|

Saturday, August 20, 2016, 1330ET

Market Timing Charts, Analysis & Commentary for Issue #155

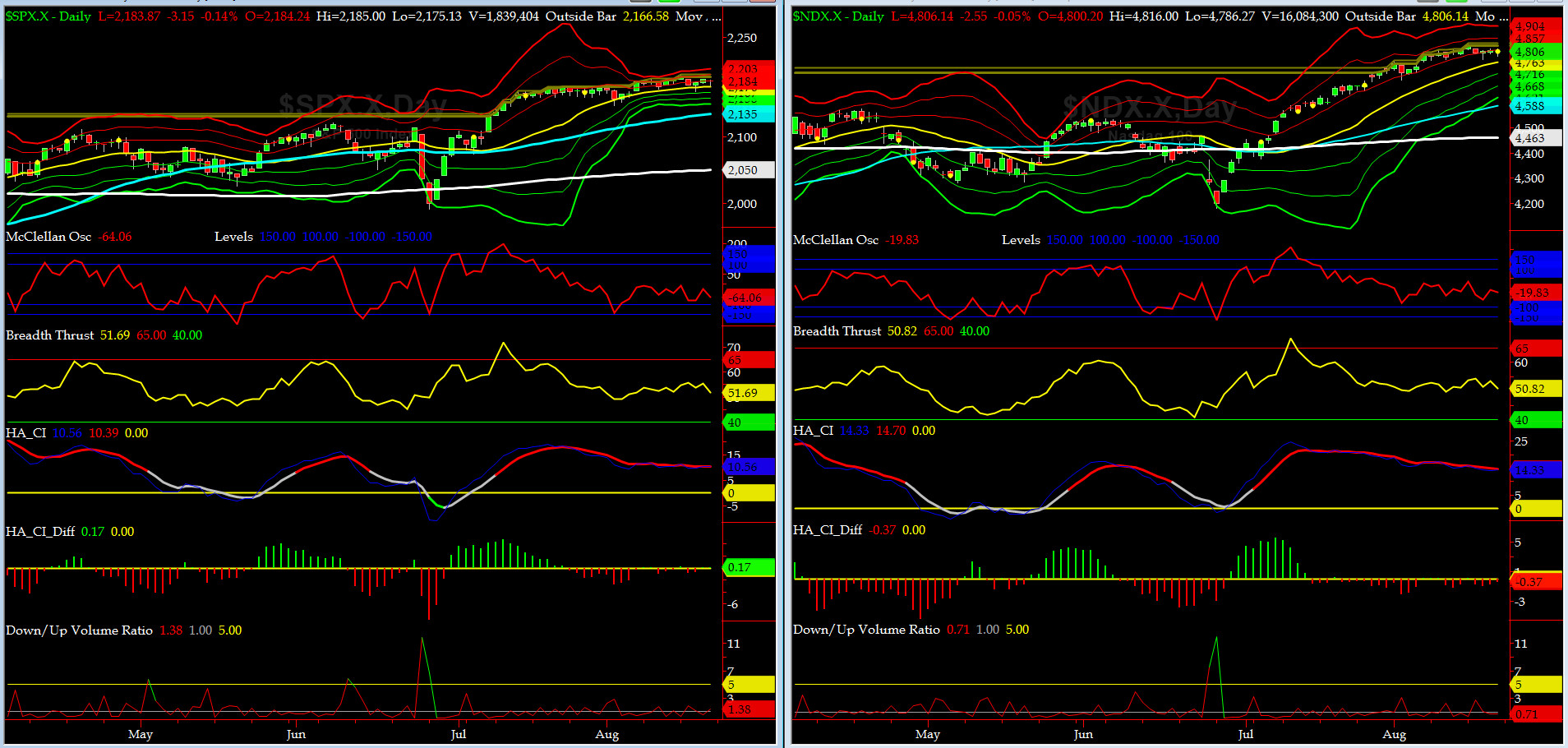

Timer Charts of S&P-500 Cash Index (SPX) + NASDAQ-100 Cash Index (NDX)

Most recent S&P-500 Cash Index (SPX): 2183.87 down -0.18 (down -0.0082%) for the week ending on Friday, August 19th, 2016, which closed near its +1 sigma.

