|

Sunday, January 8, 2017, 2255ET

Market Timing Charts, Analysis & Commentary for Issue #175

Timer Charts of S&P-500 Cash Index (SPX) + NASDAQ-100 Cash Index (NDX)

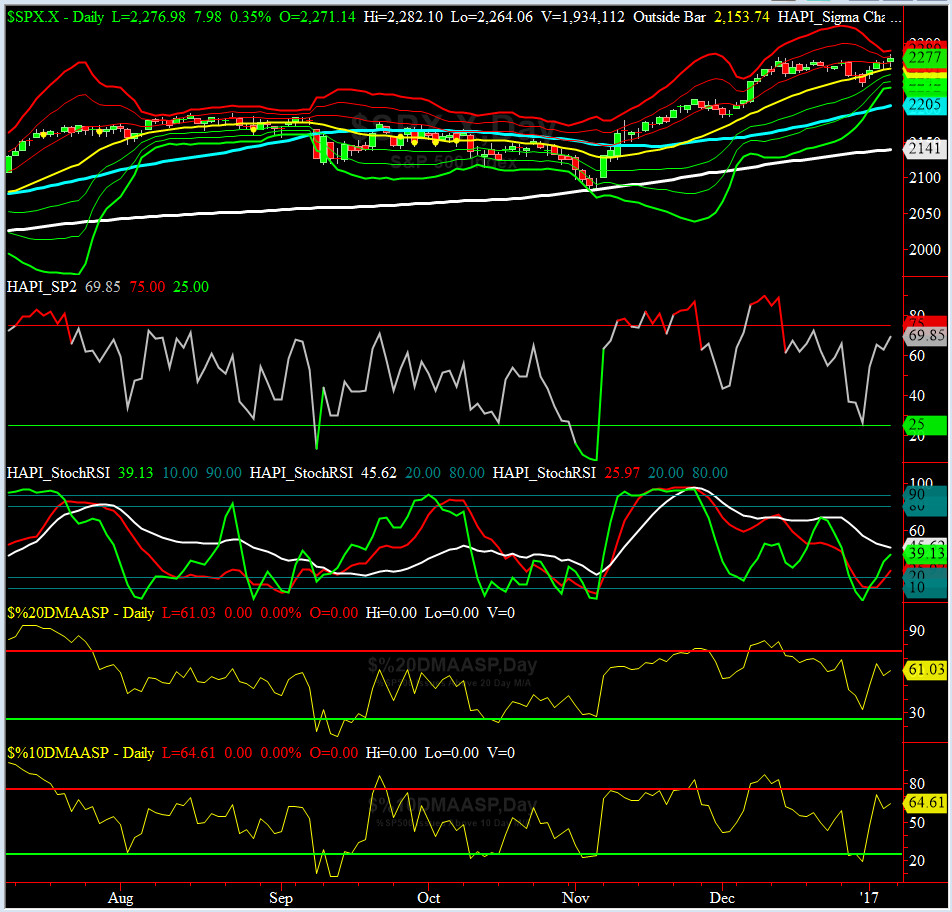

Most recent S&P-500 Cash Index (SPX): 2276.98 up +38.15 (up +1.7%) for the week ending Friday, January 6th, 2017, which closed near its +2 sigma.

SPX ALL TIME INTRADAY HIGH = 2282.10 (reached on Friday, January 6, 2017)

SPX ALL TIME CLOSING HIGH = 2276.98 (reached on Friday, January 6, 2017)

Current DAILY +2 Sigma SPX = 2279 with WEEKLY +2 Sigma = 2287

Current DAILY 0 Sigma (20 day MA) SPX = 2261 with WEEKLY 0 Sigma = 2182

Current DAILY -2 Sigma SPX = 2242 with WEEKLY -2 Sigma = 2077

NYSE McClellan Oscillator = +68 (-150 is start of the O/S area; around -275 to -300 area or lower, we go into the “launch-pad” mode, over +150, we are in O/B area)

NYSE Breadth Thrust = 54.8 (40 is considered as oversold and 65 as overbought)

Last week SPX had a very nice run helping DJIA get within 40 cents of 20,000.

