Treasury T-Notes & T-Bonds Yields Chart

Treasury Complex Yields continued to ease down for most part of last week. This is NOT what Auntie Janet was looking for.

GO DENVER GO.....

Fari Hamzei

|