SPX ALL TIME INTRADAY HIGH = 2193.81 (reached on Monday, August 15, 2016)

SPX ALL TIME CLOSING HIGH = 2190.15 (reached on Monday, August 15, 2016)

Current DAILY +2 Sigma SPX = 2194 with WEEKLY +2 Sigma = 2209

Current DAILY 0 Sigma (20 day MA) SPX = 2176 with WEEKLY 0 Sigma = 2107

Current DAILY -2 Sigma SPX = 2158 with WEEKLY -2 Sigma = 2005

NYSE McClellan Oscillator = -64 (-150 is start of the O/S area; around -275 to -300 area or lower, we go into the “launch-pad” mode, over +150, we are in O/B area)

NYSE Breadth Thrust = 51.7 (40 is considered as oversold and 65 as overbought)

On Monday SPX made new All-Time-Highs.... so all is well in the Mid-Western Front? 80% of US Equities Benchmark (SPX) thinks so. Do you?

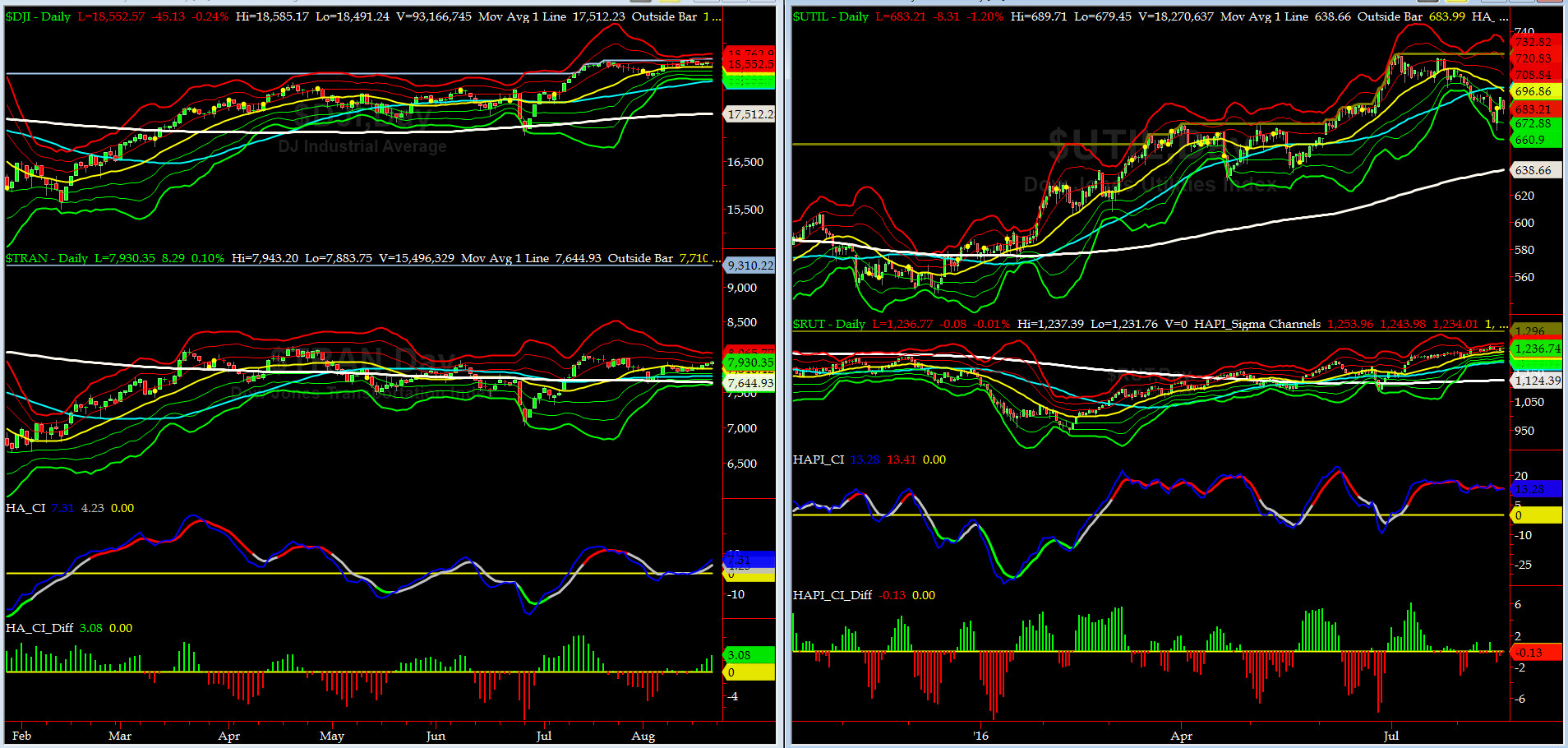

Canaries [in the Coal Mine] Chart for DJ TRAN & RUT Indices

200-Day MA DJ TRAN = 7644 or 3.7% below DJ TRAN (max observed in last 5 yrs = 20.2%, min = -20.3%)