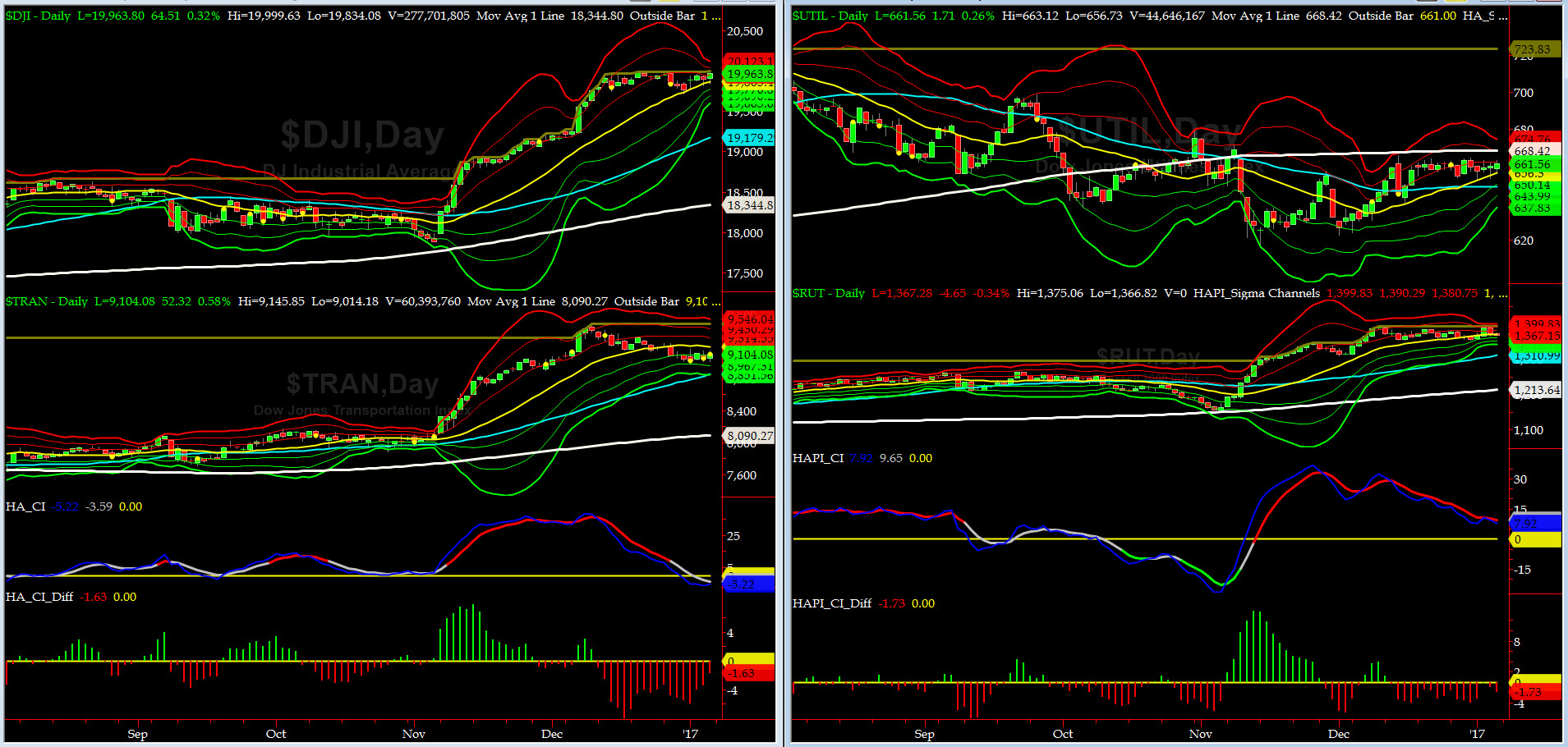

Canaries [in the Coal Mine] Chart for DJ TRAN & RUT Indices

200-Day MA DJ TRAN = 8090 or 12.5% below DJ TRAN (max observed in last 5 yrs = 20.2%, min = -20.3%)

200-Day MA RUT = 1213 or 12.6% below RUT (max observed in last 5 yrs = 21.3%, min = -22.6%)

DJ Transports (proxy for economic conditions 6 to 9 months hence) ran a very special sausage ops algo, that tells us ROMANs are getting into the Transport Biz. LOL

Russell 2000 small caps (proxy for Risk ON/OFF) was very confused as evidenced by the Railroad Tracks. RISK is still ON, ioho.