200-Day MA RUT = 1124 or 10% below RUT (max observed in last 5 yrs = 21.3%, min = -22.6%)

DJ Transports (proxy for economic conditions 6 to 9 months hence) chart pattern is still in a divergence with SPX but at less pronounced.

Russell 2000 Small Caps (proxy for RISK ON/OFF) contiued to rise, albeit, only slightly at the margin. RISK-ON trade is back.

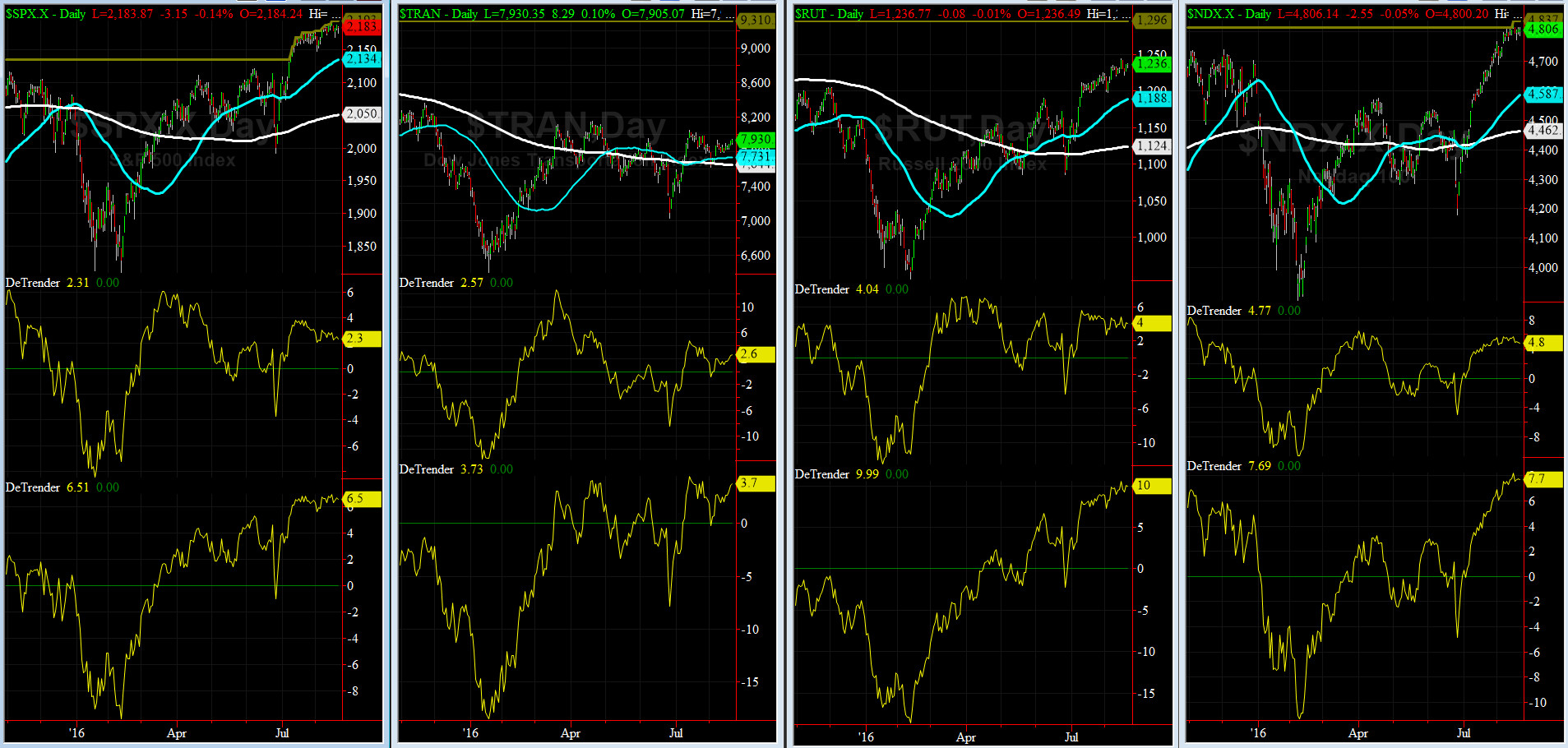

DeTrenders Charts for SPX, NDX, TRAN & RUT Indices

50-Day MA SPX = 2134 or 2.3% below SPX (max observed in last 5 yrs = +8.6%, min = -9.3%)

200-Day MA SPX = 2050 or 6.5% below SPX (max observed in last 5 yrs = 15.2%, min = -14%)

This week ALL of our Eight DeTrenders continue to stay POSITIVE. DeTrenders for TRAN & RUT continue to get our constant attention.

HA_SP1_Momo Chart

WEEKLY Timing Model = on a BUY Signal since Friday 4/15/16 CLOSE at 2081

DAILY Timing Model = on a BUY Signal since Tuesday 8/9/16 CLOSE at 2181

Max SPX 52wk-highs reading last week = 34 (over 120-140, the local maxima is in)

Max SPX 52wk-Lows reading last week = 1 (over 40-60, the local minima is in)

HA_SP1 = just above its +1 sigma channels

HA_Momo = -1.74 (reversals most likely occur above +10 or below -10)

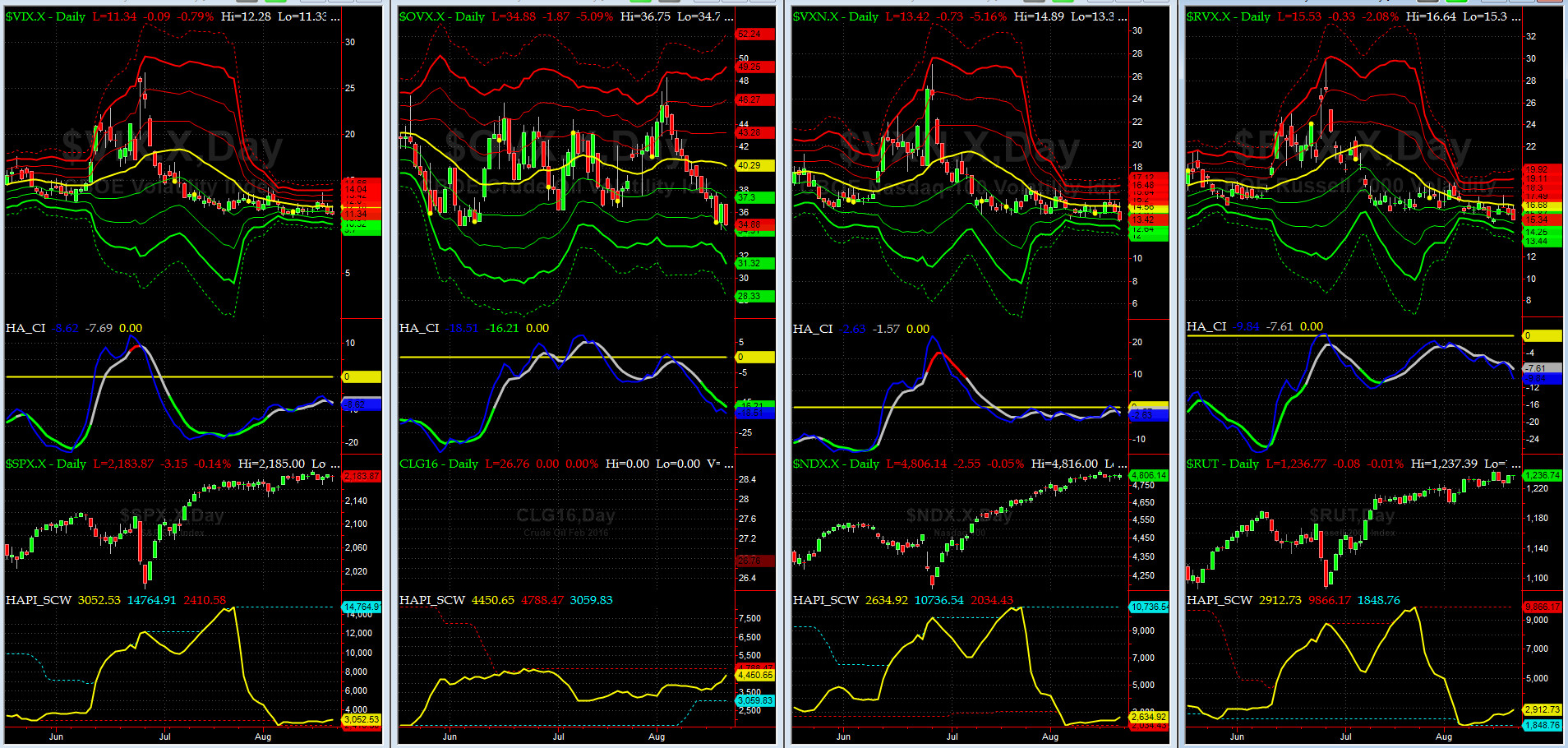

Vol of the Vols Chart

VIX = 11.34 is at its -1 sigma (remember it’s the VIX’s vol pattern (its sigma channels) that matters, and not the level of VIX itself (this is per Dr. Robert Whaley, a great mentor and the inventor of original VIX, now called VXO). VIX usually peaks around a test of its +4 sigma).

VIX had another quiet week. OVX (vol index for crude) continues to got crushed.

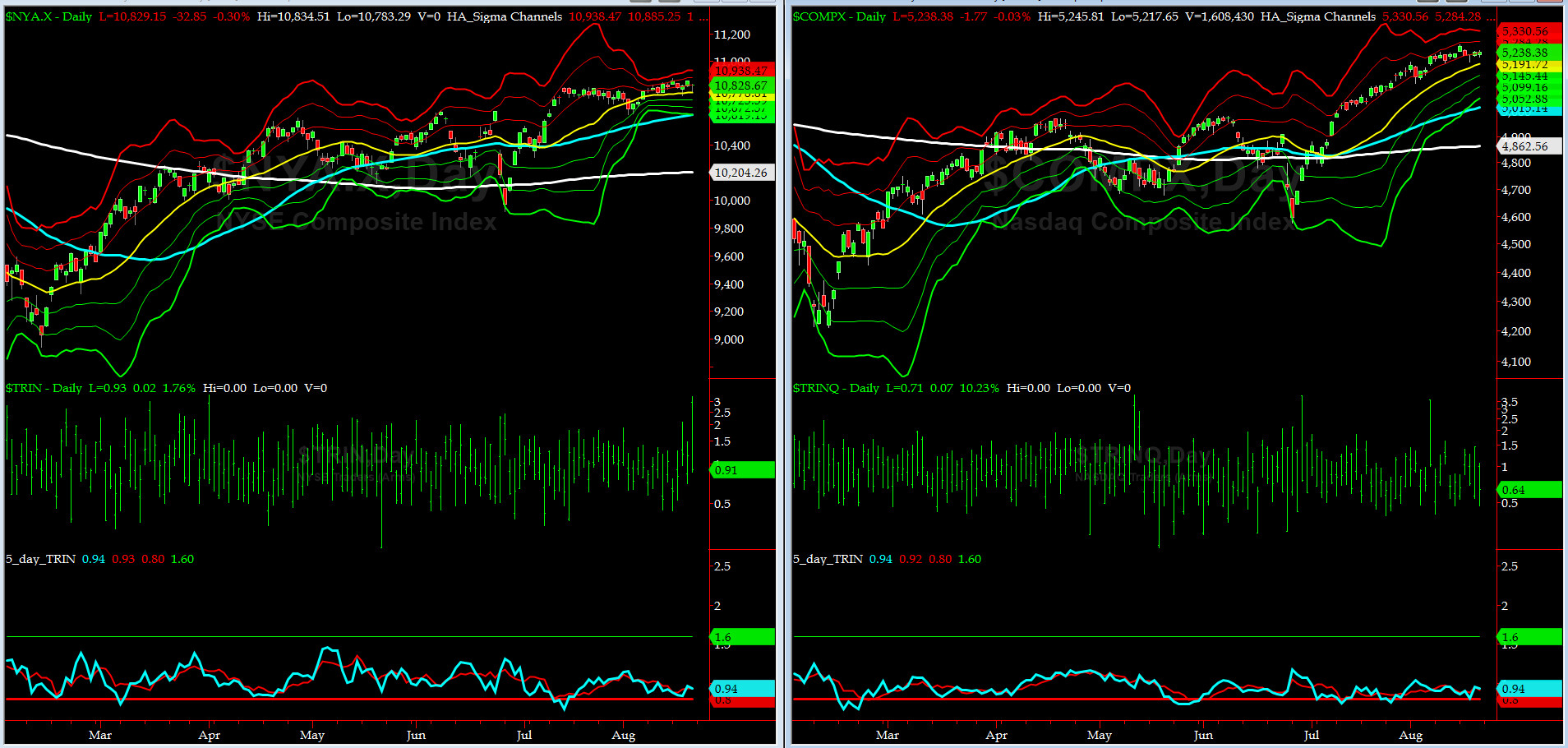

5-day TRIN & TRINQ Charts

Both charts are just a tad over SELL signal zones (0.80)........