DeTrenders Charts for SPX, NDX, TRAN & RUT Indices

50-Day MA SPX = 2204 or 3.3% below SPX closed on Friday (max observed in last 5 yrs = +8.6%, min = -9.3%)

200-Day MA SPX = 2140 or 6.4% below SPX (max observed in last 5 yrs = 15.2%, min = -14%)

NONE of our eight DeTrenders are negative. The DeTrenders for DJ TRAN & RUT will continue to be harbingers of future price behavior in broad indices.

HA_SP1_Momo Chart

WEEKLY Timing Model = on a BUY Signal since Friday 12/16/16 CLOSE at 2258

DAILY Timing Model = on a BUY Signal since Friday 1/6/17 CLOSE at 2277

Max SPX 52wk-highs reading last week = 28 (over 120-140, the local maxima is in)

Max SPX 52wk-Lows reading last week = 2 (over 40-60, the local minima is in)

HA_SP1 at its +1.5 sigma channels

HA_Momo = +0.6 (reversals most likely occur above +10 or below -10)

Vol of the Vols Chart

VIX is currently at its -1 sigma level at 11.3 (remember it’s the VIX’s vol pattern (its sigma channels) that matters, and not the level of VIX itself (this is per Dr. Robert Whaley, a great mentor and the inventor of original VIX, now called VXO). VIX usually peaks around a test of its +4 sigma).

VIX Complex dropped modestly this past week.