Components of SPX above their respective 200day MA Chart

This scoring indicator is at 81.6% now. All of its previous bearish divergences are history now.

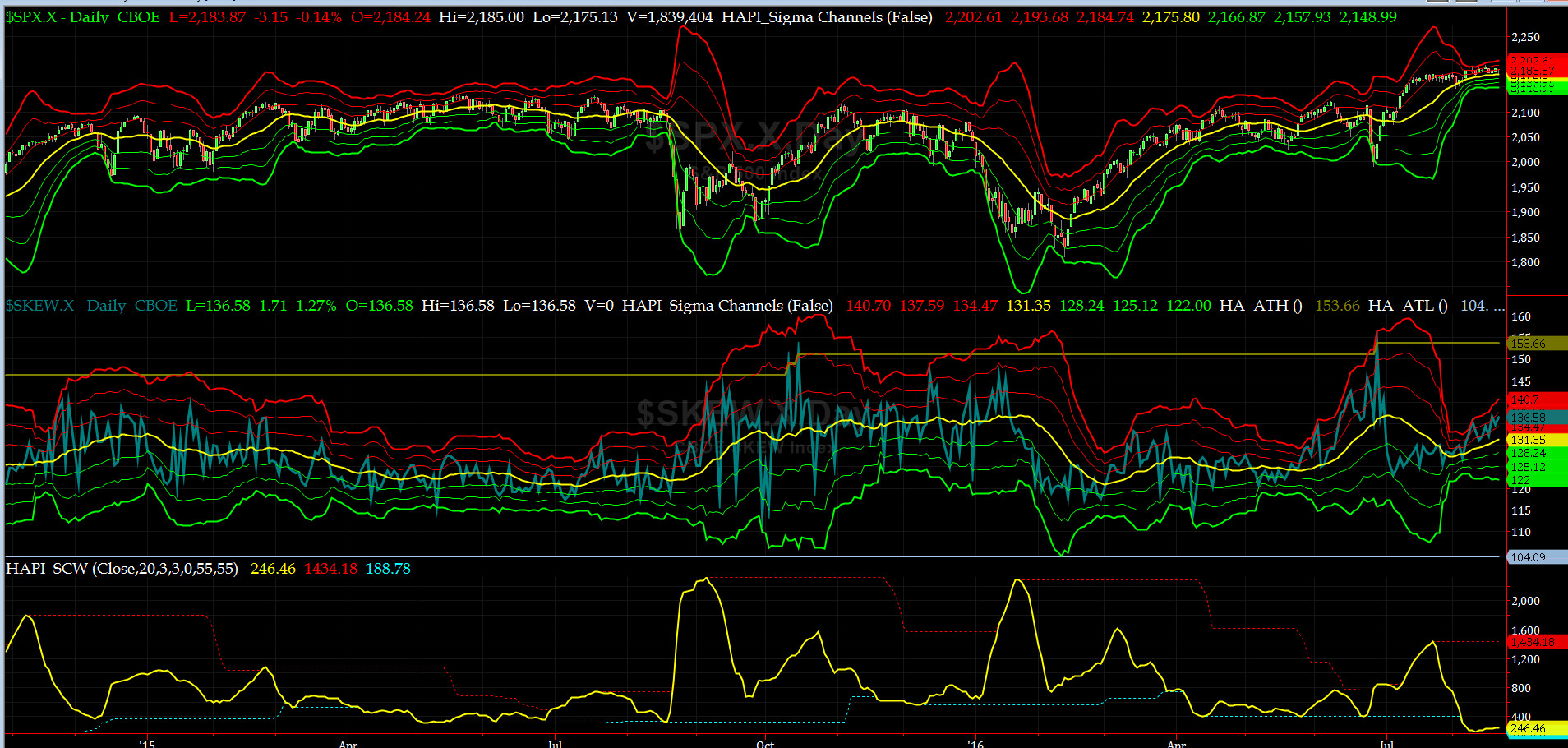

SPX SKEW (Tail Risk) Chart

SPX SKEW (Tail Risk) rose to 136.6 near its +1.5 sigma (normal = 120-125, range 100-150)

All Quiet on the Mid-Western Front? Smart Money is smelling trouble ahead (contested US General Election?)