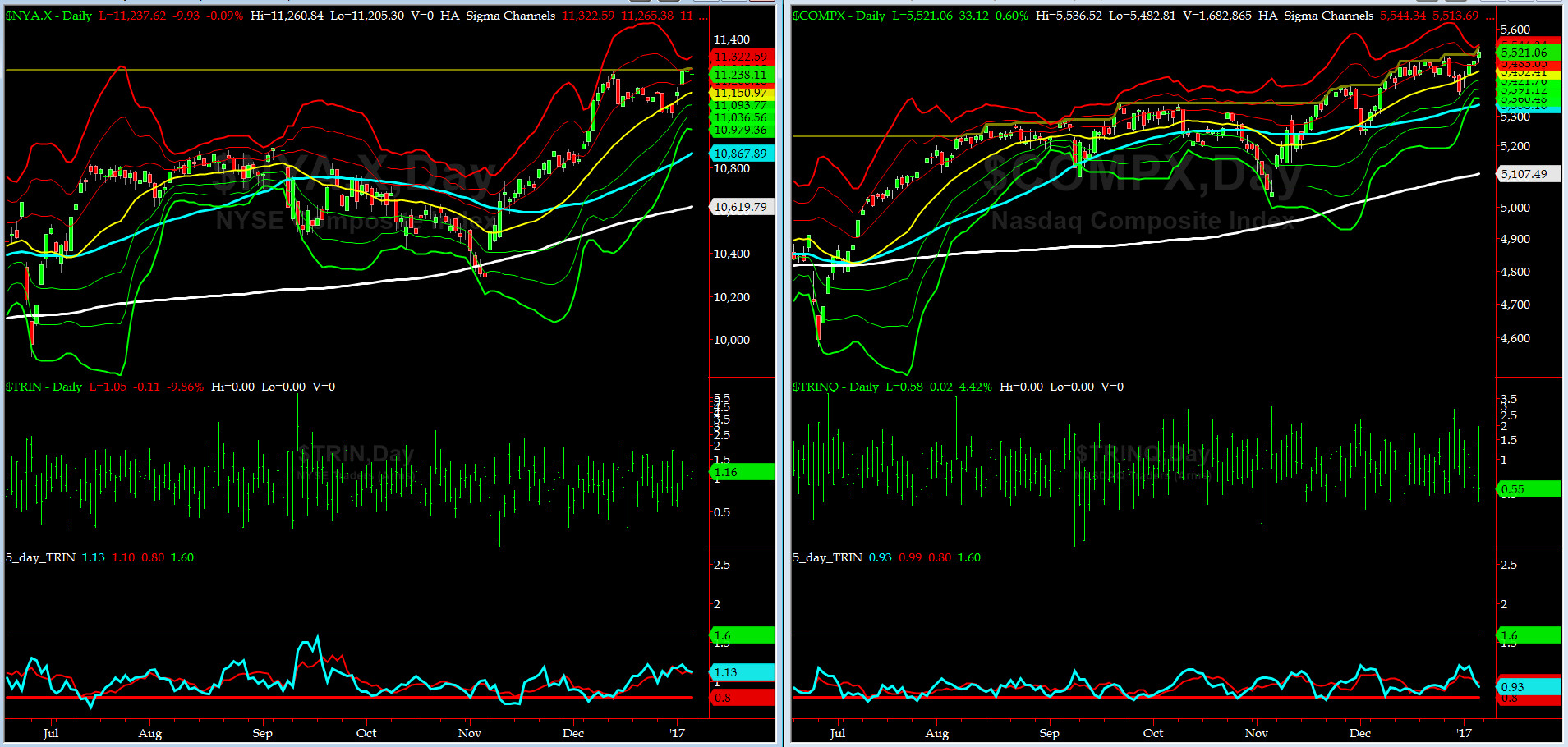

5-day TRIN & TRINQ Charts

Both NYSE & NASDAQ 5-day TRINs are again NEUTRAL for now with a possible SELL signal coming up for NASDAQ.

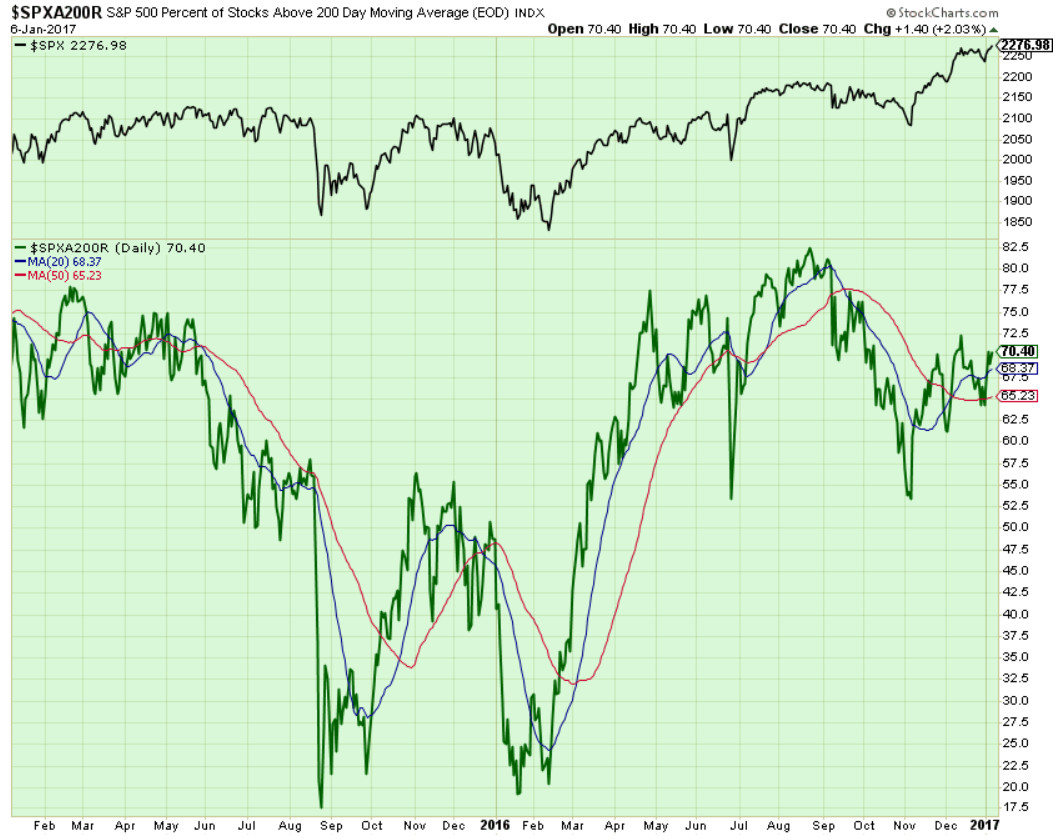

Components of SPX above their respective 200day MA Chart

This scoring indicator retreated to 70% - no signal here as we see no divergence, as of now.

SPX SKEW (Tail Risk) Chart

Last week SPX SKEW (Tail Risk) rose & dropped gradually last week and finally ended up just about its zero sigma at 123. (normal = 120-125, range 100-150).

All remain quiet on the Eastern & Mid-Western Fronts as SKEW sigma channels are very tightly spaced.

3-month VIX Futures Spread(VX) Chart

Our 3-month VIX Futures Spread (LONG JAN17 & SHORT APR17) dropped gradually each day till it closed at -4.13 on Friday.

HA_SP2 Chart

HA_SP2 = 70 (Buy signal <= 25, Sell Signal >= 75)

SP2 rallied hard from 26 (that is one reason we went long last Monday night).

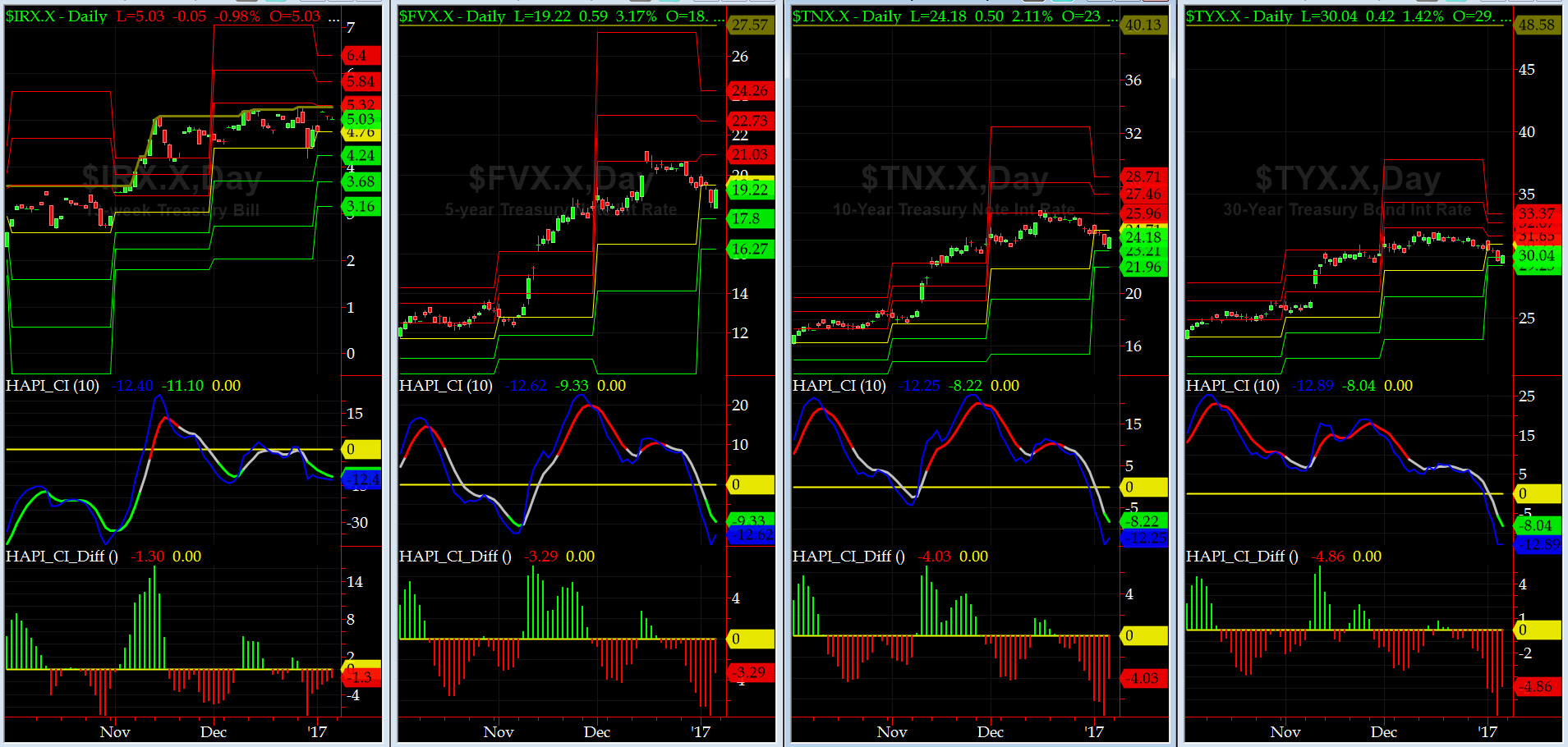

US Treasury T-Notes & T-Bonds Yields Chart

The YTMs on Treasury Complex continued to drop this past week till Friday which they reversed a tad on DEEZ NFP Release.

Fari Hamzei

|