3-month VIX Futures Spread(VX) Chart

Our 3-month VIX Futures Spread (LONG SEPT16 & SHORT DEC16) closed at -3.48 on Friday. As you can tell, this indicator continues to signal that we are extremely overbought.

HA_SP2 Chart

HA_SP2 = 54 (Buy signal <= 25, Sell Signal >= 75)

This indicator continues to be in a big divergence with SPX.

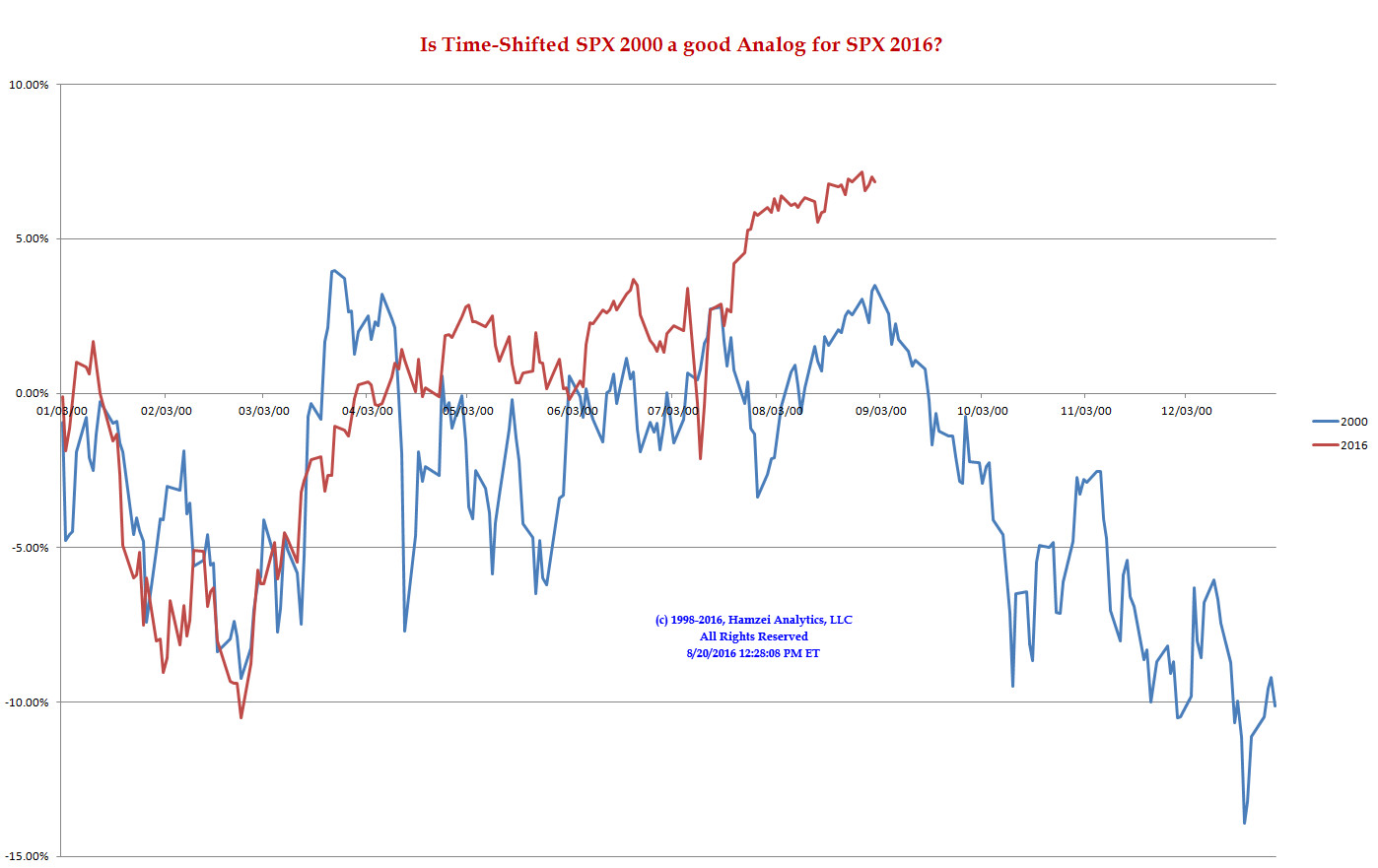

SPX 2000 Analog for SPX 2016

[If this chart is a good analog] then are we ready to Rock 'N' Roll [very soon]?

My XO, @Capt_Tiko, is.....Got Tuna?

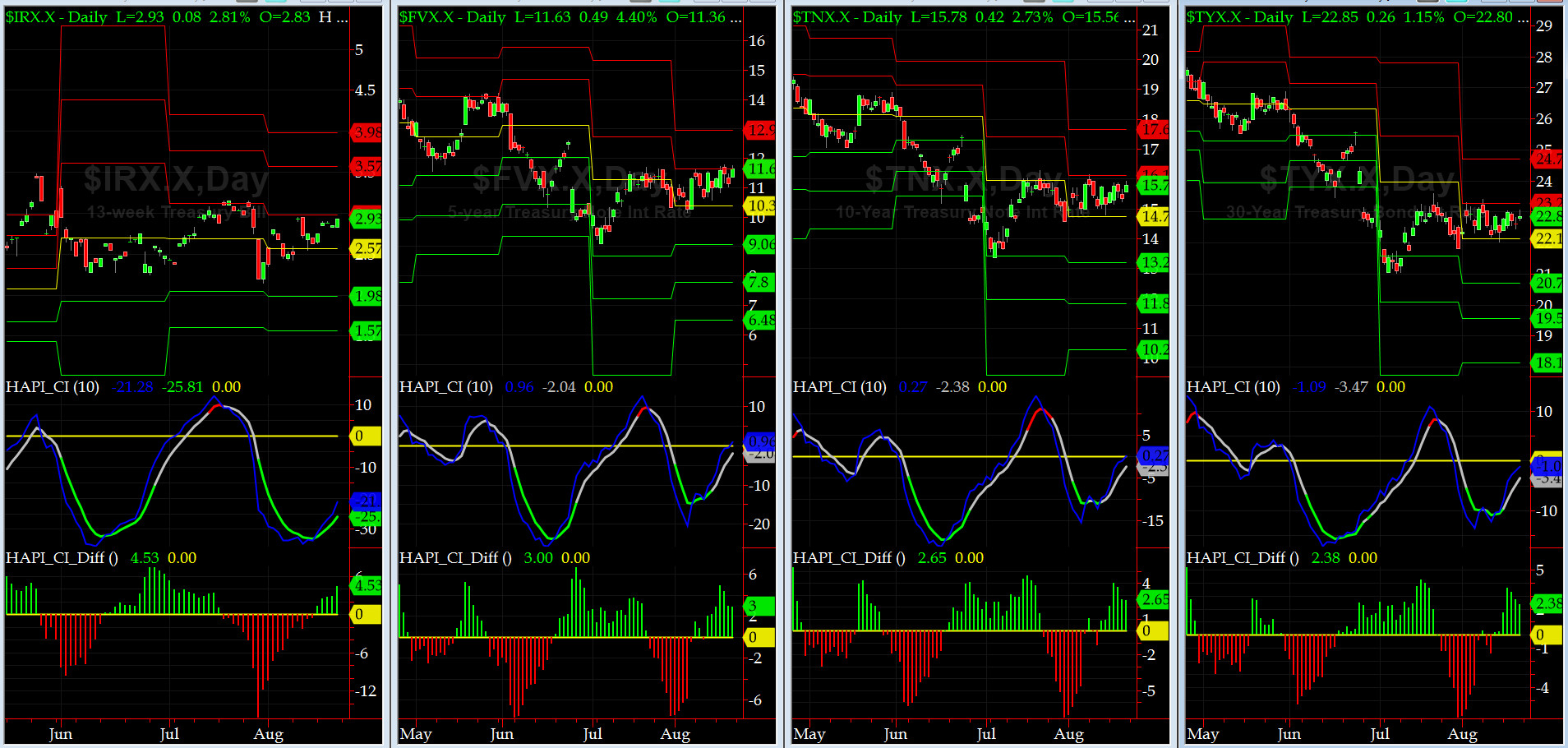

US Treasury T-Notes & T-Bonds Yields Chart

US Treasury Complex was very quiet last week and rose only slightly across the Yield Curve.

Fari Hamzei

|